The most bullish event this year took place on Tuesday November 14th. That is when the small caps in the Russell 2000 nearly tripled the S&P 500’s (SPY) return at +5.44%.

Since then large caps continue to rise and small caps are lagging once again. This makes me wonder just how bullish this market truly is???

Let’s dig in more on this vital topic in today’s commentary.

Market Commentary

November has been bullish altogether. No denying that as bond rates have dropped providing a great catalyst for stock price advances.

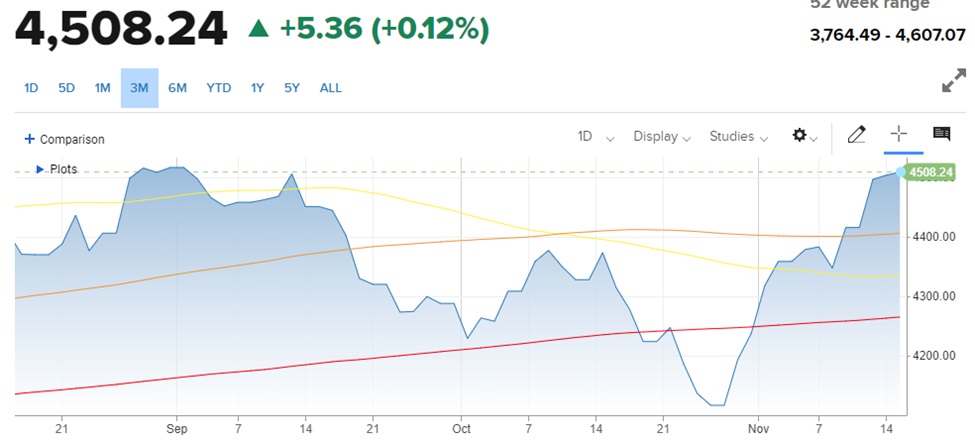

As you can see in the chart below, we have quickly reclaimed bullish territory above the 3 key moving averages for the S&P 500:

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

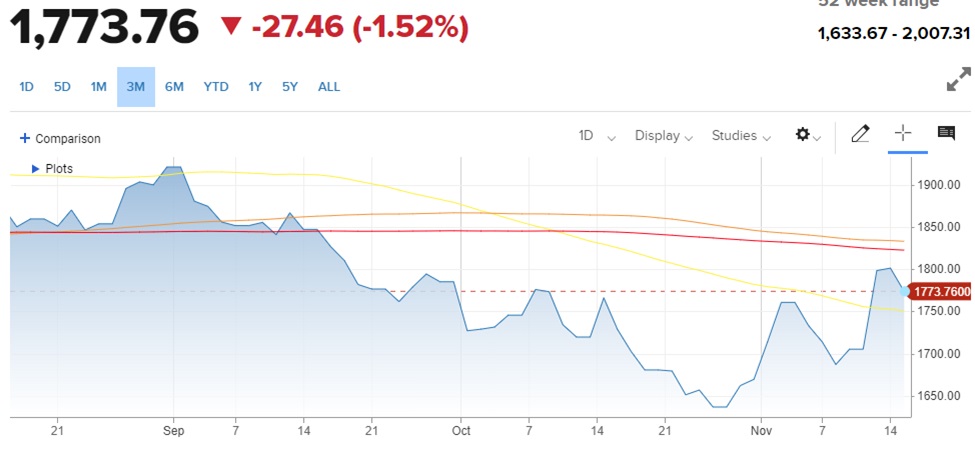

Yet as we contemplate the view from small caps…it’s not as rosy. Here is the same 3 month chart with key trend lines for the Russell 2000:

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

The aforementioned +5.44% gain for this key index on Tuesday was very promising. That’s because there is no way to feel truly bullish when all the gains are just accruing to the usual mega cap suspects formerly known as FAANG and now being called the Magnificent 7.

The mark of a truly bullish market is that there is more risk appetite leading investors to smaller, growthier companies. This also shows up in the long term advantage for small caps vs. large caps that really hasn’t been true in more than 3 years.

So yes, there are good signs for investors. That inflation and bond rates are going down which increases the odds that the Fed is at the end of their hawkish cycle. But until more of the gains show up in small caps, then we are right to be somewhat skeptical of the upside potential of this market.

Speaking of inflation, it was indeed the better than expected reading for CPI on Tuesday that was behind the impressive stock gains. That concept got an exclamation mark on Wednesday as the more forward looking PPI report showed a -0.5% decline for inflation month over month. Yes, a negative PPI reading which bodes well for future CPI and PCE readings which are what the Fed focuses on.

This explains the continued drop in Treasury rates rates…and mortgages…and auto loans…and corporate borrowing costs, which all points to a healthier economy ahead. It also points to the Fed most likely ending its hawkish rate hike regime in the not too distant future.

In fact, the widely followed FedWatch tool from the CME shows virtually NO CHANCE of another Fed rate hike given this recent news. Now the guessing game focuses on when the Fed will start lowering rates.

The odds point to a 4% chance of that occurring at the late January 2024 meeting. That increases to a 33% chance for March 20, 2024 meeting. And 42% for May 1, 2024.

Yes, the Fed is data dependent and “might” raise rates again. But they have been clear that their policy is already restrictive and has long term lagged effects.

So the market probably has this one right. That the Fed is done with rate hikes and sometime in the spring of 2024 they will start lowering rates which is beneficial to economic growth…earnings growth…and share price growth.

This says it pays to stay bullish. And it SHOULD point to the eventual outperformance in the small cap space.

Indeed, that will be the best indicator of true market health. Thus, we will keep an eye on the Russell 2000 in the hopes that it breaks above…and stays above it’s 200 day moving average that is only 3% higher than current levels.

What To Do Next?

Discover my current portfolio of 7 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model. Yes, the same model that has beaten the market by more than 4X since 1999.

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 11 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.14 (-0.03%) in after-hours trading Friday. Year-to-date, SPY has gained 19.18%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |