Right now the most important thing on investor’s minds is the dramatic rise in bond rates, and how that makes stocks less attractive. I tackled that subject pretty thoroughly in my previous commentary this week. Be sure it read now if you haven’t already:

When is the Stock Bouncing Coming?

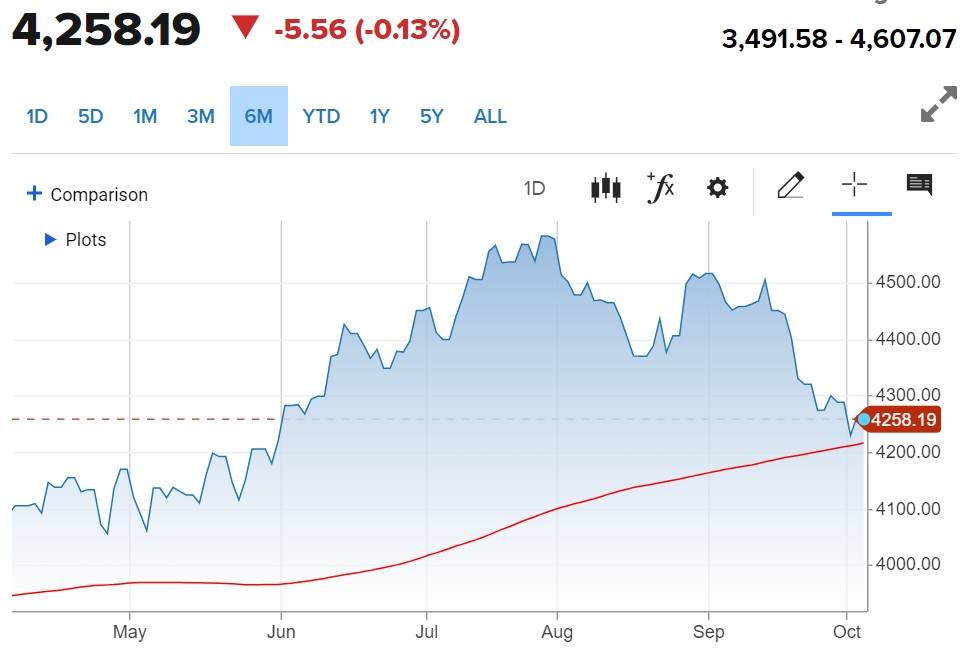

The quick answer to the above question, is that the bounce could be forming now as stock flirt with the 200 day moving average at 4,206 for the S&P 500 (SPY - Get Rating). That is the red line in the chart below.

On the fundamental front, if rates keep ripping higher, then it will only put more pressure on stock prices. I sense that 5% is a logical top for 10 year rates…but who says that the market is logical?

Also note on the fundamental end of things that the economic reports continue to come in positive. Even 20 months into the most aggressive Fed rate hiking regime in history, GDP estimates continue to be robust.

GDP Now has it their Q3 estimate all the way up to +4.9% bolstered by the most recent ISM Manufacturing report. Further, the Blue Chip Economist panel sees +2.9% as the more logical growth trajectory.

If I were to place a bet in Vegas I would say the Economists are much closer to the final number. Regardless, it is hard to look at these results and see a recession coming…and therefore it is hard to be truly bearish.

On top of that the Government Employment Situation report came out Friday morning much hotter than expected. Since so much of the initial market reaction is based on just reading the headline…then yes stocks sold off early in the session.

Gladly, as prudent investors dug into the details they discovered a hidden gem in the report. That being month over month wage inflation down to only 0.2% which means we are ebbing ever closer to the 2% inflation target for the Fed as this “sticky” form of inflation becomes unstuck at such high levels.

As this new spread…so too did the stock gains. As I put this commentary to rest with 90 minutes left in the Friday session we have a +1.4% result for the S&P 500 and nicely above recently resistance at 4,300.

Back to the big picture conversation about higher rates….

Yes, stock prices are down of late as “rates normalize” to more traditional historic levels. Meaning we are no longer enjoying the artificially low rates we that have been in hand the past 15 years.

Once everyone makes this adjustment to the new world view of rates…and realize the world is not falling apart…they will be compelled to put their money into the best stocks. And maybe Friday’s rally is an early sign of that taking place.

So, which are those best stocks, you ask?

Read on below for the answer…

What To Do Next?

Discover my brand new “2024 Stock Market Outlook” covering:

- Bear Case vs. Bull Case

- Trading Plan to Outperform

- What Industries Are Hot…Which Are Not?

- Top 11 Picks for the Year Ahead

- And Much More!

Gain access to this vital presentation now by clicking below:

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $430.05 per share on Friday afternoon, up $5.55 (+1.31%). Year-to-date, SPY has gained 13.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |