Often the early days of a new year set the tone for how the rest of the year will turn out. That is because so many investment managers have prepared for a shift in strategy that takes place to start the year.

The result on Thursday was heavy sector rotation which continues the rolling correction we saw forming in late 2024. I shared insights on the rolling correction back a couple weeks ago in this article.

Today we will expand on this notion with the recent performance results. Even more important, we will talk about how to invest in this environment to enjoy superior results.

Market Outlook

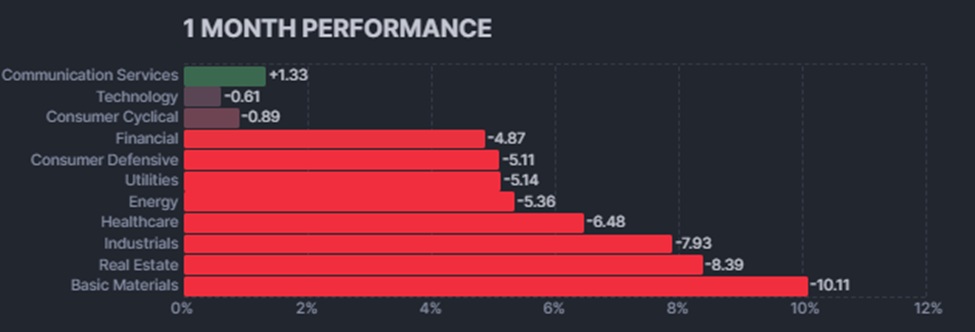

I think the fastest way to get across the notion of a rolling correction is with this 1 month sector performance chart:

You will notice that most sectors are beyond the limits of a pullback nearing in on a full blow 10% correction. And yet the S&P 500 (SPY - Get Rating) is only 3% off the highs.

On the surface that math doesn’t add up until you understand that most of the Magnificent 7 are inside the Communication Services sector while some are in Technology. Those larger stocks barely budging while the rest of the market is selling off mode helps put the rolling correction concept into focus.

My 2025 Stock Market Outlook still looks on track. The main change from what I said in September is that I expected stocks to sprint into the finish line in 2024 leading to a sell off to start the year.

As it turns out that sell off (rolling correction) started in December and continues to start the new year. This should set up for an interesting shift in the investment landscape the rest of the year where…“One man’s trash is another man’s treasure”.

Meaning that the discarded stocks from this correction will become wonderful value opportunities for some longer term investors. There was some bargain shopping today. But even more will follow in the weeks ahead.

Most importantly, I think the 4 year reign of Mega Caps (and large caps for that matter) is over. Some of these stocks have straight up nose bleed valuations that are not supported by history. And yes, fairly close to “irrational exuberance” territory.

Thus, it was nice to see TSLA cough up another 6% Thursday and now down over 20% from the December peaks. This means that some well needed order and sanity is being returned to the investing world. Let’s hope that continues.

This should lead to a rotation to find greater value elsewhere in the market. Gladly that can easily be found in small and mid caps with PEs under the historical norm at 15-16. That is more than a 30% discount from the PE level of the S&P 500. And about half of the Mega Caps.

On top of that, I still think economically sensitive, Risk On groups are the place to be. Like the aforementioned Industrials and Basic Materials. On top of that would be those groups that benefit from lower rates like home builders, auto, and finance.

This formula certainly paid the bills on the first session in January…and believe will be the formula to outperform the rest of the year.

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my top 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.35 (-0.06%) in after-hours trading Friday. Year-to-date, SPY has gained 1.00%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |