(Please enjoy this updated version of my weekly commentary released Tuesday January 5th from the Reitmeister Total Return newsletter).

Rocky start to the new year was not a big shocker as there were lots of gains from 2020 that investors finally pocketed on Monday.

Why did they wait til now?

To delay the tax hit a full year which is pretty common practice. However, it didn’t take long for investors to get back to their bullish ways as we enjoyed a strong session on Tuesday.

Today we will talk about the overall market outlook and some recent economic data. But truly the most interesting thing to discuss is on the political front with congress set to certify the election on Wednesday January 6th. Beyond political theatrics the outcome of the election will go Biden’s way. However, this may unleash a potential negative chain of events for the country and stock market. Will discuss it in detail below.

Market Commentary

As for the overall market, the sell off on the first session of the year was to be expected. In fact, we talked about that in last week’s commentary:

“To be honest, part of that call is for more quality in the portfolio. Stable…proven companies with attractive upsides, but greater resistance to downside.

Why?

Because I think this market is running a tad too hot. Let’s not forget that the market has raced about 70% from the March bottom to current heights. And more recently it has zoomed 15% from the pre-election low to where we stand now.

I believe all of these gains in hand leads to a potential round of profit taking to start the year. This is quite typical and to be expected with the size of the gains that have taken place this year.

However, this path is not such a certainty that we need to take money off the table. In fact, this may prove to be nothing more than a consolidation period where the overall market trends sideways for a while with profit be taken from some sectors and moved to others. That type of action increases volatility for, which again, a call for quality is helpful.

New portfolio entrants like (tickers reserved for Reitmeister Total Return subscribers), fit the quality bill. And really as I look across the span of our entire portfolio there is a lot of quality on board. Yes, there is some risk in their too like the “Back to Normal” trades. But they are calculated risks where the future upside is still much more attractive than any short term downside.”

So indeed this is what did happen with a broad sell off to likely lock in profits and take the tax hit in 2021 instead of 2020. As for our strategy to increase portfolio quality to see less harm come our way did seem to pay off too as our portfolio only declined only -0.5% on Monday while the S&P was off 1.5%. And Tuesday we stayed ahead of the pack as well as the market bounced higher.

More specifically our recent additions, (tickers reserved for Reitmeister Total Return subscribers), held up much better than their predecessors MDC and MTZ on Monday. So I am glad we made these moves.

Now onto today’s main topic. That being the events tomorrow, Wednesday January 6th. That is when Congress is set to certify the election results.

Before we press further lets remind each other of the following disclaimer. And that being I am trying to talk about these issues in the most politically neutral manner possible. If you take offense…then that is more a statement on you than me. Because if we can’t talk about these things civilly, and logically, then we are doomed as a society. Pressing on…

There are some Republican members of congress who are prepared to put on some political theatre to call the vote into question. The odds of that working are extremely low just as it was back in 2004 when Democrats tried their hand at it. These politicians just want to make a name for themselves for future elections. In the end Joe Biden will be named the President elect with the inauguration two week later on January 20th.

The real reason to talk about January 6th is what will happen OUTSIDE the halls of Congress. I am referring to the “March for Trump” which will be a mass gathering of Trump supporters in DC who believe the election has been stolen from them. No doubt they will be upset when Congress certifies the election for Biden. And no doubt there will be folks from the Democratic side eager to heckle these beleaguered Trump supporters. This is a potentially volatile combination.

Remember that we talked about this concept early and often when it was clear that this would be a contested election. Gladly most demonstrations to date have been civil. But this one has serious potential to get out of hand. The kind of event that may spark other protests and unrest around the country given the very divided views over government and the legitimacy of election results.

Gladly the odds of this kind of widespread chaos is fairly low. Like only 10% possibility in my book. But high enough of a risk to put on your radar. Because if it did set off a negative chain of events around the country, then it would certainly be a negative for stocks with a 5-10% pullback a strong possibility. And yes, we would want to get a bit more defensive in such an event.

Do you believe I am making a mountain out of a mole hill?

Then read the home page message for the official website: www.TrumpMarch.com

“Democrats are scheming to disenfranchise and nullify Republican votes. It’s up to the American people to stop it. Along with President Trump, we will do whatever it takes to ensure the integrity of this election for the good of the nation.”

“Whatever it takes” is a scary concept in the wrong hands. And unfortunately there are many at that march who may be willing to take that concept to a violent extreme.

Again, I do not believe this will happen. Nor do I want this to happen. But the odds of it happening are just high enough to warrant being on our radar screens with a contingency plan in place to act fast in our portfolios if need be.

That plan would be to get more conservative moving to perhaps 70-80% long from the current 100%. Then we assess if things are getting better or worse making logical subsequent moves in our portfolio.

As long as we are talking about political events, one more deserves a quick notation. And that is the Georgia run off elections today. The general market wisdom is that Republican’s keeping control of the senate would be smiled on the most by investors. That is because it would be a sign of gridlock in Washington which is considered favorable to one party having complete control over policy.

Meaning investors assume that politicians will do most everything wrong. So gridlock = less new policies and thus less likely to mess things up.

Reity, are you saying the market will tank if Democrats win both of those Georgia Senate seats?

No. It just wouldn’t be as positive in the short run for the markets as would Republican control creating political gridlock. Over the long run we should remember that historically stock markets have done equally well under Democratic or Republican administrations.

Now let’s quickly switch back to the economy to wrap up today’s market commentary.

ISM Manufacturing for December came out today and was a big positive surprise. The 60.7 showing is well above the previous 57.5 result. Plus the New Orders component at 67.9 is SMOKING HOT which bodes well for the future readings. Also the Employment reading finally climbed into positive territory at 51.5. All in all you could not ask for better which was certainly one of the catalysts behind Tuesday’s strong session.

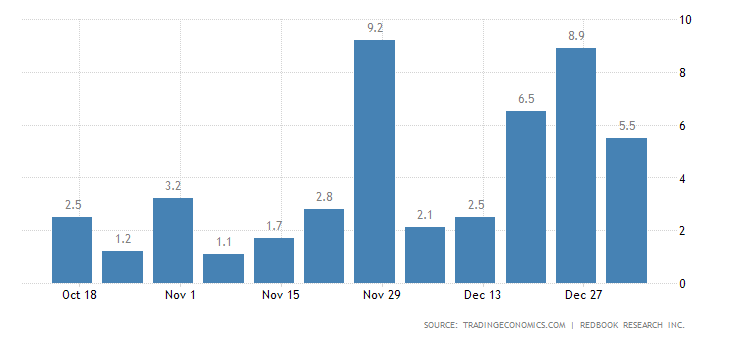

Also today we got the Redbook Weekly Retail Sales report at +5.5% leaving no doubt that this was a strong holiday shopping season. The chart below shows the year over year gains for the past few months which are markedly above the 2020 levels starting with the +9.2% reading the week of Black Friday.

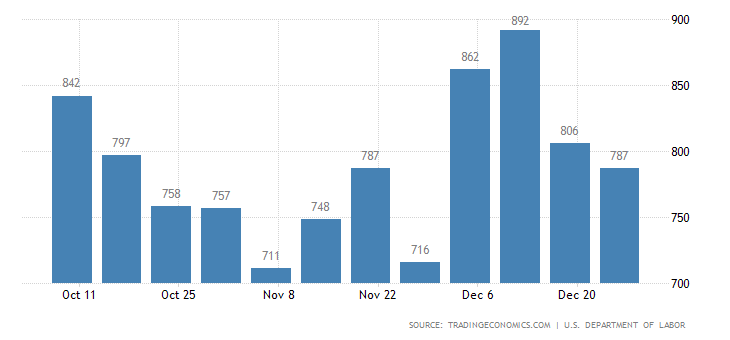

Lastly, Jobless Claims are trending lower for a second straight week after spiking higher in late Nov as the Coronavirus swelled around the country. As you know this led more governments to impose stricter control over in person businesses which was especially hard on restaurants. See these readings retreat from recent highs is a good sign with hopefully even lower readings in store in early 2021.

All in all the bull market is still alive. However, the events of January 6th to certify the election is one to watch as we have some pretty “heated” citizens who could take the results very badly with seriously negative consequences for the nation. Let’s all hope and pray that cooler heads prevail so that our nation can more successfully mend from the ails of 2020 emerging into a new era of growth and prosperity.

(Above is the end of my Tuesday January 5th commentary. Below is a follow up note shared with subscribers after the close on Wednesday January 6th).

Even though I warned of this kind of event in my commentary for the last few months, including my weekly commentary published yesterday…it is still highly unsettling to see what happened in DC today. I am sure that people of all political stripes feel the same.

No…I don’t want to get up on my soapbox and tell you how I truly feel. There is plenty of talking heads on TV taking care of that for me already. Instead we will have a brief discussion as to what it means for our investment strategy.

As a reminder here is what I said about the effect on the market and our strategy in commentary yesterday:

“Gladly the odds of this kind of widespread chaos is fairly low. Like only 10% possibility in my book. But high enough of a risk to put on your radar. Because if it did set off a negative chain of events around the country, then it would certainly be a negative for stocks with a 5-10% pullback a strong possibility. And yes, we would want to get a bit more defensive in such an event.

Do you believe I am making a mountain out of a mole hill?

Then read the home page message for the official website: www.TrumpMarch.com

“Democrats are scheming to disenfranchise and nullify Republican votes. It’s up to the American people to stop it. Along with President Trump, we will do whatever it takes to ensure the integrity of this election for the good of the nation.”

“Whatever it takes” is a scary concept in the wrong hands. And unfortunately there are many at that march who may be willing to take that concept to a violent extreme.

Again, I do not believe this will happen. Nor do I want this to happen. But the odds of it happening are just high enough to warrant being on our radar screens with a contingency plan in place to act fast in our portfolios if need be.

That plan would be to get more conservative moving to perhaps 70-80% long from the current 100%. Then we assess if things are getting better or worse making logical subsequent moves in our portfolio.”

Indeed the S&P gave back more than half of the early gains into the close. Yet still it was very much a bullish, Risk On session. That is why our portfolio shot up +2.81% on the day (about 5X better than the S&P). But in particular, our biggest gains came from positions that benefit from higher interest rates as the 10 year Treasury finally broke above 1%.

This led to ticker ABC rallying an RTR leading +7.8% followed by our short of the Treasury bonds, ticker DEF, bolting +4.3% higher. (actual tickers reserved for Reitmeister Total Return subscribers),

As of this moment, the investment world sees the Capitol building riot in DC as an isolated event. Indeed that may end up being true with no additional events sprouting up around the country.

HOWEVER, if more events of this nature sprout up around DC, or the country as a whole, then investors will change their tune potentially devolving into that 5-10% correction noted above. And yes, we would want to enact some trades to get more defensive in our portfolio.

My strong hope is that the ugliness on full display on our TVs will actually serve as a preventative measure from other citizens wanting to participate in such horrific fashion. Instead let’s hope that it inspires all Americans to find that peaceful path to resolution that makes our country a beacon of hope to so many others.

What To Do Next?

Right now my Reitmeister Total Return portfolio is correctly positioned for where the market appears to be headed in 2021. That’s because we are overweight the groups most likely to benefit from society slowly, but surely emerging from the dark hole of the Coronavirus period.

If you would like to see the current portfolio of 12 stocks and ETFs, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $376.26 per share on Wednesday afternoon, up $4.93 (+1.33%). Year-to-date, SPY has gained 0.64%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |