Welcome back to 2023.

What do I mean?

Mega caps are walking away with all the gains pushing the S&P 500 (SPY) to new record highs. But by comparison most people are wondering where is there slice of the stock market profit pie.

Today’s Reitmeister Total Return commentary will talk about these unique trends…what it means…and where we go from here.

Market Commentary

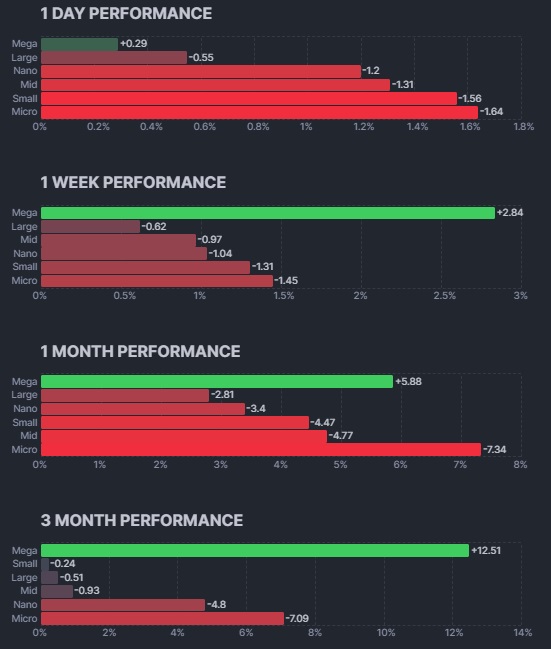

Let’s start with the following…do these performance charts look bullish to you???

Just like early 2023, all the gains are accruing to a small handful of the usual suspect mega cap tech stocks that dominate the S&P 500 pulling it forward as everyone else gets left behind.

So you are not alone in wondering why your portfolio is not measuring up of late. And you are not alone in thinking that doesn’t sound like a healthy bull market.

This same situation was the way the market looked for much of the early bull market in 2023. The rest of the market came along for the ride starting November 1st after the Fed’s dovish tilt. In fact, small caps led the charge (which is a good thing).

I suspect that once the Fed is truly on course to lower rates that this same broadening of gains will be on tap for stocks. And that will be good news for ALL concerned.

Helping the cause on Tuesday was the weaker than expected Retail Sales announcement. This is a positive under the heading of slowing demand which helps further soften inflationary pressures and allows Fed to contemplate the first rate cut.

The key with all these soft readings is to make sure the US economy not slipping into recession. And that too is going along swimmingly well as the Q3 GDP Now estimate currently stands at a healthy +3.1%. I suspect it will come in softer than that towards 2%. The point is that a recession is nowhere in sight.

Going back to the Fed meeting on 6/12 they told us that they no longer expect 3 rate hikes this year. That was slashed to 1 as the consensus with four officials expecting zero cuts this year.

This tells me that the 68% probability the market is putting on a September 18th first rate cut is far too high. That is because once the Fed starts cutting rates, then history shows they will likely keep cutting.

So starting September 18th would mean 2-3 rate cuts this year…which they just told us AIN’T GONNA HAPPEN!

This sets up investors for a bit of disappointment in September if that first rate cut is not served up on a platter. But as we have seen the several times in the recent past that when the starting line for rate cuts is moved back that it doesn’t elicit more than a 1-3% haircut. So don’t get bearish on this concept.

The main point is that “logically speaking” stocks should not move much higher until that rate cut is in hand…but who says the market is ever logical?

This leaves us open to a wide range of potential outcomes. When that is the case it is best to pull back to the big picture. And that is to appreciate that we are in the midst of a long term bull market.

Since that is the case, then best to stay 100% invested in the best stocks.

Which are those?

The next section will shine some light on that to help you outperform.

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

Plus 2 specialty ETFs that are benefiting from some of the hottest investment trends.

These hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $548.49 per share on Tuesday afternoon, up $1.39 (+0.25%). Year-to-date, SPY has gained 15.75%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |