(Please enjoy this updated version of my weekly commentary published September 20, 2021 from the POWR Growth newsletter).

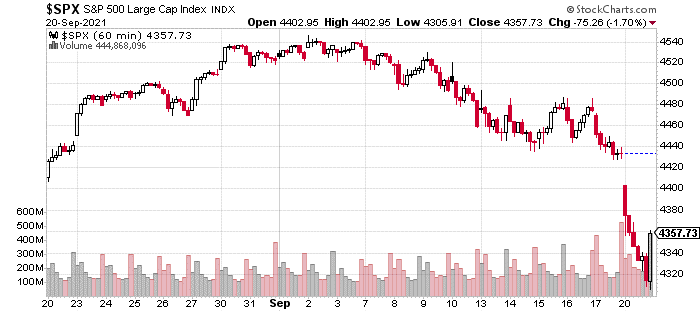

First, let’s do our regular look at what’s transpired in the S&P 500 for the last week:

For much of last week, the S&P 500 traded in a tight range between 4440 and 4480. It broke this range to the downside on Friday, and this negative momentum continued as the S&P 500 was down by more than 3% at its lows of the day before an end-of-day rally, cut these losses nearly in half.

There are two primary catalysts for this move lower. The biggest and most visible culprit is Evergrande. This is the second largest property developer in China which is dealing with insolvency issues.

Given the connected nature of financial systems, there are signs of increased credit stress and concerns about potential spill-over effects into the economy.

Chinese stocks were down big and so were stocks and commodities connected to Chinese demand like steel stocks and copper.

A Dip or a Correction

Despite these very real concerns, I see this as another dip that will be bought and it will lead to higher highs. The simple reason for this is that earnings continue to rise. Additionally, the financial stressed caused by this potential, looming crisis will push the Fed to be more conservative in its tapering timeline.

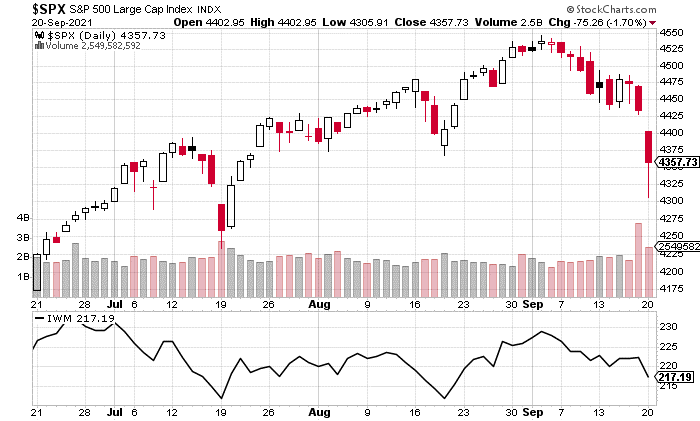

What’s interesting is that the market’s intramarket relationships seem to be confirming that the market’s weakness is “transitory”. For example, small-caps were also weak today but we are also seeing some relative strength for the first time in months.

While, the S&P 500 made a lower low today vs its mid-August low, the Russell 2000 made a higher low:

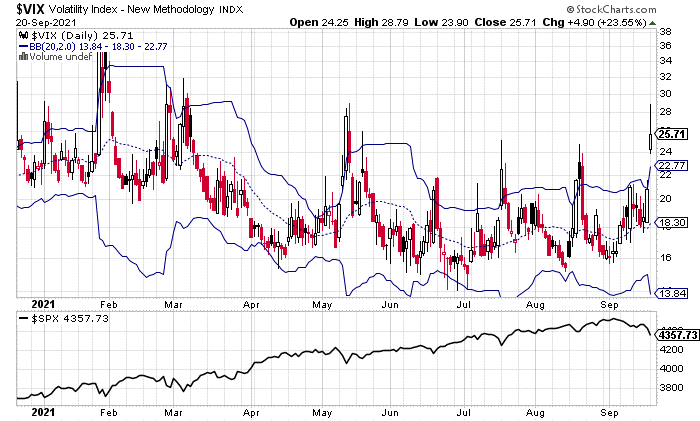

Additionally, spikes in the Vix above the second standard deviation of its 20-day moving average (upper Bollinger Band) have tended to mark buying opportunities over the past few months:

Although, I think the market could be volatile in the short-term, I am not too worried that this is going to lead to a longer, more extended correction which would necessitate a change in strategy.

Update on Falling Case Counts

I believe that one of the most interesting market narratives until the end of the year will be the improving coronavirus situation which will I think lead to a resumption of strength in parts of the market like restaurants, travel, and energy.

We’ve been tracking this closely in our previous commentaries. For the US, the 7-day moving average of new cases is down almost 50% from its high of 189,000 in early September. Florida was the hardest-hit state, and case counts are down 2/3 since its peak of 27,000 new cases/day in late August.

And, it’s interesting to note that even today, we saw relative strength in travel stocks and ETFs. For example the JETS ETF was green on the day, while our stocks – EAT and CHH – were down less than the market.

Market Commentary Summary

I believe that on the other side of this dip, we will see outperformance in travel and energy stocks. The biggest development, this week, will be the Fed meeting. Many are expecting that the Fed is going to announce that they will start tapering in November.

However, I think this week’s events in China marginally increase the chances that the Fed will punt on its taper decision especially as inflationary forces have receded in the past couple of months.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $434.06 per share on Tuesday afternoon, up $0.02 (0.00%). Year-to-date, SPY has gained 16.86%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |