(Please enjoy this updated version of my weekly commentary published November 29th, 2021 from the POWR Growth newsletter).

First, let’s take a look at how much has changed over the past week:

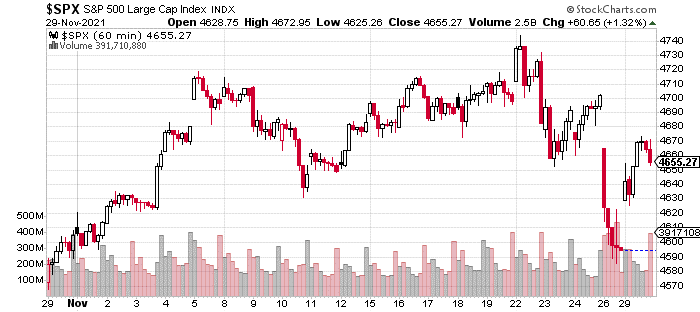

As we can see, the deterioration in market conditions that we discussed last week, started to also matter for the S&P 500. From its peak last Monday to Friday’s low, the S&P 500 was down by a little more than 3% before clawing back a little more than a third of its losses in today’s session.

It was also a continuation of last week in that there was more pronounced weakness in other parts of the market which was masked by the S&P 500. This is apparent with the Russell 2000 dropping 6.6% between Monday’s high and Friday’s low.

Notably, the Russell 2000 had a much more tepid move today, actually finishing flat on the day despite the S&P 500 climbing more than 1%.

The major factor in the move lower was the omicron-variant of the coronavirus which some are fearing will be more contagious than previous variants and evade the vaccines’ antibodies. Still, it’s way too early to draw any conclusion, let alone panic. Further, there are differing accounts on its characteristics.

After all, the economy and markets have performed remarkably well despite a host of even more formidable challenges over the past 20 months. Therefore, I believe that the markets and economy, on an aggregate scale, will be fine regardless of the scope of this challenge.

If the virus is worse than feared, earnings, for companies in certain sectors, may take a hit. But, it would cause other companies’ earnings to surge. And, it would give the Fed reason to slow or halt its taper which would also be stimulative for asset prices.

HOWEVER, It’s important to continue monitoring this situation as its path will certainly impact which parts of the market will outperform and underperform.

Case for a Bottom

Friday’s sell-off was extreme by many measures. It’s essentially the type of sell-off that marks a low or the beginning of a bearish phase in the markets. The move was also exaggerated since it happened on a low-volume day with less liquidity which ensures greater volatility.

Nevertheless, I’m seeing some signs that this might mark a meaningful low and be the best buying opportunity since October.

First is the Vix which nearly doubled from early November to Friday’s high. Such moves indicate a high level of fear which tend to be great, entry points in bull markets. The next factor is a spike in the put/call ratio which also shows a big spike in fear and investor positioning.

In a bear market, these developments don’t mean much. But, in a bull market, these provide the entry points that can lead to V-shaped rallies that lead to big returns in weeks.

And, there’s no reason to think that the bull market is not intact. The earnings backdrop and monetary policy continue to remain supportive. We continue to make higher highs and higher lows with regards to the major averages. The current advance is supported by market breadth which remains strong and shows no signs of distribution.

We also have a nice risk/reward in that we undercut the low from November 11 around 4,630 and are now trading above this level. 4,630 and 4,590 are key levels, and I would have to rethink my thesis if we were to fall and close below these levels.

Market Outlook and Strategy

Ever since the POWR Growth portfolio has started, we have maintained a bullish stance due to low rates and earnings growth. This stance has been validated so far and these pillars of the market advance remain intact.

Recently, I’ve talked about a more bullish, short-term setup, supporting the notion of an end-of-year rally. To recap – Q4 and December are seasonally bullish. They are even more seasonally bullish in years when the S&P 500 is already up 20% going into the final month.

We have another bullish circumstance with fund managers underinvested and underperforming the S&P 500. They are in a difficult position, where many are likely underinvested, because they are bearish.

But if they end the year with major underperformance, they could potentially risk losing capital or their careers. Thus, many managers in this situation, end up capitulating and getting long which can cause a squeeze as other managers have no choice but to join the frenzy. This is the classic dilemma of career risk vs portfolio risk.

Thus, it’s not surprising, that I’m quite excited by the market’s recent tumble as it’s the perfect setup to fuel another major advance like we just experienced in October.

In terms of strategy and tactics, I’ve discussed important levels to monitor. Any sustained breach of these levels means we would pullback on the risk. Above these levels, I want to stay aggressive in deference to the primary bullish trend and this short-term, bullish setup.

In terms of what parts of the market will outperform, I have less conviction. If the virus fizzles out, I could see another move higher in rates which would lead to strength in our cyclicals and energy stocks.

However, if the virus does prove to be a meaningful challenge and case counts keep rising, then we could see more strength in some of the healthcare, tech, and ‘classic’ growth stocks which do well in lower-rate environments.

I believe we have a nice mix of both of these areas, but I’m ready to make any necessary adjustments as necessary.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $456.82 per share on Tuesday morning, down $7.78 (-1.67%). Year-to-date, SPY has gained 23.38%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |