The S&P 500 (SPY - Get Rating) has been above 6,000 every day in December. And yet I tell you the stock market has been miserable for the average investor.

What we are seeing is all the money getting sucked back into the Magnificent 7 (especially TSLA) and a rolling correction taking place across the rest of the market.

What is a rolling correction?

And how should we navigate this unique market?

The answers to those questions and more will be at the heart of this week’s Reitmeister Total Return commentary.

Market Outlook

Just a reminder for you guys to watch this timely presentation from Amber Hestla: Why Most Will Fail to Profit from the “Trump Bump 2.0?”

p.s. A brand new stock pick is coming tomorrow from Amber to take advantage of this trend. So now is good time to watch her presentation.

What is a Rolling Correction?

Think about a normal correction for a stock. That is a decline of 10% or more.

Same goes for a stock market correction which we would say is a 10% decline for any group or index.

A rolling correction is where the main stock indices seem relatively calm trading in a narrow range…but under the surface is major sector rotation.

Some groups are getting pounded into submission. And some are busting higher.

However, over time just about every group gets chopped down which is why we call it a rolling correction. Meaning it rolls from group to group with everyone getting their lashings in the end. And yet, because other groups are seeing increases at the same time, then the overall market is relatively unchanged.

With the above in mind you can now appreciate that the S&P 500 is actually up +0.30% in December. This is mostly led by the usual mega cap stocks like the Magnificent 7.

However, below the surface the pain is much more evident in the December results for these groups:

-3.99% for Equal Weighted S&P 500 (RSP) where even the smallest stock has the same weighting as the mega caps.

-4.14% for the small caps in the Russell 2000

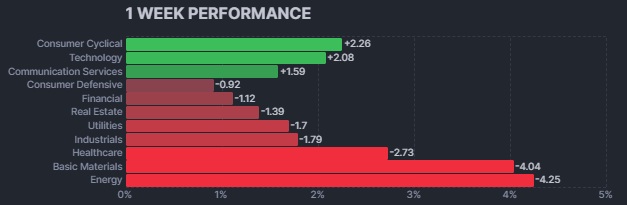

And then check out this 1 week performance chart by sector which shows the unevenness of recent price action:

Now that we understand what is happening, the next question is; What should an investor do about it?

First it will help you not panic as much as you see all this volatility to appreciate its normal and you are not the only one enduring these painful sessions.

Second, a rotation is like a boomerang that returns right back to you. Meaning just stay in place with your quality stocks and the price action of your shares will improve over time.

Or to put it another way, keep your eyes on the long term horizon. Be sure that you own the stocks that have healthy growing earnings while trading for reasonable valuations. Those properties will be rewarded in time.

Magnificent 7 stocks have growth…but valuations are getting extreme. That is why today I am going to recommend shorting TSLA (more on that further below).

Thus, as a group I think the Mag 7’s time in the sun ends in January 2025 as many investors will finally take profit off the table to delay tax consequence one more year.

That money should be rotated to worthy small and mid cap stocks that combine those qualities of healthy growth and reasonable valuation.

Yes, the POWR Ratings can help you find those stocks.

And yes, my favorite of those stocks are shared with you below…

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my top 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.35 (-0.06%) in after-hours trading Tuesday. Year-to-date, SPY has gained 28.33%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |