We are enjoying a very traditional Santa Claus rally. These are not marked by days with big gains. In fact, it has been nearly a month since we saw a daily rally of greater than 1% for the S&P 500 (SPY - Get Rating).

Instead, we simply have a bullish bias like the last 4 sessions in being in positive territory. And 2/3rds of the days over the past month also being in the positive camp helping to grow our portfolios.

The looming question at this moment is if the Fed meeting on Wednesday 12/13 will further endorse these warm holiday spirits for investors…or are we about to get a lump of coal in our stockings?

That will be the focus of this week’s Reitmeister Total Return commentary.

Market Commentary

Stocks have finally broken above the July highs to new ground above 4,600.

This is not a surprise once the Fed flashed a green light for investors after their 11/1 meeting. This helped reverse the dramatic rise of bond prices that was the catalyst for the correction that unfolded in the previous 3 months.

To be honest, the Fed’s statements on 11/1 did not seem that different from the past. The general tenor being there is still more work to do to rein in high inflation. However, it was the acknowledgement of Chairman Powell in the press conference that rates were currently restrictive and they were seeing positive results on the inflation war front.

Reading between those lines investors took this to mean that the Fed was more likely to leave rates at current levels than risk implementing higher rates which would increase the odds of recession.

Since that time, we have more evidence of a stable economy all the while inflation comes in lower and lower. That includes Tuesday CPI report where we continue on a path back towards the Fed’s target of 2% inflation.

Another key point for investors is evaluating the state of employment. The incredible resilience of the labor market 20 months after an aggressive rate hiking regime is going to have economists reconsidering their models in the years ahead. Meaning it is unprecedented that unemployment has not risen more dramatically at this stage.

Last Friday we saw the monthly Government Employment Report come in a notch above expectations with 199,000 jobs added. That is a solid showing that points to a still healthy economy…but not necessarily an overheating jobs market which has been one of the Feds concerns as it leads to persistent wage inflation.

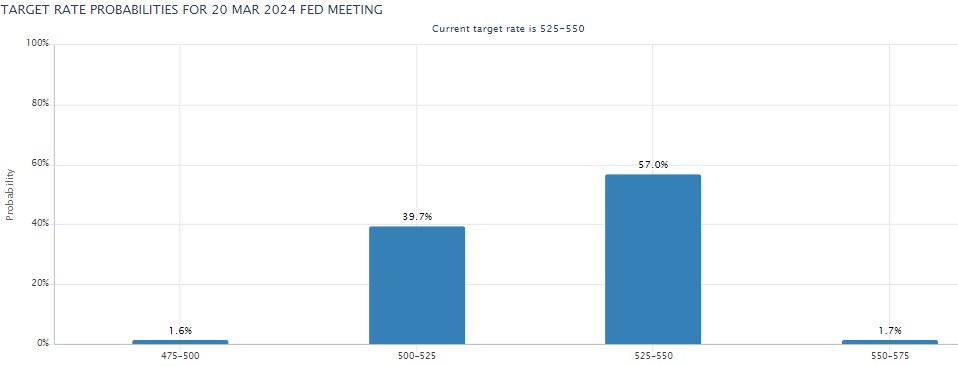

Given all the new data since the last Fed meeting, the CME shows the odds of another rate hike on 12/13 drop at a paltry 1.8%. What is more interesting is the expectations for the first rate hike to come at the March 20, 2024 meeting.

A month ago that was considered only a 12% probability. Yet today it is all the way up to 41% likelihood (39.7% of quarter point cut and 1.6% for half point cut).

So, the key to the stock market reaction on 12/13 depends on how Fed statements change the above probabilities. If Powell sticks to his hawkish guns and says that inflation is still too persistent or sticky…then the March rate cut probability drops…and so too will stock prices recede from recent highs.

However, if the Fed nods to the improvements made and gives an indication that the committee is finally starting to contemplate the timing of rate cuts…then stocks will be off to the races.

Given all the evidence to date, I suspect that Powell will try and navigate something in the middle of these two examples. Bulls will continue to read positive things between the lines…and bears will do the opposite.

The problem for bears is that bulls are clearly in charge…that’s because there is more evidence on their side. And thus I would expect that the recent Santa Claus rally to continue to melt up day by day into years end. This puts the year end target of 4,700 well in hand…and maybe a touch higher.

Even better than that is the continued broadening out of stock gains to previously underperforming small and mid caps. Those groups have been leading the charge ever since the rally began at the outset of November…and I expect that to be the case in the year ahead.

Thus, wise to start overweighting those smaller stocks like we have been doing in the Reitmeister Total Return portfolio. More on that below…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model.

This includes 4 small caps recently added with tremendous upside potential.

Plus I have added 2 special ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.51 (+0.11%) in after-hours trading Tuesday. Year-to-date, SPY has gained 22.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |