(Please enjoy this updated version of my weekly commentary published November 03, 2021 from the POWR Value newsletter).

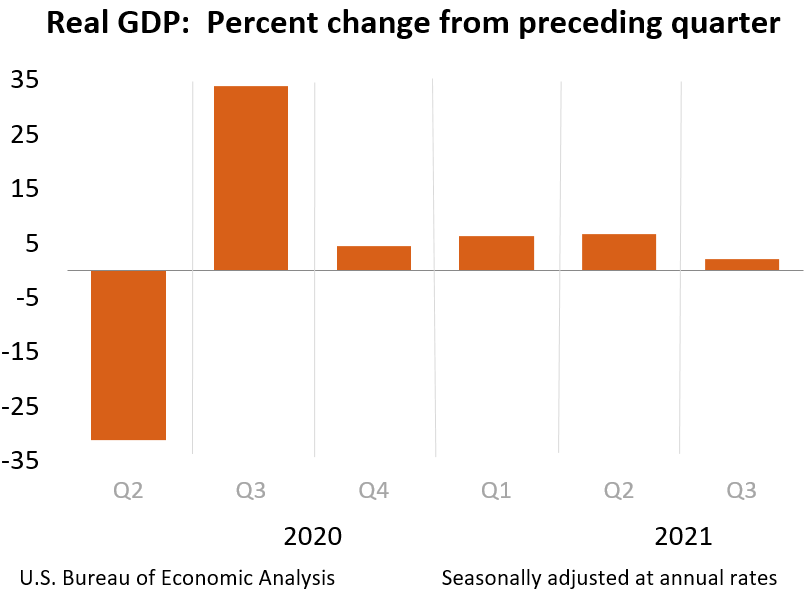

One of the first concerns I had in March of 2020 when the proverbial “….” hit the fan was that the GDP growth was about to fall off a cliff. And it pretty much did. In the first quarter of 2020, GDP fell 5.1% from the previous quarter. Then in the second quarter, it fell another 31.2% from the first quarter. Things looked dire.

But then things were looking up for the third quarter of last year as cases started to fall in the summer and more people were out and about. In fact, GDP rose 33.8% in the third quarter.

And since then, the economy has been back on track and moving along. However, the U.S. economy only grew at a 2% rate in the most recent quarter (Q3 2021). This was the slowest gain since the economy recovered from the pandemic.

There are multiple reasons that GDP growth slowed. First was a slowdown in consumer spending. Due to the resurgence of COVID-19 cases, there were new restrictions in some parts of the country and delays in reopening establishments.

Then we’ve got the usual players, supply chain concerns, and labor shortages. Plus, government assistance payments slowed, and the trade gap widened.

All of these issues impacted growth and spending. So how does this affect the markets, and better yet, our portfolio? Well, first, we need to remember that GDP is backward-looking. I expect the fourth quarter’s figure to rebound as COVID cases have slowed down.

Plus, a considerable factor weighing on GDP was a drop in car purchases. If you exclude automotive production, GDP actually rose 3.5%.

If we consider a forward-looking indicator, the future looks brighter. The latest data from the Conference Board’s Leading Economic Index, which forecasts future economic activity, was up 11.1%.

I should also note that the service industries saw a substantial increase in activity. I have previously mentioned that much of the recent growth we have seen has been through the purchase of goods.

But now, people are out and having fun, and consumers have moved on to purchasing services. If services are growing, the economy is starting to fire on all cylinders, and any concern over the Delta variant is going by the wayside.

The GDP report was also well received by investors on Friday as all three major indexes were up for the day. In fact, the S&P 500 finished the day at an all-time high.

So, while 2% growth is lower than the second quarter, it’s certainly better than the zero growth that Atlanta Fed’s GDP tracker predicted. In addition, without the supply-chain constraints, production would have been much higher and similar to the second quarter’s production.

So, this is what we know. First, peak growth is over. Growth slowed over the past three quarters, but it didn’t stop. The economy is expected to grow, but not as fast as the last few quarters from this point on.

Second, we should expect growth to climb higher as consumer spending has moved to services. This should help relieve some of the inflationary concerns.

So even though GDP growth slowed, I expect it to pick back up, especially considering that consumers are still holding considerable savings, but not at the levels we saw earlier this year.

Strong productivity should help support corporate profit margins, leading to a continuation of the bull market and gains in our portfolio.

What To Do Next?

The POWR Value portfolio was launched in early May and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Value Stocks strategy which has stellar +38.63% annual returns.

If you would like to see the current portfolio of value stocks, then consider starting a 30 day trial by clicking the link below.

About POWR Value newsletter & 30 Day Trial

All the Best!

![]()

David Cohne

Chief Value Strategist, StockNews

Editor, POWR Value Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $466.94 per share on Thursday morning, up $2.22 (+0.48%). Year-to-date, SPY has gained 26.11%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: David Cohne

David Cohne has 20 years of experience as an investment analyst and writer. Prior to StockNews, David spent eleven years as a consultant providing outsourced investment research and content to financial services companies, hedge funds, and online publications. David enjoys researching and writing about stocks and the markets. He takes a fundamental quantitative approach in evaluating stocks for readers. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |