(Please enjoy this updated version of my weekly commentary published December 6th, 2021 from the POWR Growth newsletter).

First, let’s do the usual review of the past week:

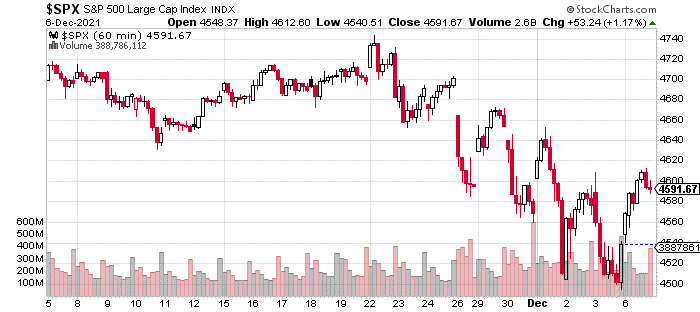

A lot of volatility and a lot of drama. But, overall, we are down a bit more than 1% over the past week.

To recap: The market has been selling-off since November 22 due to the Fed getting more hawkish and the emergence of the omicron variant. The omicron variant seems to be more contagious but more benign than previous strains based on early data from South Africa. Equally important, vaccinated people are experiencing mild symptoms.

Overall, the S&P 500 dropped 5% from its ATH on 11/22 to its low last Friday. However, we had much more severe pullbacks in the Russell 2000 (R2K) and growth stock universe. The R2K actually peaked on 11/8 and declined nearly 11% from peak to trough.

The carnage in growth stocks is one of the major narratives, and we have seen severe pullbacks between 20% and 40% in many names.

The latter development shouldn’t entirely be surprising given that rising short-term rates put negative pressure on high-multiple stocks. In fact, it could be argued that the Fed is doing a masterful job of squeezing froth out of the market and tamping down inflationary pressures.

Major commodities and oil are down over 10%. The frothiest parts of the market saw even bigger haircuts. And, the S&P 500 is down by less than 5%.

These developments have increased my optimism about what the next few weeks will bring as we enter what is the most bullish time of the year.

Year-End Playbook

The VIX skyrocketed above 30. The Fear/Greed Index hit extremely bearish levels. And, we have hit bearish levels in terms of investor positioning.

All of these are contrarian, bullish signals that reliably indicate good entry points in bull markets.

Finally, the S&P 500 also formed a nice double bottom between Wednesday and Friday which gives us a nice level to trade against. While some sort of retest and even brief undercut is possible, I would have to reevaluate my thesis if these levels were decisively broken.

Ideally, we would have one more meaningful pullback to form a higher low which would serve as our launch point for the year-end frenzy. But, I’m also open to the possibility that Friday’s retest marked the bottom, and we could just blast higher from here.

To be frank, I have much more conviction about the ultimate destination and less so about the path we will take to get there.

Thus, we are staying fully invested but also constantly tweaking the portfolio so we can have exposure to the top stocks and sectors.

Top Stocks and Sectors

One market aphorism is that when liquidity vanishes, we find out who is swimming naked. (And we certainly did.)

A corollary to this is we also find out who is swimming… not naked. And, I’m not interested in the swimmers in speedos, I’m looking for wetsuits and fins and goggles and… well, you get the idea.

And, I’m finding many candidates in 3 sectors – housing, semiconductors, and industrial sectors.

A commonality is great earnings in Q3 and very reasonable valuations. They will be beneficiaries from the ongoing growth to value rotation and their stocks showed signs of institutional accumulation during this recent selloff.

Therefore, we also increased our allocation to these groups, and I’m quite excited about their near and intermediate-term prospects.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $468.35 per share on Tuesday morning, up $9.56 (+2.08%). Year-to-date, SPY has gained 26.49%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |