The S&P 500 (SPY - Get Rating) made new highs on Wednesday at 5,354 on the heels of NVDA soaring higher once again. And pretty well stayed at those highs on Thursday.

But is the rest of the market really in record territory?

And thus how bullish is this news?

We will dig into these intriguing topics in today’s commentary.

Market Commentary

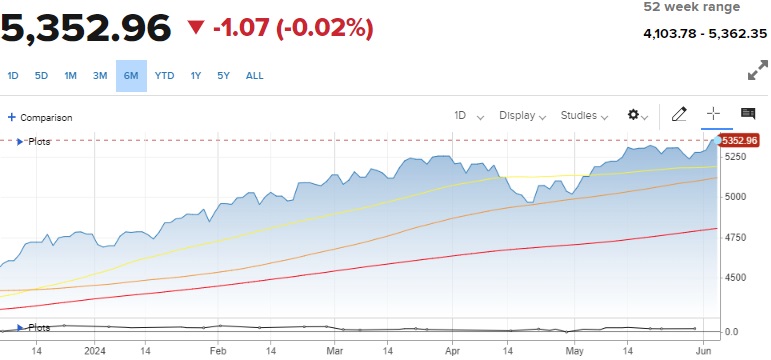

Let’s start with the current picture of the S&P 500.

Moving Averages: 50 Day (yellow) @ 5,188 > 100 Day (orange) @ 5,108 > 200 Day (red) @ 4,792

There are 2 ways to look at this. We are either in the process of breaking to new highs. Or we are testing the upper end of the range before the next leg higher.

Of course, we all prefer seeing the formation of a breakout as that rising tide would lift all boats increasing our collective net worth. The problem I see with that scenario is two fold.

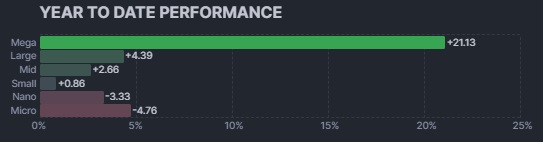

First, this seems to be another case of the Magnificent 7 leading the parade with almost no one else joining the party. These charts for 1 month and year to date performance do tell that tale that mega caps are once again running away with the lion’s share of the gains.

It is hard to be truly bullish without the broad market participating. The November 2023 rally was a great example as small caps outperformed which is the hallmark of healthy bull runs.

Second, investors have had far too many false starts assuming the Fed is ready to lower rates…only to find inflation data too stubbornly high and Fed officials willing to be very patient.

Yes, some people are very encouraged by the recent lowering of rates in both Canada and Europe. And indeed the Fed will cut rates in time. I just suspect they will not be overly swayed by what others are doing as the US economy is a kingdom unto itself. Meaning that we often have unique circumstances not felt elsewhere and why the Fed is not always in step with other central banks.

This could lead to great disappointment as early as Wednesday June 12th when the next Fed announcement is issued. This includes the quarterly release of the Summary of Economic Projections.

Anyone still expecting to see 3 rate hikes in the forecast for 2024 needs to stop taking illegal drugs…cuz that ain’t happening!

That hawkish announcement may coincide with other statements from Powell that call into question the starting line and pace of rate cuts. Once again, they have been ABUNDANTLY clear that they would rather risk a recession forming then to stop rate hikes too soon before inflation is under control.

I hope to be wrong. And would love to hear Powell continue the dovish tilt that started in November 2023. Unfortunately, with a combination of my Economics background and a student of Fed speak…I just think odds are high that they will wait longer than most expect.

This would lead to the latter…less attractive scenario of stocks pushing lower in the range in the days ahead.

Again, not a bear market. Not even a correction. Just ebbing lower in the range awaiting some later date when rates will be cut for certain allowing stocks to make a series of new highs.

This should keep everyone in a long term bullish posture. And thus fully invested. But because of the downside risk in the near term, then still believe a solid portion of your portfolio should be in more defensive/conservative positions.

This is why my Reitmeister Total Return portfolio has a 39% allocation to these kinds of stocks/ETFs. And a good thing we have done that as most of them, including CASY and WMT, have outperformed by a good stretch in recent months.

For more specifics on the stocks and ETFs I am recommending now, then read on below…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

Plus 2 specialty ETFs that are benefiting from some of the hottest investment trends.

These hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.09 (+0.02%) in premarket trading Friday. Year-to-date, SPY has gained 12.84%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |