(Please enjoy this updated version of my weekly commentary originally published June 15th in the POWR Stocks Under $10 newsletter).

As expected, the Fed decided not to raise rates at the June FOMC meeting. This comes on the heels of a bigger expected drop in CPI. The popular inflation measure came in at 4%, which was down significantly from 4.9% in the previous month.

The apparent easing of inflation may be one reason the Fed was comfortable not raising rates this time around.

However, the FOMC wasn’t shy about being hawkish with its language. There’s nearly a 70% chance of a quarter point rate hike in July. Moreover, the central bank made it clear they have a lot of work left to do before they get to the inflation number they prefer.

Nevertheless, the warnings from the Fed made little difference to the stock market. After a brief pullback in the major indices, stocks rebounded by the end of Fed Day. And on Thursday, the S&P 500 (SPY) climbed another 1.2%.

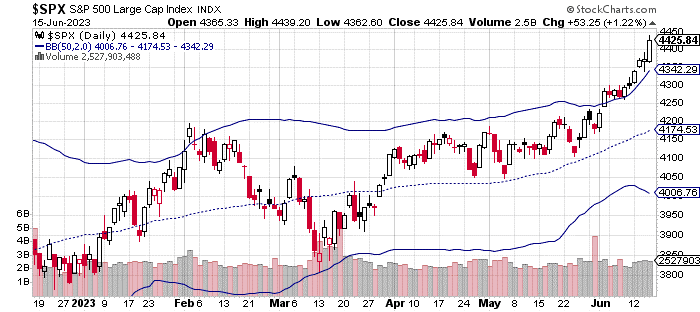

You can see in the chart above, the SPX (S&P 500 index) is clearly above the two-standard deviation upper barrier.

Volatility has increased a bit, so the breach is a bit less egregious than it would have been a week ago. That being said, I would expect some mean reversion next week as the buying subsides.

That’s not to say stocks won’t keep going up on average. In fact, at this point, I would be surprised by any meaningful selloffs for the next month or so.

Still, as I often say, mean reversion is a real thing and at some point the market will move back towards its mean price.

In the meantime, the economy continues to chug away. Retails sales also beat expectations this week (climbing 0.3% in May) as consumers continue to shop despite higher than normal inflation.

The Fed has an interesting situation on its hands. Do they want to take a chance torpedoing the economy? Or, should their focus be mostly on lowering inflation?

We’ll see how things play out, but I would expect a couple more rate increases this year before we are in a position to hold steady (and eventually see lower rates). We may be stuck with higher rates for another year or so at this rate.

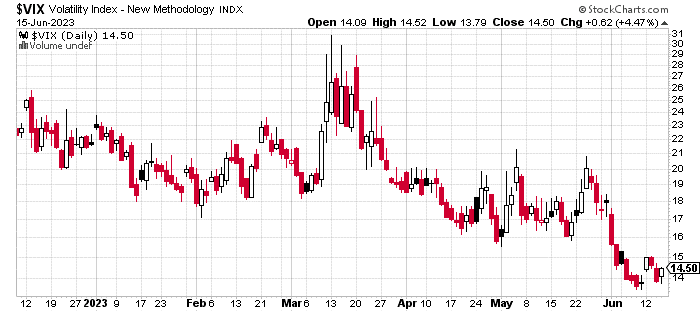

Volatility moved a bit higher before the Fed announcement but it fell back down below 15 on Thursday. All signs point towards a continued low volatility regime for the summer trading months. You can see the VIX action in the graph below.

Outside of some unexpected news items, I wouldn’t expect any significant increase in the VIX level until we approach the July FOMC meeting.

Keep in mind, the July 4th holiday is major travel season and there isn’t likely to be much volatility around that period.

What To Do Next?

The above commentary will help you appreciate where the market is going. But if you want to know the best stocks to buy now, then please check out my new special report:

What gives these stocks the right stuff to become big winners, even in this challenging stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Jay Soloff

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares closed at $439.46 on Friday, down $-3.14 (-0.71%). Year-to-date, SPY has gained 15.35%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jay Soloff

Jay is a former professional market maker who cut his teeth trading on the floor of the CBOE. With more than 20 years of experience trading and investing, his focus is on making professional strategies accessible to everyone, which is exactly what does in his highly profitable POWR Income and POWR Stocks Under $10 investment advisory services. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |