Here is what happened on Tuesday:

- CPI Inflation Report Hotter Than Expected

- Fed Rate Cut Odds Declined

- Bond Rates Rose

- S&P 500 Made New Highs

Back to the multiple choice exams we took in school…one of these does not belong. And yes, that is the last bullet which doesn’t quite add up given this backdrop.

So, what exactly did happen on Tuesday? And what does it mean for stocks in the days ahead?

The answers will be at the heart of today’s Reitmeister Total Return commentary.

Market Commentary

We have long come to appreciate the interrelationship between inflation and the stock market.

Rising Inflation > Lower Stock Prices

Falling Inflation > Higher Stock Prices

That’s because as inflation falls back towards the 2% target of the Fed’s then they will start lowering rates. This form of accommodation helps spur heightened economic growth which begets higher earnings growth…and by extension higher stock prices.

This fits under the time honored tradition: “Don’t Fight the Fed”. And thus when they are on your side by lowering rates, then it’s best to be bullish on stocks.

If that is true…then why did the S&P 500 (SPY) make new highs once again on Tuesday?

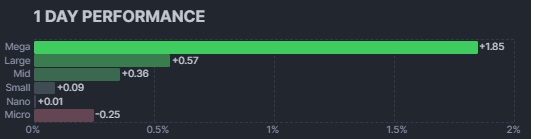

Unfortunately, it is one of the worst possible answers. That being that the broad market was actually lackluster. And it was only the Magnificent 7 and related mega caps leading the charge:

As we move down the market cap of stocks we find less appealing returns. Meaning that Tuesday’s results were not an overly bullish signal.

It’s funny. For the vast majority of the 44 years I have been investing the idea of “Flight to Safety” meant to go to defensive positions like Consumer Staples, Utilities and Healthcare.

Yet the modern safety game plan is to go for large cap tech stocks as they are the ones to own rain or shine. Hard to argue with that logic given their tremendous gains the last few years. But it does call the true strength of the recent stock rally into question.

Quite often we have seen these surges by the usual suspect tech stocks that cleared the way for the rest of the market to follow. So, I don’t want to make this sound more ominous then it needs to be.

I simply want to point out that the fundamental premise behind the recent amazing stock gains may be running out of steam and wouldn’t be surprised with more tepid price action going forward. Or even a modest pullback as we await more bullish catalysts to arrive. (Like the catalysts that would point to the Fed more likely to lower rates).

This brings us around to Tuesday’s CPI report which was relatively as expected with inflation continuing to come down from the highs. But still a 3.2% inflation rate is fairly well above the Fed target of 2%. Not to mention that the Atlanta Fed’s measurement of “Sticky Inflation” is still far too high at 4.4% year over year.

Sticky inflation is what the Fed has complained about the most keeping them on pause with hawkish rates. The main components are wage inflation and housing which have stayed elevated far too long and not going away as quickly as hoped for.

More investors are coming to terms that even the May Fed meeting is probably too soon for the first cut. This lines up the June 12th meeting as being the most likely starting point for rate cuts. This idea is being bolstered by Powell’s recent statement that they are “not far” from lowering rates.

Yet, let’s remind ourselves of the Fed’s favorite statement that they are “data dependent”. And more data like this sticky inflation over 4% is not going to have them lowering rates as soon as investors anticipate.

Thursday’s PPI report is likely the last piece of data the Fed will consider going into 3/20 Fed rate decision. No one is expecting a cut at this event as Powell clearly took that off the table at the previous press conference.

The key for investors will be any change of tone, or tipping of the hand, that points to the eventual start date for rate hikes. Again, June is the current expected start date. Yet for amusement, there was a consensus forming that it would happen at the end of 2023. So these expected start dates are more liquid than solid.

Trading Plan

Based on the fundamentals (like tepid earnings growth and rising valuations) this market is pretty fully valued. Thus, I can just not envision a sustained, broad based bull rally above current levels UNTIL the Fed starts lowering rates. That would usher in a new wave of earnings growth pushing share prices higher.

On the other hand, I do not expect any kind of serious correction either as investors would rather idle at the stop light waiting for it to turn green.

Thus, I think a modest 3-5% pullback is the worst possible outcome. More likely we just have more of a consolidation and tight trading range above 5,000 with ample sector rotation.

This is what some call a “buy the dip” market. That’s because most every sector will endure rough sessions at some point making shares more appealing for purchase.

Make sure you have your wish list of attractive stocks ready so you are prepared to strike when the time comes.

In the next section I will talk about my favorite stocks at this time including my radar screen of picks that I may be enticed to buy on a future dip.

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.19 (+0.04%) in after-hours trading Tuesday. Year-to-date, SPY has gained 8.72%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |