Stocks lurched to new highs. Yes, I said lurched. Because there was nothing smooth about it given so much sector rotation and volatility that it makes it hard to see the trend.

But that lack of clear trend is in fact, the trend that exists.

Meaning this swirling, twirling action has been with us since March. And til proven otherwise that is the trend in place. So you should count on that going forward.

We will talk more about that…and how it effects our trading strategy…and updates on our individual positions in the weekly commentary that follows.

Market Commentary

Over the last several months I, and many other market commentators, have used the following terms to describe recent stock market activity:

- Volatile

- Consolidation

- Sector Rotation

- Rolling Correction

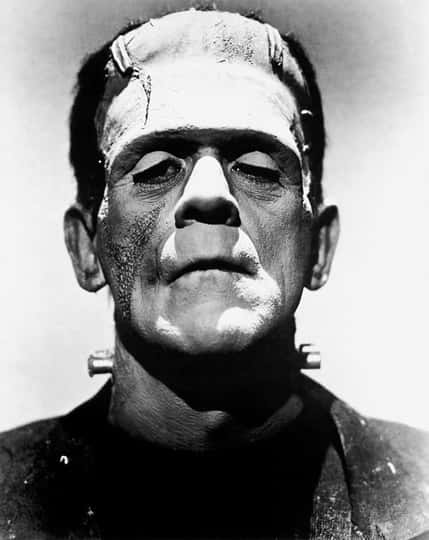

- Frankenstein (fits in with the lurching theme in the intro).

All of that is true…but still a bull market. Thus, if you read too much into the daily tale of the tape you will misread what the market is telling you. Because today’s winner is likely tomorrow’s loser and anyone trying to catch some momentum in that trend is likely going to be fairly disappointed.

This is where we come back to other themes discussed in recent commentary. And that is just to stay focused on the fact that it is a bull market. More specifically a bull market based on 2 main drivers:

- Low bond rates…like really low…like historically low and an absolute thumb on the scale for the stock market (like Paul Bunyan’s thumb).

- Economy still making its ways back from the Coronavirus crisis.

The first part about low bond rates should just have you bullish day in and day out because odds are so ridiculously skewed in our favor. The second part about the improving economy says that, in general, go for more Risk On and cyclical stocks. That’s because they should sport faster earnings growth at this stage which generally leads to higher share price appreciation.

That certainly has been the game plan for the RTR portfolio this year. Unfortunately that doesn’t work every day, week or month given the all the volatility. But over time it proves it’s merit with our strong outperformance on the year (+26.16%).

Reity, wasn’t our gain at +29% YTD on Friday?

Yes, it was. Which only proves my point about the violence and short term illogic of this market. But if you panic and think the strategy is not working because of these short term hiccups, you will miss those stretches where we absolutely crush it…like last week…and probably once again right around the corner.

Do I like this kind of market?

No…I absolutely hate it as shared most recently in the 8/20 end of the week note entitled “Who Hates This Market?”…the answer is yours truly 😉

But hating it doesn’t mean I am scared of it. Or running away from it. Just that I prefer stock action that is less volatile and more rational.

Gladly we do understand the trend in place and are playing our hand quite well.

What To Do Next?

The Reitmeister Total Return portfolio has beaten the market by a wide margin this year. (+26.16% YTD through 8/31/21 close)

Why such a strong outperformance?

First because I focus on the macro trends that tell us if we are in a bullish or bearish environment.

Second, determine the industries and groups set to outperform in the days and weeks ahead.

Third, I hand-pick the very best stocks from across the POWR Ratings universe. In fact right now there are 12 Buy rated stocks and 2 ETFs in the portfolio ready to excel in the days and weeks ahead.

If you would like to see the current portfolio, then start a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $452.51 per share on Wednesday morning, up $0.95 (+0.21%). Year-to-date, SPY has gained 21.82%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |