There are only 2 possible ways to interpret the Fed statements from Wednesday.

First, take the Fed at their word that probably 2 more hikes are coming and unemployment will rise because of those efforts.

Second, assume they are bluffing and are actually done with rate hiking cycle.

Now let me ask you…Does chairman Powell look like the bluffing type? Or does he look like an Eagle Scout that has told the truth every time his mouth has opened since birth???

Hopefully the answer is obvious enough. The Fed is not bluffing. Which explains why the CME’s FedWatch Tool has risen to show 74% probability of a rate hike at their next meeting in late July.

More to the point, the Fed has consistently stated that high inflation is an economic disease that harms long term growth and employment. Thus, their goal is to wholly eradicate it and get back to 2% annual inflation target.

Their method to eradicate it is to “lower demand” by slowing down the economy. It is hard to lower demand if you have full employment and everyone’s wallet is full.

That is why time after time Powell’s press conference talks about the employment picture being too strong which leads to sticky wage inflation.

Adding these concepts together it is CLEAR that they will keep rates aloft until they have effectively caused unemployment to rise. That is why they are still anticipating a 1% increase in the unemployment rate before all is said and done.

Now let me say it another way.

They WANT unemployment to rise to put a final nail in the high inflation coffin. That is why so many commentators are saying they will keep rates aloft until “something breaks”.

That is why you should take them at their word that…

- There is more work to be done to control inflation

- 2 more rate hikes are likely in the forecast this year

- Lower rates will NOT occur in 2023

- And yes, unemployment will rise by 1%…or more!

Here is the real wakeup call friends.

The unemployment rate has never gone up by 1% and stopped there. Research shows that once you rise that much, it typically leads to a 2% or greater rise. Kind of like opening Pandoras Box which greatly increases the odds of future recession (and deeper bear market).

Do You Feel Lucky, Punk?

To the market bulls I repeat the point blank question from Dirty Harry “Do You Feel Lucky Punk?”

In that infamous scene Dirty Harry (Clint Eastwood) has fired several shots to apprehend a criminal on the run. And now he stands over him with gun pointed at his head with one of the greatest monologues of all time.

That being in all the flurry of activity Harry is not sure whether he shot 5 times or the full 6 in the gun. Thus, he asks the guy does he feel lucky as to whether the gun is empty and he should attempt to flee the scene. Of course, the criminal was wise to turn himself in because the risk of getting his head blown off was far too high.

Yes, the Fed has shot many rate hike bullets at the economy. So, when they tell you they are probably going to shoot twice more…and that will likely lead to a hike in unemployment…and history shows that comes hand in hand with recession…and recessions go hand in hand with lower stock prices…THEN it feels “straight jacket crazy” to keep buying stocks at this time.

Another Rally That Wasn’t a Rally

On the surface it sure looks like investors interpreted the Fed meeting as a green flag for the bull market. Yet as we dig deeper we find it was just more of the same insanity from earlier this year. Just all the money going to the usual suspects in the Mega Cap space.

This is why the Bond King, Jeffrey Gundlach, said on CNBC that that we are seeing a mania style bubble in mega caps because of the excitement over AI. But given the current valuation of the overall stock market, that bonds are the much better value at this time given the tremendous rise in yields. And yes, that stock prices should fall. His analysis is absolutely, historically, objectively true.

So as we dig below the surface we find that mid caps and small caps are actually down since the Wednesday afternoon Fed announcement. Not rallying with the mega cap dominated S&P 500.

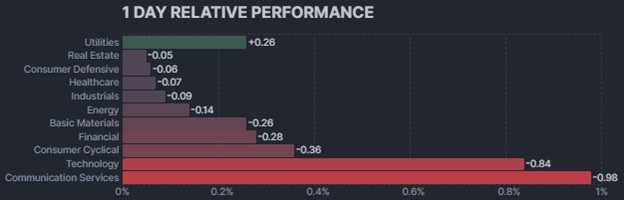

Meaning there is NO breadth…and therefore not much real substance in the rally. With that in mind, now take a look at this chart from Friday of the top performing sectors:

Look at the top 4 sectors. Those are defensive groups which means Risk Off market conditions. Not the bull market that is being too widely advertising in the media circles.

Can stocks keep rallying in the light of these facts?

Sadly yes. That is the very nature of manias and bubbles which brings to mind the famed quote from legendary economist John Maynard Keynes:

“Markets can remain irrational longer than you can remain solvent”.

Trading Plan

Given all the above is why my trading plan continues to be balanced. As in 50% invested.

That is the best way to straddle the bearish fundamental outlook against bullish price action. (Yet as shared above, the price action is not as bullish as it seems given not enough stocks are really participating in the good times…just the usual suspects in the mega cap space).

This balanced posture allows us to shift more bearish if a recession comes on the scene pushing investors to hit the SELL BUTTON in earnest.

And yes, we can still shift more bullish if the fundamental picture improves allowing the stock gains to broaden out to more groups.

Heck, Powell may be the greatest poker player on the planet and the Fed may be done raising rates. But with that rate hike gun pointed at my head…I am going to take him at his word that there are more bullets to be fired.

What To Do Next?

Discover my balanced portfolio approach for uncertain times.

It is perfectly constructed to help you participate in the current market environment while adjusting more bullish or bearish as necessary in the days ahead.

If you are curious in learning more, and want to see the hand selected trades in my portfolio, then please click the link below to what 43 years of investing experience can do for you.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.14 (+0.03%) in after-hours trading Friday. Year-to-date, SPY has gained 15.35%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |