The better than expected PCE inflation report on Thursday led to another rally pushing the S&P 500 (SPY) back towards the highs at 5,100. This represents a hearty 5% return in February. Even better, market breadth improved with smaller stocks coming along for the ride in the final days of the month.

I hate to be the bearer of bad news…but unfortunately the fundamentals are not totally supporting this rampant bullishness. Especially because I don’t believe things get that much better even after the Fed does finally start lowering rates.

Why is that?

And what does that mean for stocks in the weeks ahead?

Get the answers below with my updated outlook and trading plan.

Market Commentary

In my commentary earlier this week I shared the following insight:

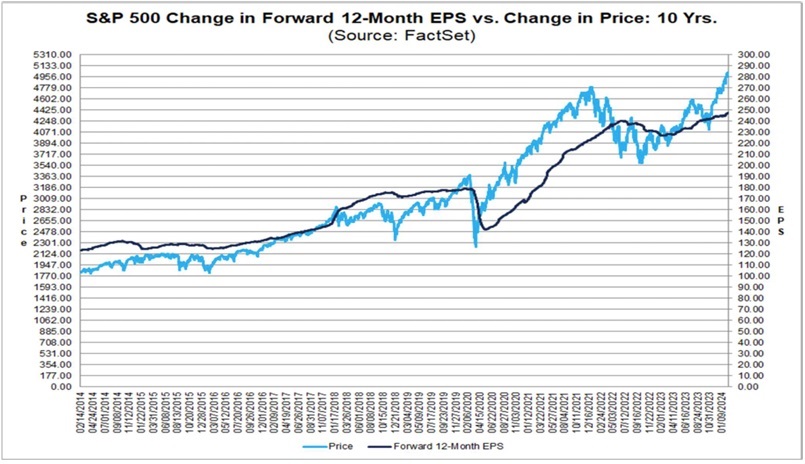

We need to start the conversation with this provocative chart from FactSet comparing the movement of the forward S&P 500 EPS estimates versus the stock index:

You will discover that for most of the past 10 years the dark line for earnings is above the price action. Meaning the improvement in the earnings outlook propelled stocks higher. Yet each time we find the stock index climbing above the EPS outlook it comes back down to size like it did in 2022.

If the lessons of history hold true, then it points to 2 possible outcomes.

First, would be a correction for stock prices to be more in line with the true state of the earnings outlook. Something in the range of 10% should do the trick with some of the more inflated stocks enduring a stiffer 20%+ penalty.

On the other hand, stocks could level out for a while patiently waiting for rates to be lowered. This act is a well known catalyst for greater economic growth that should finally push earnings higher getting things back in equilibrium with the index price.

Yes, there is a 3rd case where stocks just keep rallying because investors are not wholly rationale. Unfortunately, those periods of irrational exuberance led to much more painful corrections further down the road. So, let’s hope that will not be the case here.

(End of previous commentary)

However, here is what I left out of that conversation that needs to be added now. Even when the Fed finally starts lowering rates, it may not be as great of a catalyst for earnings growth and share price appreciation as investors currently believe.

Just consider what is happening now. GDP is humming along around normal levels and yet earnings growth is sub-par to non-existent year over year….why is that?

Because difficult times, like a recession, leads to more stringent cost cutting on the part of company management. This lower cost base = improved profit margins and higher growth when the economy expands once again. And yes, that is the prime catalyst for stock price advances.

But note…we didn’t have a recession. And unemployment remains strong. And thus, there was never the major cost cutting phase which ushers in the next cycle of impressive earnings growth which propels stock prices higher.

Or to put it another way, even when the Fed lowers rates…it may have a very modest impact on improved earnings growth because of what I just noted above. And this equates to less reason for stocks to ascend further.

No…this does not equate to the forming of another bear market. As noted earlier, perhaps a correction is in the offing. Or more likely that the overall market stays around current levels with a rotation out of growth stocks towards value stocks.

This is where we get to press our advantage with the POWR Ratings.

Yes, it reviews 118 factors in all for each stock finding those with the most upside potential. 31 of those factors are in the Value camp (the rest being spread across Growth, Momentum, Quality, Safety and Sentiment).

This value bias helps the POWR Ratings out every year leading to it’s average annual return of +28.56% a year going back to 1999. This year we might be able to press our advantage even more as growth prospects dim and the search for value takes center stage.

Read on in the next section for my favorite POWR Ratings value stocks to add to your portfolio at this time…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $512.85 per share on Friday afternoon, up $4.77 (+0.94%). Year-to-date, SPY has gained 7.90%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |