(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

Market Commentary

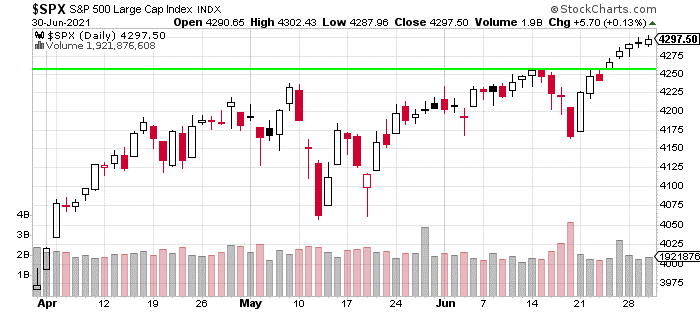

As the 3-month, daily chart of the S&P 500 shows above, we broke above the upper end of the range and since then, we have been trending higher.

That’s the story from the top-down perspective.

From a bottoms-up perspective, the story is less bullish. Market breadth has not made new highs with the index which is an indication that the move is “thin” in terms of participation. There’s simply a higher chance of a reversal during advances or declines with thin participation.

We see the same thing from a different angle by looking at new highs and new lows. In my experience, trending, sustainable advances come with an expansion of new highs as new leadership emerges to drive the market higher.

During previous breakouts in the fall of last year or in the early months of this year, new highs on the NYSE would be around 500 to 700 and on the Nasdaq it would be around 400 to 600. Currently, it’s around 200 on the NYSE and 60 on the Nasdaq.

Thus, despite the market’s breakdown, I continue to believe that our current strategy remains appropriate. This strategy will change if market conditions start to improve in a manner that is consistent with a trending move.

Second-Half Preview

Our current market strategy is about maximizing optionality and being prepared for any outcome. I think this is especially appropriate give my outlook for the second-half.

Basically, I’m looking for two things to happen:

- A nasty pullback that makes investors question whether the bull market is over and leads to a spike in bearish sentiment

- Stocks finishing the year at their highs

So, now let’s go over my reasoning for both predictions.

Nasty Pullback

The average year in the market features a 10% correction which we haven’t experienced since March of last year. Of course, this type of bullish price action has also led to complacency and excess bullish sentiment.

It’s evident from a variety of indicators such as the put/call ratio, meme stock frenzy, investor positioning, surveys, and anecdotal evidence. (Are teens on TikTok confidently telling us what stocks to buy, the new shoeshine indicator?) We’ve covered these in detail in previous commentaries.

However, I discovered something even more stark that shows how excessive bullish sentiment has gotten. MagnifyMoney did a survey of new investors. 40% had taken out a loan to use for investing. And of this group, a majority had tapped into their credit cards, home equity, or taken out a personal loan to finance their trading.

Simply put, every cell in my body understands that this state of affairs is not healthy for the individuals or for the market as a whole.

What’s particularly fascinating is that sentiment has increased over the past couple of months despite the market not doing much. In fact, my hypothesis is that the market’s stunted action is the byproduct of this bloated sentiment picture and strong fundamental picture.

A pullback would be consistent with historical norms and a remedy to the unsustainable, bullish sentiment.

Year-End Highs

At the same time, I understand why the market is so strong and defies any skeptics.

Earnings are growing at a tremendous rate and have continued to beat expectations. Q2 earnings are expected to once again be strong relative to expectations.

The sectors that thrived during the pandemic continue to grow albeit at a smaller rate. And, the sectors that struggled during the pandemic are benefitting from pent-up demand and the economy normalizing.

I believe that retail stocks are a perfect encapsulation of this. Their e-commerce sales continue to grow at a double-digit rate – secular trend. And, they are benefitting from an unprecedented cyclical boost as people are eager to return to in-store shopping. According to mall operators in Texas and Arizona which have relaxed all restrictions, foot traffic is above 2019 levels.

Interest rates remain low which means there is no real competition for capital. With leading indicators of inflation already turning down, the Fed is unlikely to be compelled to tighten or hike sooner than it wants which removes another risk to our outlook.

As we’ve noted, this is a typical Y2 of a bull market. Given the market’s strong fundamentals, I expect us to end the year at new highs.

Summary

Overall, we continue to see bulllish price action, but things are less bullish under the surface. I am seeing speculative excesses in the market that make me wary. Further, the market is due for a pullback which would also help get the market to a much healthier equilibrium. It would also set up some fantastic opportunities to take advantage of the market’s strong fundamentals.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $429.69 per share on Thursday afternoon, up $1.63 (+0.38%). Year-to-date, SPY has gained 15.68%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |