(Please enjoy this updated version of my weekly commentary published August 04, 2021 from the POWR Growth newsletter).

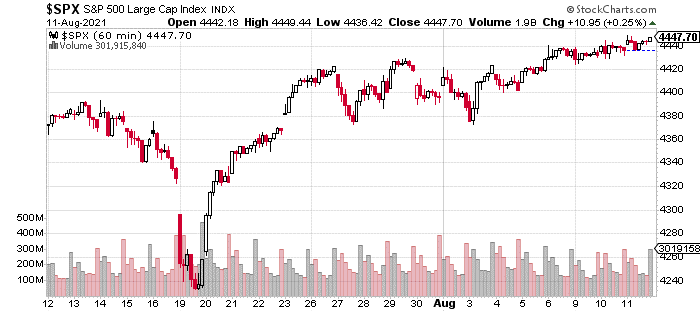

As usual, let’s start with the one-month, hourly chart. which shows that the market has been drifting higher out of its recent consolidation over the past couple of weeks:

I’m expecting that this low-volume, low-volatility drift higher could continue for a couple more weeks.

Let me Explain My Reasoning…

Last week, we discussed the tug of war between bullish and bearish forces. On the bullish side, we have earnings growth and low rates. On the bearish side, we have an overbought and overbullish market with some threats like the Delta variant, inflation, and growth concerns.

These are valid concerns and have triggered market corrections. However, the bullish forces have overwhelmed these potential, bearish catalysts. Now following a superb earnings season, I think the window has closed for some time on the bears.

Why? In sum, the earnings picture has gotten even better with 85% of companies beating on revenue and 87% on earnings. We are seeing earnings estimates being hiked for the near and long-term. 2021 EPS estimates for the S&P 500 are being raised to $200+, while 2021 estimates are now above $220.

On top of this, economic data has come in at a solid pace but it isn’t so good that it would cause the Fed to accelerate its tapering and hiking timeline. So, it’s in the perfect sweet spot -enough to generate earnings growth not enough to put upwards pressure on rates.

And, the threats to the outlook have receded. Countries that experienced the Delta variant are already seeing cases decline, so the US should peak sometime in the next couple of weeks. Inflation readings continue to come in hot, but forward-looking measures have peaked and are dropping fast.

Final Thoughts: The market took some heavy blows over the past few weeks. In terms of the indices, there has been no, lasting damage. Of course, the story is different with a deeper look at the market and some of the subcomponents.

I’m happy that we emerged from this with little damage and are well-positioned to take advantage of the market’s risk-on environment.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $445.03 per share on Thursday afternoon, up $1.25 (+0.28%). Year-to-date, SPY has gained 19.81%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |