(Please enjoy this updated version of my weekly commentary originally published December 15th, 2022 in the POWR Stocks Under $10 newsletter).

Market Commentary

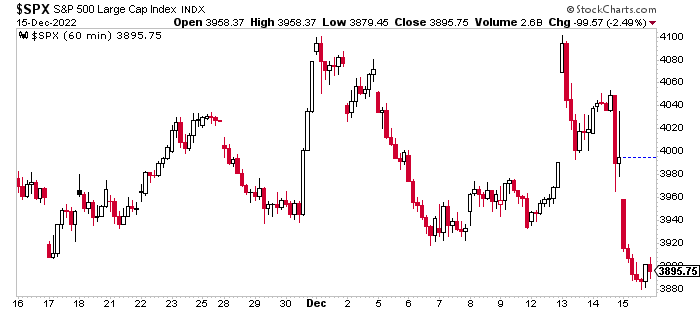

The S&P 500 (SPY) tumbled 2.5% on Thursday as traders realized next year is going to be painful.

Yes, the Federal Reserve’s latest reality check — more on this shortly — is partly to blame for the drop, but we had other forces at work as well.

But I’m getting ahead of myself. Let’s go back to where all this trouble started…

As I predicted in my last commentary, Fed officials voted to increase interest rates another 50 basis points. Great! A smaller hike. But then we got the latest dot plot and an updated commentary from Powell… and both reiterated that the war against inflation is far from over.

First, the dot plot.

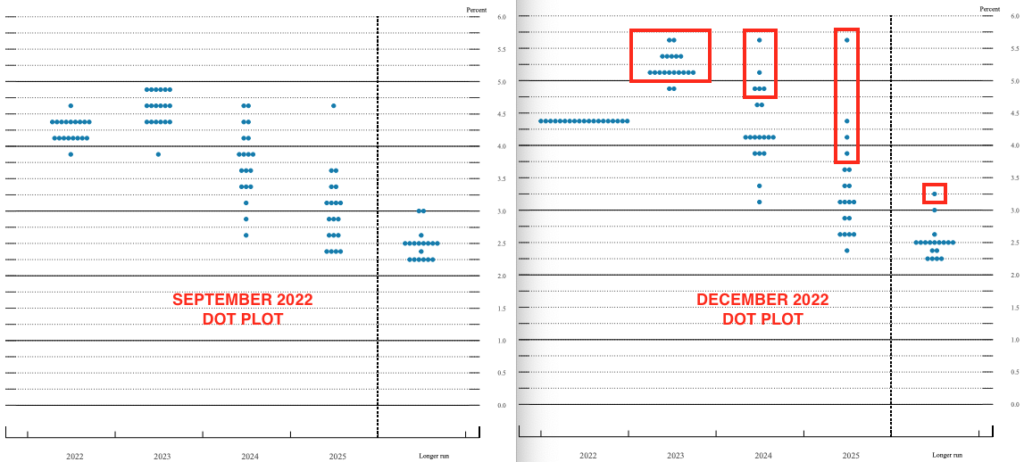

The Fed’s “dot plot” is basically a visual tool that shows where each of the Fed officials believe interest rates will be in the short, mid, and long term. Here’s the September dot plot (left) next to the one from yesterday’s meeting (right).

The dots make it plain as day: A number of Fed officials now believe we’re going to have to raise rates even higher… and keep them high for longer.

When the Fed last released these projections in September, they showed forecasts that the fed funds rate would peak between 4.75% and 5.0% sometime in 2023 before slowly coming back down the following years.

Now, we have notably more hawkish projections for rates of 5.1% to 5.4% in 2023 (with some Fed officials forecasting rates as high as 5.5% to 5.75%)…staying above 4% throughout 2024… and then maybe coming further down in 2025.

(Also, I would love to know who that one super hawk is, projecting interest rates of 5.5% to 5.75% THROUGH 2025. Bold.)

Powell’s comments put words to the message painted by the visual — there’s more work to do. A few choice quotes from his post-meeting press conference…

“I would say it’s our judgment today that we’re not in a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes will be appropriate.”

“Historical experience cautions strongly against prematurely loosening policy. I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to 2% in a sustained way.”

In other words, the Fed’s keeping its foot on the gas, and it’s not letting up until the job is done.

Yes, this absolutely contributed to the selloff we saw on… but as I mentioned at the top, it wasn’t the only factor.

On Thursday, both the European Central Bank and the Bank of England issued their own rate hikes, along with messages that further tightening is likely.

Lastly, the U.S. retail sales report showed spending dropped in November — not a very promising start to the holiday season.

Powell keeps saying there’s still a chance for a “soft landing” where we successfully navigate inflation without triggering a recession, but that’s looking less and less likely.

And if we do end up in a recession, that’s certainly not the end of the world. Stocks have always recovered their recession losses over time, and I don’t expect that to change now.

Is the road going to be bumpy? Yes.

But those bumps don’t mean we should panic. It just means we have to be nimble. The strategies that outperform going forward probably won’t be the same as what worked during the bull market. But here’s something incredible…

Applying POWR Ratings to stocks under $10 has been a consistent winner through bear markets, bull markets, expansions, recessions, and everything in between.

Going all the way back to 1999, this strategy has delivered positive, market-beating returns in every year but one (2008).

It’s like nothing I’ve ever seen. And it’s a good signal we should stay the course.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in the brutal 2022 stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Meredtih Margrave

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares closed at $383.27 on Friday, down $-6.36 (-1.63%). Year-to-date, SPY has declined -18.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith's background, along with links to her most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |