The recent bear market rally is not surprising. That is because stocks dropped as far as they should until there is greater proof of the pain that is to come in the economy. In particular, investors need to see more glaring weakness in 2 key areas before pressing lower: corporate earnings and employment.

Well, here we are in the midst of Q3 earnings season with early results definitely on the weaker side. We will dig into the stats to understand what it tells us about the market outlook and why I remain decidedly bearish.

All that and more is on the menu for today’s Reitmeister Total Return commentary.

Market Commentary

Yes, we are having another bear market rally as stocks have bounced nearly 8% from the recent lows. Any student of past bear markets will see that each had several meaty bounces before the next leg lower.

Meaning there is no real reason to give this bounce any merit as the beginning of the next bull market. That is because investors cannot accurately call bottom yet as we are still in the midst of things getting worse. Meaning we need to have a better sense of how bad things will truly be in the end. (More on that topic a little bit later in today’s commentary).

Now I want to dig into the early results from Q3 earnings season to see what it tells us about economic conditions and market outlook. To put things into perspective I want to share with you this morning’s insights from Nick Raich of EarningsScout.com followed by my thoughts:

- “In total, 170 companies in the S&P 500 have now reported 3Q 2022 results.

- The overall earnings results are not making us optimistic that the worst will soon be over.

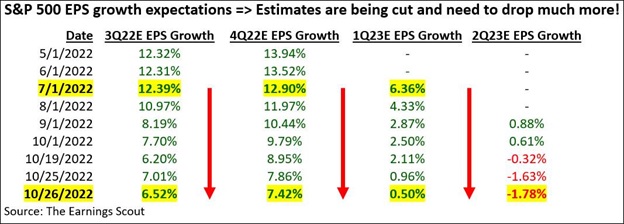

- We are discouraged S&P 500 (SPY - Get Rating) EPS growth expectations are not coming down more.

- As we see it, mild estimate cuts reflect too much optimism and will only prolong the negative EPS estimate revision trend.

- Stay underweight stocks.”

Please note that Nick and I spent many years together at Zacks Investment Research where we understood that the earnings outlook was the #1 predictor of stock price movements (both the overall market and individual stocks).

There is no way to look at the reductions in earnings outlook in a positive light. Note that for Q3 and Q4 the earnings growth rate has been cut in half since earlier in the year. Whereas the first half of 2023 earnings outlook is moving more and more towards recessionary levels.

For as bad as these reductions are, please note that the average recession comes with a 20% decrease in expected earnings. Yet at this stage Q2 of 2023 has only slid to a -1.78% outlook. Directionally the slide into the red is a negative. However, as Nick pointed out “We are discouraged S&P 500 (SPY) EPS growth expectations are not coming down more.”

Nick is not saying that because he likes bear markets. It is because he knows that you first need to see the worst of the estimate revisions take place. Shortly after that the market usually finds bottom and the next bull market begins.

The point is that Wall Street analysts continue to be too optimistic about what the future holds. The sooner they appreciate the full extent of the pain on the way…the sooner this market will tumble to its lowest levels…the sooner we can get back to the more joyous topic of the next long term bull market.

Now let’s transition to the uniquely bad news that sprang from Google’s earnings miss Tuesday night. And reiterated with Meta’s earnings miss on Wednesday night.

This is not just about these 2 companies. It’s really about the steps taken on the way to recession.

Consider this…when corporate executives are fearful of the future economic outlook, the first lever they pull on is to reduce ad spending. That is because if the economy worsens, then the rate of return on that ad spend will be poor.

Seeing what happened to ad revenue reliant businesses like Google and Meta, it means that step 1 of corporations preparing for recession is taking place.

After that they start to consider holding off on other key investments in the business, like computer upgrades. We have already heard from enough folks in the corporate technology market like AMD that weakness is starting to take place.

The next and most painful leg of the downward spiral is employee layoffs. That has not happened yet…but no doubt the key indicator that many investors are watching the closest. Once the employment market rolls negative that momentum will carry for a while because of this vicious cycle process:

Lower employment > lower income > lower spending > lower profits > lower of cost > lower employment (rinse and repeat til bottom is found).

Given that on Monday we saw the PMI Composite Flash drop from a bad 49.5 last month to terrible 47.3 this month (below 50 = contraction) is even greater signs of the economic slowdown coming together. Most compelling of that report was the surprising weakness in services which had been holding up fairly well til now. All in all, this report shows more of the recessionary pieces of the puzzle falling into place.

This is why I remain decidedly bearish as there are more dominos to fall. Typically, you cannot find bottom on the stock market until investors have enough facts in hand to stare down into the abyss of the recession and predict how deep is bottom. From that stage investors can envision the eventual return of economic expansion which begets the dawning of the next bull market.

Since those facts are not yet in hand…then I call BS on the latest rally as there is no way for investors to feel comfortable enough with the forward looking picture to predict bottom and eagerly await the next economic expansion and bull market.

I have previously said that bottom is likely in the range of 2800 to 3,200 for this bear market given historical precedents. Hard to pin point more til we truly appreciate the full extent of the recession that is to come.

However, I thought it would be interesting to come at this from the earnings perspective. Typically forward looking earnings will decline 20% during a recession. From a peak of $240 for the S&P 500 (SPY) that EPS outlook would be trimmed 20% down to $192.

Now consider that the PE for the market usually ends under the long term 15.5 historical average PE as the bear claws its way to bottom. So 15.5 PE x $192 estimated earnings = 2,976 for S&P 500. That is right in the middle of the aforementioned range that I have been predicting.

Putting it altogether, we are in the midst of another bear market rally before the next leg lower. Thus, the word to the wise is to align your portfolio for much more downside to come.

What To Do Next?

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a robust gain for investors as the S&P 500 (SPY) tanked.

If you have been successful navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next…then do consider getting my updated “Bear Market Game Plan” that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.89 (+0.23%) in after-hours trading Wednesday. Year-to-date, SPY has declined -18.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |