(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Let’s get right to the heart of the matter.

The bull market was doing just fine to start off 2022 with some nice positive sessions. And then came the Fed minutes on Wednesday 1/5 and a nasty sell off commenced.

This is BEYOND comical to me. That’s because the Fed has been BEYOND clear on its intentions to raise rates in the future.

First, by ending their $120 billion per month bond buying program. Next to trim their $9 Trillion balance sheet by selling more bonds. And then likely to raise rates a few times in 2022.

Net-net rates will be on the rise in 2022 and beyond.

This has been CLEARLY signaled to investors many times over. And each time it happens traders act like it’s the first time leading to a sell off…leading to a bounce…leading to making new highs once again.

In fact, I have talked about it in my commentary on numerous occasions. Most recently was September 28, 2021. And before that on 8/24/21.

I want you to read the 9/28 commentary exactly as stated back then with no edits. That’s because it is the best way to explain why it was so absurd back then when the S&P was at 4,352…and today stands over 4,700. And thus just as absurd today as it is nothing more than a silly speed bump before the market makes new highs once again:

(Start 9/28/21 commentary)

“What is a “Taper Tantrum”?

This is an overdone stock market sell off that begins when the Fed first signals that they plan to take actions that will raise rates. This gets some hyperactive traders to start selling immediately because they foresee that the tide has turned and there will be more Fed actions to raise rates in the future.

This reaction sounds logical on the surface. But is completely insane given all historical reference points which we will dig into below.

More to the point, when the Fed shifts to a more hawkish view (less accommodation with higher rates likely to follow) the stock market typically goes up for 2-3 more years afterwards. That is the norm.

In this case, rates are so far below normal…that it may take a lot longer than 2-3 years for higher rates to cramp the economy and stock market. Thus, to have any kind of sell off now is irrational and borderline insane.

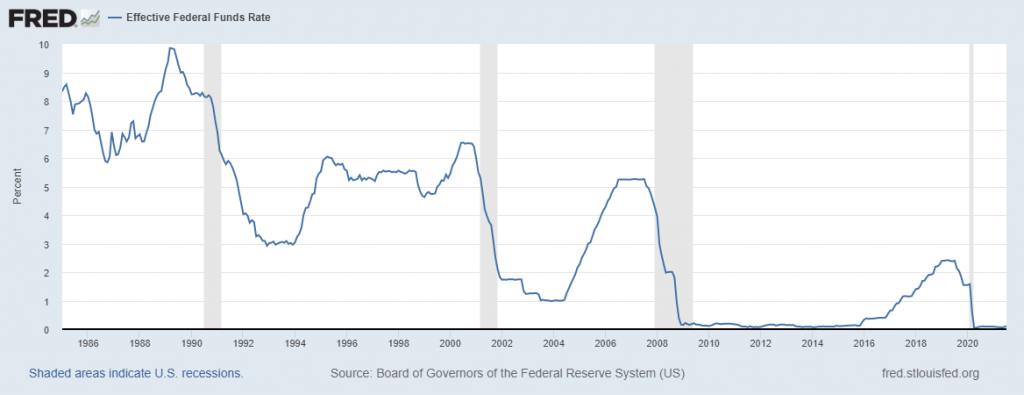

Here is a chart going back over 35 years and 4 bear markets (the gray vertical bars). See how long before the bear markets arrive that the Fed starts moving rates higher. And see how high rates had to go before the bear market began. Meaning the ticker tantrum sell off last week was a downright JOKE. Thus, not a surprise how quickly stocks have rebounded since.

Then it begs the question; Why do these illogical market reactions happen so often?

It comes down to the difference between traders and investors. In particular day traders and computer based trading is a world view compressed to just seconds and minutes. That is opposed to the months or years that the typical investor contemplates.

When your time horizon is that compacted, then you are hyper vigilant to the headlines. There the view becomes binary such as:

More Fed accommodation = Buy

Less Fed accommodation = Sell

These decisions are instant and reflexive with no care or concern for the longer term ramifications. Indeed, looking at the chart above, last week’s sell off would be like bailing out of the stock market 1994 at the first sign of Fed rate hikes even though there was 6 more years of glorious stock gains to follow.

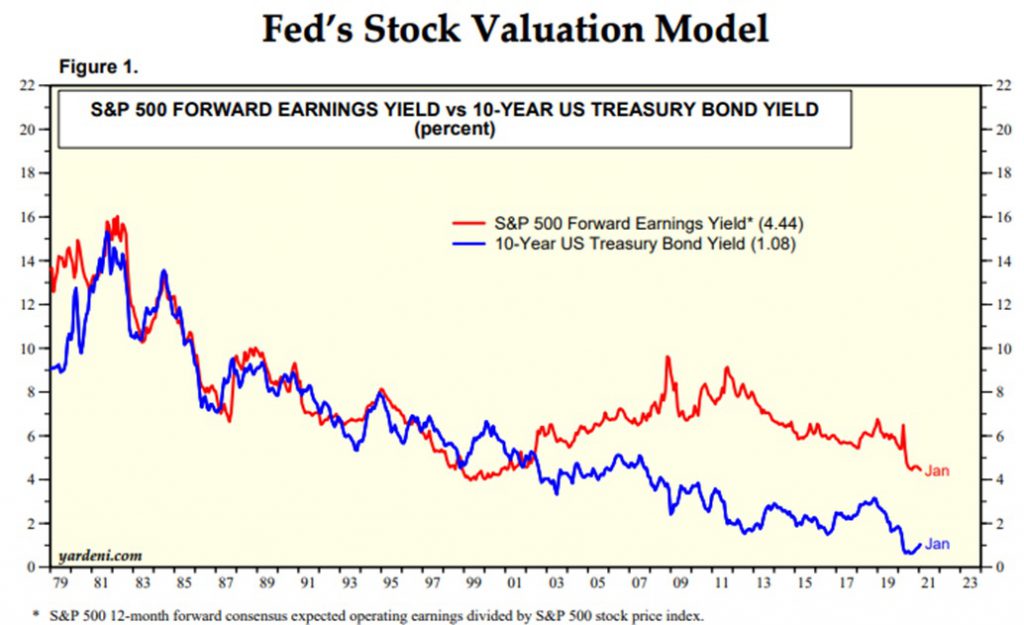

Just to solidify the point, below is the chart which shows the value of the stock market if it was on par with the yield of 10 year Treasuries. This is an important chart because as you will see on the left side, the stock market has been relatively on par with that valuation model between 1979 and 2001. So now picture how much more rates would have to rise to call into question the value of the stock market and end this bull run.

(9/28/21 Edit: This chart may be from end of July #s…but even with rates up to 1.55% the stock market is still the OBSCENELY better value at this stage).

I think you see my point. That rates are so incredibly low creating an undeniable value story for stocks that will NOT be undone anytime soon.

This does not mean to take a second mortgage on your house to put in the stock market.

This does not mean the stock market will just go up and up and up.

This does not mean that there will not be other extended sell offs here or there along the way.

It simply means that the long term market outlook is bullish til proven otherwise. And to undo that we would need to see some great threat to the economy that meant recession with subsequent bear market. Virtually nothing taking place right now points to that outcome which is why a bullish bias is warranted.

Having that clear eyed view in place allowed us to unflinchingly stay in our stocks during the taper tantrum to enjoy some pretty impressive gains since.”

(End of 9/28/21 commentary)

Long story short…stay bullish. And do it with the right group of stocks to put the odds of outperformance in your favor. To help you on that journey, then be sure to read the next section…

What To Do Next?

Discover my top picks for the year ahead.

I am referring to the 12 stocks and 2 ETFs in my Reitmeister Total Return portfolio that firmly beat the market last year.

These selections are based upon my 40 years of investing experience. Plus we rely heavily on the benefits of the POWR Ratings model with it’s impressive +30.72% annual returns since 1999.

All you have to do to see my current recommendations is to…

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.05 (-0.01%) in after-hours trading Tuesday. Year-to-date, SPY has declined -1.10%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |