We have entered the “not so fun” part of the bull market. That is because after gains so fast and so furious, we now see a lot of pullbacks, sector rotations and overall volatility.

Unfortunately, this is what I expect to be on the menu for the next year befitting the normal results in year 3 of a bull market. That’s because once the easy gains have been made bouncing from bear market bottom…then investors need to do a bit more soul searching for what to buy next as the S&P 500 (SPY - Get Rating) typically comes in around breakeven.

Gladly if you know this is coming…it is easier to stomach and easier to chart your course to market gains by picking the best stocks. All that and more will be discussed in today’s Reitmeister Total Return commentary.

Market Outlook

On most levels the economic reports have come in as expected. That is a soft landing growth rate between +1-2% GDP with inflation readings continuing to ebb lower.

Then on Friday the Government Employment Situation came in about as expected at 142,000 jobs added. What was eye popping about the report was the higher than expected 0.4% month over month increase for Average Hourly Earnings (aka Wages). This sticky form of inflation is still far too sticky with the year over year level increasing from 3.6% to 3.8%.

Yes, increasing inflation in wages is NOT what the Fed wants to see at this point. Bond investors still are looking for 100% chance of a rate cut at the next Fed meeting on September 18th, but the odds have shifted back meaningfully towards a smaller 25 basis point cut instead of 50.

I agree that this still burning ember of wage inflation will have the Fed be more cautious with a smaller cut at the next meeting. The more curious question is the pace of cuts that follow. No doubt upcoming inflation reports will have a great deal to do with that including:

9/11 CPI

9/12 PPI

9/27 PCE

10/4 Government Employment Situation (with eyes focused on that Average Hourly Earnings component).

Price Action & Trading Plan

Moving Averages: 50 Day (yellow) @ 5,505 > 100 Day (orange) @ 5,388 > 200 Day (red) @ 5,157

In August was a pretty brutal correction with a break under 50 and 100 day…but still the 200 day never really in jeopardy. Sense the same is likely true this time around as I simply don’t see a catalyst to fall that far.

On the other hand, Mr. Market can do whatever it wants…whenever it wants with little rhyme or reason. So, it could happen just under the heading “stuff happens”.

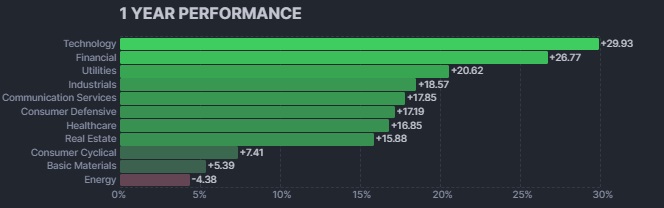

More interesting is the rotation below the surface. Let’s start with the 1 year performance picture by sector:

This is a very bullish picture with Technology, Financials and Industrials charging ahead. But now lets look at the last 3 months:

This is a very defensive rotation with Utilities, Consumer Defensive and Healthcare as top performers. The other 2 top groups, Real Estate and Financials, are doing well because the drop in rates is very beneficial to both groups.

On top of that the most Risk On and economically sensitive groups are lagging. Namely Energy, Basic Materials, Consumer Cyclical and yes, Technology.

I am not saying this points to a turning of the tide and get ready for the next bear market. Just a bothersome shift to Risk Off groups.

My expectation is that the more dovish the Fed appears to be from their 9/18 meeting…the more accommodation will be on the way for the economy…the more GDP and earnings grow…the more likely people shift back to these more Risk On industry groups.

The one note of caution is that at this stage of the bull market valuations do matter. So, investors are likely to be much more selective about what they buy going forward.

I suspect that will be a combination of healthy earnings growth plus reasonable valuations. Exactly the type of stocks that emerge from our POWR Ratings analysis of 118 fundamental factors.

The key to what happens next lies in the September 18th Fed meeting. Until then I would not worry too much about the noise and volatility in the market. Those stocks that fall the most on the pullbacks will also bounce the most on the next bull run.

Just like a bull rider you need to hold on tight and not get thrown off.

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.29 (-0.05%) in after-hours trading Tuesday. Year-to-date, SPY has gained 16.19%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |