(Please enjoy this updated version of my weekly commentary published June 6th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

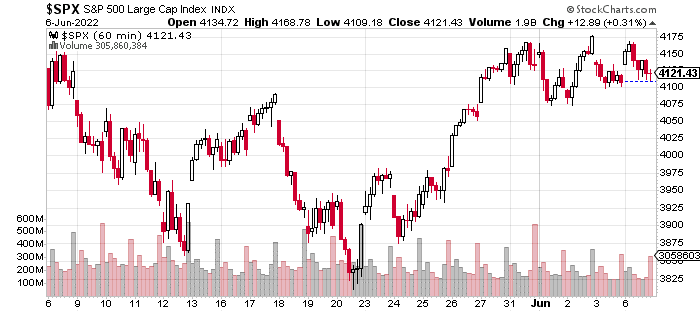

Here is an hourly, 3-week chart of the S&P 500:

We are basically flat over the past week with similar performance in all the major averages. The only thing that really caught my eye is that energy stocks are flirting with a major breakout, and a handful of growth stocks kept trending higher.

But the major question remains – Is this a healthy pause after an impressive initial rally off the lows. Or are we about to roll over to new lows as we have consistently done for much of 2022?

My inclination is that we still have one more upward thrust before we encounter any significant selling pressure. To be clear, this is a ‘loosely-held conviction’, and I’m mentally prepared for any outcome – a swift decline, sideways action, or a thrust higher.

My reasoning is that China’s economy reopening is a positive catalyst and is the final ingredient in helping the economy to normalize and slay some of the supply chain issues still plaguing the economy.

Also, the market remains very oversold on a longer-term basis and underinvested which makes it vulnerable to a sharp move higher.

Further, my study of previous bear markets shows that bear market rallies tend to be between 15% and 20% and often retrace more than 50% of the decline.

In all of 2022, we’ve only had 1 really good bear market rally – in March, when the market rallied 11% in 2 weeks. We’ve had about a 7% rally from late May till now, and I think we could go higher with the China catalyst and oversold market.

The job of the bear market rally is to punish latecomer shorts, lure in a fresh batch of longs, and turn sentiment from bearish to bullish which ironically sets up the next leg lower.

This type of bullishness in these market conditions can only be justified with a proper risk-management strategy: If the S&P 500 breaks below 4,000, I get less aggressive. If we break below 3850, I would get neutral.

Let’s Go Outside the Box…

In conversations with people about topics like a recession or a bear market, I’ve often used 2015-2016 as a comparison to what’s going on now. There are many huge differences, but I think one similarity that we can learn from is both are instances of different parts of the economy being out of synch.

This can be a curse when the economy is expanding and a blessing when it’s slowing.

In 2015-2016, there was an outright recession/depression in many parts of the market like energy and commodities. But, consumer spending and tech continued to grow which was enough to keep overall economic growth positive.

Now, I think it’s an inverse situation where parts of the economy like industrials, services, and travel are booming but tech and consumer spending are slowing/contracting. Since these are larger parts of the economy, the risk of a recession and/or bear market is higher.

Still, the bigger lesson is that there will be opportunities in the parts of the market and economy that continue to work.

Another reason that I’m thinking about 2015-2016 is that it also featured a massive bear market rally that did its job of turning sentiment from bearish to bullish.

From July 2015 to September 2015, the S&P 500 declined by about 16%. Much less dramatic than the current market with fewer risks and lower levels of inflation.

But, there still were bear market fears, concerns about the Chinese economy tipping into a recession, and worries about a spiral due to defaults in the energy space with oil prices under $40 per barrel.

In this environment, we got a big bear market rally in which the market retraced about 80% of its losses over the next month and a half. Market sentiment turned on a dime, and the talk became about new, all-time highs.

So, I want to think ‘outside the box’ and consider a similar scenario for this time around.

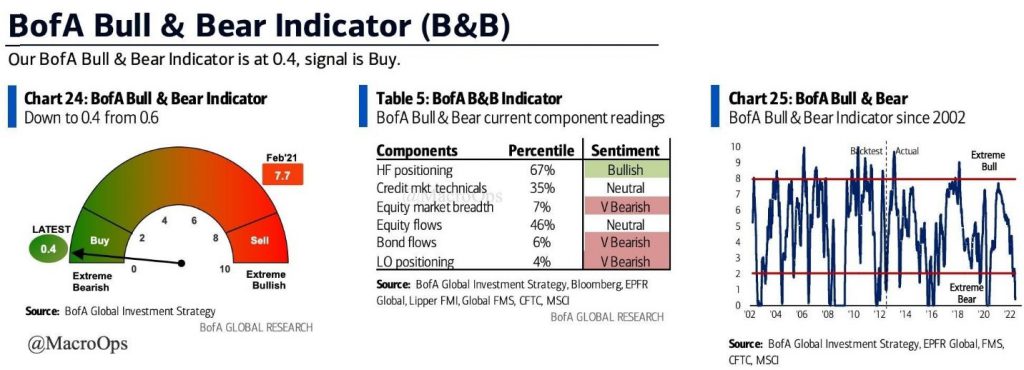

There’s plenty of ‘dry tinder’ with sentiment so bearish. This image captures the bleak state of affairs:

Doesn’t mean that we have to go up. But, it does mean that any move to the upside could be quick and violent.

Another positive is that I’m seeing stubbornly, strong, relentlessly bullish price action despite bad news like the jobs report, Fed Governor Brainard crushing hopes of a September pause, oil continuing to trend higher, high levels of CEO pessimism, MSFT missing earnings, and several private market markdowns and ominous warnings from VCs.

As mentioned above, I think China successfully reopening is a meaningful catalyst. It’s also likely one reason that growth has suffered in the past couple of months.

This would almost be like a ‘Goldilocks’ impulse where we get a growth spark and a deflationary force in one. Another potential positive especially in an inflationary environment is the Republican takeover of Congress.

This is going to essentially take fiscal policy off the table for the next 2 years, and markets tend to like gridlock, especially with a Democratic President and a Republican Congress.

In terms of a quantitative target, the last leg lower was from late March to late May and the S&P 500 dropped from 4,600 to 3,850. I think that somewhere around 4,450 would be a good target for this move.

But, what I’m more interested in is the qualitative target. Sentiment that is closer to neutral but extremely bullish in the short-term with traders piling into calls and making the case that new highs are just around the corner.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $411.78 per share on Tuesday afternoon, down $0.01 (0.00%). Year-to-date, SPY has declined -13.03%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |