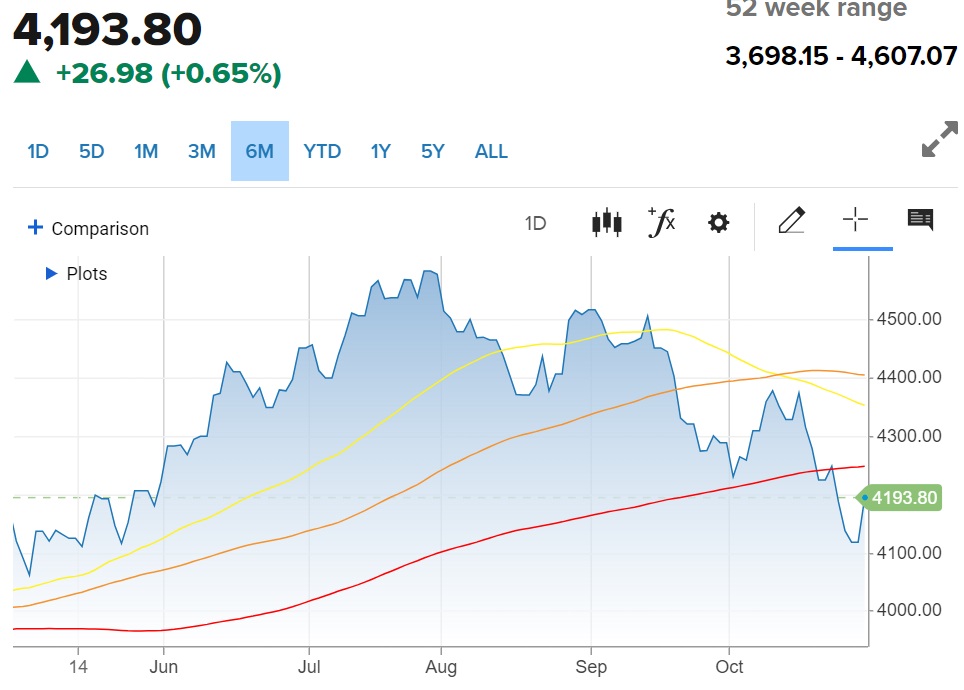

Indeed the stock market looks haunted this Halloween season as we continue to wallow under the 200 day moving average for the S&P 500 (SPY). Sure, there are some positive sessions like we enjoyed to kick off this week. However, the overall the mood is rather negative.

This is all happening while recently soaring bond rates have leveled off. So why is the mood still so dower? And will that keep the Santa Claus rally away this year?

We will “unmask” those issues in this Halloween edition of the Reitmeister Total Return.

Market Commentary

Bond Rates Up > Stock Prices Down

This has been the equation that explained most of the downfall for stocks over the past couple months. The more benign version of that story was that rates were normalizing to more traditional historical levels versus the ultra low manipulated levels we have enjoyed the past 2 decades.

The more sinister version of that rate rising story was that perhaps investors were losing confidence in major world governments to pay back that UNSEEMLY debt burdens. This is what some call the Debt Supercycle which would be a painful debt crisis (picture the Greek debt problem and make it 50X worse).

Read more about these 2 ideas in my recent commentary: Bear Market Warning from the Bond Market?

10 year Treasury rates did briefly touch 5% back on 10/18. That has seemed to be a place of resistance with rates settling under that mark ever since.

So why have stocks not been more robust with this bond rate reprieve?

First, the concern is that like any long term rally there are runs higher followed by pauses/pullbacks/corrections and then the next run higher. Meaning that just because rates ran out of steam around 5% at this time doesn’t mean they won’t run higher down the road. Thus, investors are likely in wait and see mode to appreciate what happens next.

Also, this rising of rates has many investors predicting a great softening of the economy from a fairly overheated +4.9% pace in Q3. That is why the key economic reports this week will have market moving impact. I am referring to ISM Manufacturing on 11/1 followed by Government Employment and ISM Services on 11/3.

Certainly, you can throw the 11/1 Fed meeting into the mix as an important event to watch. But right now, investors are dead certain they will sit on their hands once again.

The key, as per usual, will be Powell’s comments that will give us a sense of their future rate plans. Also of interest will be if there are any comments about higher rates, outside of their efforts, is doing some of the hard work to further soften the economy in the quest to finally tame high inflation.

Back to the economic reports for a second. Yes, ISM Manufacturing leads the parade on Wednesday. However, on Tuesday we got served up the best leading indicator for that report in the Chicago PMI that stayed very low at 44 (under 50 = contraction).

This likely points to a subdued ISM Manufacturing report to jump start November. The key is how soft? If it just comes in a notch under 50 then some investors may celebrate that as a sign the economy is moderating from the too hot pace set in Q3…and this would be good for moderating inflation and allowing the Fed to lower rates sooner.

However, if we have a reading greatly lower than the previous 49…then it could raise fears of a recession forming…and that most certainly would not be good for stocks.

Let’s also consider what is happening this earnings season as we are at the mid point. Right now it seems quite similar to other recent quarters. That means companies have been beating low expectations which shows up with the rise of earnings growth for the current quarter.

Before you celebrate, cast your eyes on the 3 columns to the right where earnings estimates are getting cut for the future. And overall, no real earnings growth expected til Q2.

Since the expectations for future earnings growth is a main catalyst for stock price appreciation…then you can appreciate why the market has been in correction mode. And that is why the maker of this earnings chart, Nick Raich of Earnings Scout, is recommending that folks stay underweight stocks at this time until we see earnings revisions turn positive.

Price Action & Trading Plan

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

No way to see the above and feel good about the market being below all 3 key trend lines. Especially bad when the things break below the 200 day moving average (4,242) which took place a week ago.

Honestly, I don’t sense a lot more downside on the way given the current facts in hand. Rather, I just see us consolidating under the 200 moving average for a while as investors await more facts on what lies ahead.

Unfortunately, I also don’t see much reason to break back higher until investors are more convinced that the advancement of rates has ended and thus odds of future recession remains low.

Given this explains our recent changes to be more cautious in the Reitmeister Total Return portfolio. More about that below.

What To Do Next?

Discover my current portfolio of 5 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 6 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead. (And yes have some inverse ETFs in the mix that are rising as the market falls…even some gold mixed in given the rise in worldwide tensions).

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 11 hand selected trades, and all the market commentary and trades to come….then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.85 (-0.20%) in after-hours trading Tuesday. Year-to-date, SPY has gained 10.57%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |