(Please enjoy this updated version of my weekly commentary published December 27th, 2021 from the POWR Growth newsletter).

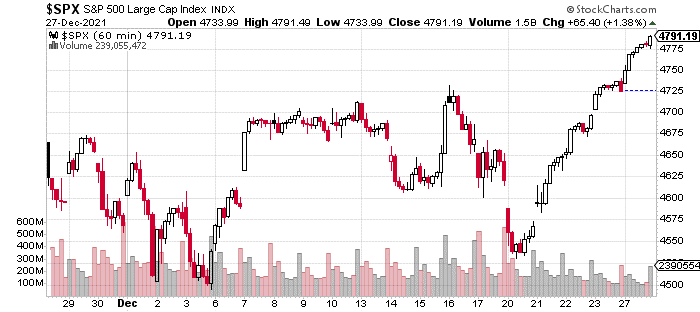

First, let’s check out the bullish reversal of the past week:

As we can see, the market has climbed higher by 5% since last Monday. Even more impressive, when you consider that there was no trading on Friday.

It’s pretty remarkable how the market basically followed its seasonal pattern… but at the same time managed to convince a lot of people that this time was going to be different.

Even I (who had been talking about the Santa rally, and it being more powerful in years when the S&P 500 was up more than 20% entering December for weeks and weeks) started to doubt.

Luckily, everytime, the doubts crept up, I went back to the drawing board and came to the same conclusion – that this was just a pause or a dip in an ongoing bull market. Thus, we were able to use this weakness to pick up some great positions… many which are already up more than 15%.

It’s almost like Santa was always going to come… but like everyone else he was bogged down due to supply chain issues.[* rimshot *]

Nevertheless, we now have the S&P 500 and Nasdaq at new highs, while the Russell 2000 remains about 8% off its all-time highs, made in November.

As we begin the final week of 2021, it’s prudent to look ahead into 2022. Here are some thoughts on what I think will be the 2 biggest stories – earnings and inflation.

Earnings Growth

Given my expectations for this rally and its strong start, I am confident that the small-caps index will start outperforming, in earnest. To me, this rally is being fueled by strong earnings and economic growth. Cyclicals, which continue to be priced at very attractive levels, are posting blowout earnings across the board.

These are priced as if earnings will deteriorate over the next 12 to 24 months, but I see continued earnings growth based on the economy continuing to expand with the most strength concentrated in the industrial sector.

Q4 earnings season won’t really start strong until later in January. But as of now, analysts are anticipating 21.4% earnings growth, this is slightly higher than the previous 20.9% earnings growth. Remember what happened in Q3. Analysts were expecting 24% earnings growth entering the quarter but the actual figure turned out to be 40%.

Caution, among analysts, remains pervasive. There’s something about human nature that keeps compelling us to bet against a trend rather than simply riding it out. And, we also see it in their estimates for 2022 earnings with the consensus forecast being a 5% earnings increase.

Again, I disagree with this. I, simply, don’t see the catalyst for an earnings slowdown. In fact, I am expecting something in the range of 15 to 20%. And, the reason for this stance may surprise you…

Inflation Thoughts

This is another area, where I will be presenting a variant perspective.

So, much of the inflation dialogue has been centered on the transitory vs structural dispute which is an attempt to forecast the inflation trajectory. Another big topic is that high inflation will force the Fed to choke the recovery in order to tamp it down.

I think that both of these arguments are missing the big point. Think about it this way:

Let’s say that you are cooking some eggs. No salt, and it’s barely edible. Too much salt, and it’s also not edible. Somewhere in the middle of ‘no salt’ and ‘too much salt’ is the right amount of salt which will make your eggs delicious.

In a similar vein, the market pendulum is constantly swinging from one extreme to another. Inflation has been below-trend for many years, and it’s now on the path to above-trend. It could very well get to a point where there is so much inflation that it forces the Fed to act.

But, we are in the middle stages when this dose of inflation is highly stimulative for corporate profits. It’s leading to more pricing power and more demand which of course, turn into higher profits. So far, there is no erosion in margins which is another positive indication.

Another way to look at it is the difference between the path vs the destination.

The destination may be what the bears and inflationistas are warning us about. But, the path to this destination is going to be very bullish and supportive of higher equity prices… until, we see a material impact on margins.

Paying attention to the path while being mindful of the destination is the optimal way to navigate the inflation duality, where moderate doses are very bullish but excessive doses can be lethal.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $476.50 per share on Tuesday afternoon, down $0.76 (-0.16%). Year-to-date, SPY has gained 29.15%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |