(Please enjoy this updated version of my weekly commentary published December 02, 2021 from the POWR Stocks Under $10 newsletter).

The last couple of weeks, we’ve discussed the stealth sell-off in the small caps and cyclical stocks. Last week, the selling broadened out, and the S&P 500 dropped 2.4%.

The market’s volatility has only continued and resulted in some wild, intraday price swings. Overall, the S&P 500 was down 4.9% from its all-time high on November 22 at yesterday’s low.

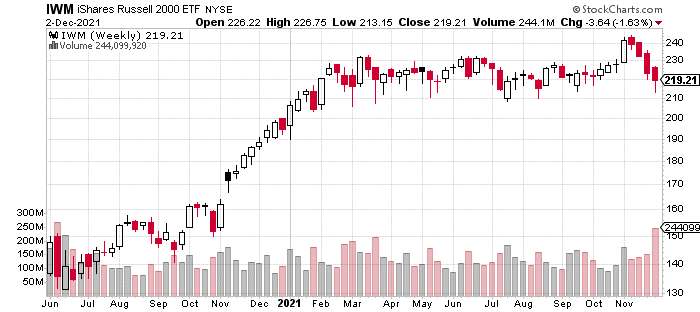

In contrast, the Russell 2000 was down 12.7% from its recent high on November 8 and was down 9.4% from its highs on November 22 at yesterday’s low.

Today’s bounce is certainly encouraging. But, it’s understandable if caution remains the prevailing emotion especially as any strength has been brutally reversed over the past week.

From a bigger-picture view, the Russell 2000’s price action is concerning. As the chart above shows, its picturesque, textbook breakout has been negated. And, we are firmly back in the range which has defined much of 2021. In fact, it has now retraced its entire advance in October and early November.

Why Has the Market Been So Weak?

The market naturally ebbs and flows. So, it’s not unusual for the market to pause or consolidate or have a mild pullback after a big move higher. Of course, this has been more than a mild pullback.

Another factor is the Fed signaling a more hawkish stance, whether it was Chair Powell saying he was going to retire the use of ‘transitory’ to describe inflation or regional Fed Presidents discussing the potential for an accelerated taper.

As a result, Fed Futures went from a 50% chance of 1 rate hike in 2022 to a 98.5% chance of 1 rate hike, 89% chance of 2 rate hikes, a 65% chance of 3 rate hikes, and a 34% chance of 4 rate hikes.

The Fed is so big that it can achieve outcomes by merely signaling its intention. This is why many market-participants pay so close attention to every word, verbal pause, and facial expression that comes from Committee members. So, now monetary policy has already tightened even though the Fed has only started to taper asset purchases.

This is evident with the US dollar strength over the last few months or the flattening of the yield curve as long-term rates decline, while shorter-term rates rise.

The final factor in the market’s weakness is the omicron-variant of the coronavirus which has injected a dose of fear and uncertainty into the markets. Omicron is obviously a big deal, but at this point in time, not much is known in terms of its ability to evade vaccines and contagiousness.

Rather than focus on what we don’t know, let’s focus on what we know. The world is in a much better place given vaccination rates, availability of vaccines, effective treatments, and the fact that we can develop vaccines if necessary.

Therefore, I continue to see omicron as more of a speed bump rather than something that will throw the bull market off its path.

Is This the End?

Given these negative developments, it’s not unreasonable to think that maybe “the best is over”.

But while, this is probably true for organized crime, it’s simply not the case for the stock market.

Bull markets need a ‘wall of worry’ to keep climbing. If we look at the last decade, one factor in the previous bull market’s duration was that there was always some bearish development that would dupe investors into selling or shorting… only to see the market rip higher.

Just off the top of my head, I can recount – the taper tantrum; the PIIGS fiasco; European sovereign bond yields blowing out; a government shutdown; oil crashing leading to fears of a debt crisis; the Chinese economy sputtering; and Brexit. All of these led to fear building up in the markets and some portion of investors believing that the bull market was about to end.

The bull market didn’t end, simply because financial conditions remained supportive for stocks, and earnings continued to rise on an aggregate level.

Financial conditions have tightened modestly from a year ago. But, the economy has recovered spectacularly from a year ago. Thus, tighter financial conditions are appropriate and the economy and stock market will be able to handle it.

I’m also feeling good about earnings growth. Q3 featured 39.6% earnings growth, while analysts are estimating 20% growth in Q4. If anything, the economy is moving closer to normal in Q4 based on metrics like TSA data, hotel occupancy, and miles driven that are indicating even more economic activity which is supportive of more earnings growth.

For these reasons, I continue to see the market’s pullback as providing an attractive, entry point in an ongoing bull market. A close by the S&P 500 under 4,400 would lead me to reevaluate this thesis.

In last week’s commentary, I asked:

What’s Next? I’m expecting a retest of today’s lows and a possible undercut which should mark the ultimate bottom and provide the final launching pad for our year-end rally.

Not much has changed that would alter our bullish stance and expectations of an end of year, buying frenzy. In fact, this is the ideal shakeout to turn sentiment bearish and get some weak hands to capitulate on their positions.

I think this description still stands, and this roadmap seems to be playing out.

Summary

The market is in a deeply oversold state. Given the positive, longer-term fundamentals and attractive technical and seasonals, I remain confident that bulls will be rewarded in a few weeks’ time.

What To Do Next?

The POWR Stocks Under $10 portfolio launched in September and is off to a tremendous start.

What is the secret to its success?

The portfolio gets most of its fresh picks from the Top 10 Stocks Under $10 Strategy which has market beating +62.88% annual returns.

If you would like to see the current portfolio of low-priced stocks, then consider starting a 30 day trial by clicking the link below.

About POWR Under $10 newsletter & 30 Day Trial >>

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $451.11 per share on Friday afternoon, down $6.29 (-1.38%). Year-to-date, SPY has gained 21.84%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |