(Please enjoy this updated version of my weekly commentary published February 7, 2022 from the POWR Growth newsletter).

First, let’s do our review of the past week:

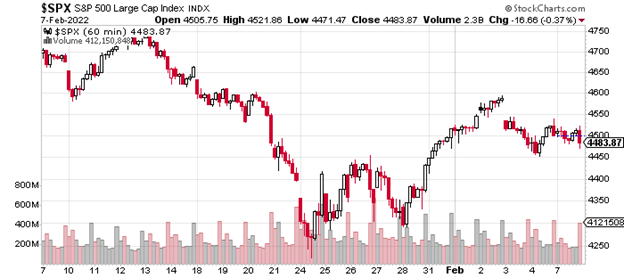

Over the past week, the market is down by a little less than 1%. This type of back-and-forth trading is to be expected as the market continues moving off its lows. Another sign that the market is normalizing can be found in the VIX continuing to move lower and also the daily ranges for the S&P 500 getting tighter.

The last few commentaries have obsessed over the question of whether this is it in terms of the selloff or will there be another leg lower?

I don’t think anything has materialized in the past week that is particularly meaningful on either side. So, our assessment from last week still stands: If this is a normal dip or pullback within a bull market, then we’ve generated sufficient oversold and extreme bearish readings that would result in a meaningful bottom.

If this is a correction or even a bear market, then we could see these lows retested or even undercut as the market is not really oversold or too bearish on longer-term timeframes.

Some Positives…

Over the past month, the tenor of these commentaries has been mostly cautious or negative which was appropriate given the weakness and risks in the market. Now, I believe these risks are much more balanced.

It doesn’t mean that the market is going to straight up from here, but it does mean that it’s time to start getting interested in the recent market dislocation in what I’m labeling as “hypergrowth” stocks.

The ”hypergrowth” stocks are those whose prices only make sense based on assumptions that investors were making about years or even decades of growth. Of course, these fantasies were punctured by the reality of the market. Most of these stocks are down by more than 50% from their highs and some even more.

With today’s purchase a leading healthcare IT stock, we are slowly dipping our toes back in the water. This company has many characteristics in common with some of the most successful growth stocks in history.

It has a great business, providing software for the healthcare, pharmaceutical, and life sciences industry, which is very high on the value chain.

Its end markets are likely to keep growing regardless of the broader economy. The company has high amounts of recurring revenue and a consistent pattern of growing revenue per user in addition to organic user growth.

This stock is currently down about 40% from its all-time highs. Given that it is one of the top healthcare IT stocks, and I’m confident that the stock price will be much higher in the future, I’m willing to add the stock even if I’m unconvinced that the bear market in “hypergrowth” stocks has ended.

Tweaking Our Strategy

Since we started this service last April, we have steered clear of these “hypergrowth” stocks and focused on companies with genuine, tangible earnings growth.

Due to recent developments, I’m ready to get to a more balanced allocation between these two categories. For the latter group, I believe the upside is priced in, while there could be more downside in the event of the economy slowing.

For the former group, I believe that a lot of the negatives are priced in. Given the extent of selling and bearish sentiment, any catalyst could trigger a big jump higher in this oversold group of stocks.

Therefore, over the next few weeks, we will be looking to take advantage of the inevitable rebound or potentially new bull market that will follow this localized bear market..

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +48.22% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $449.02 per share on Tuesday morning, up $1.76 (+0.39%). Year-to-date, SPY has declined -5.46%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |