Investors pressed pause in October with it being the first down month for the S&P 500 (SPY - Get Rating) since April. This is very typical cautious behavior coming into a contentious Presidential election.

On Wednesday we cleared the hurdle of the Presidential Election. Next on Thursday we got the next round of accommodation from the Fed with another quarter point cut. Add all this together you can appreciate why stocks have sprinted to new highs just below 6,000.

What comes next?

That will be the focus of today’s conversation.

Market Outlook

I have been beating the drum that we will march up to 6,000 for the S&P 500 before years end. That was back when stocks were closer to 5,700. All we needed to do was get the following 3 elements in place:

- Clear conclusion to Presidential election (not a repeat of 2020)

- Fed continue to lower rates with expectation of more rate cuts to come (11/7 second cut confirms this notion)

- Seasonally beneficial Santa Claus rally for stocks

This week we got the first 2 bullets which pretty much guarantees the 3rd bullet of the Santa Claus rally will be served up. Yet at this stage 6,000 is not that much higher than Thursday’s close of 5,973.

So yes, breaking above that mark is more likely than being stuck below given how much time we have left on the year. Maybe 6,100, even 6,200, is the more likely outcome for 2024.

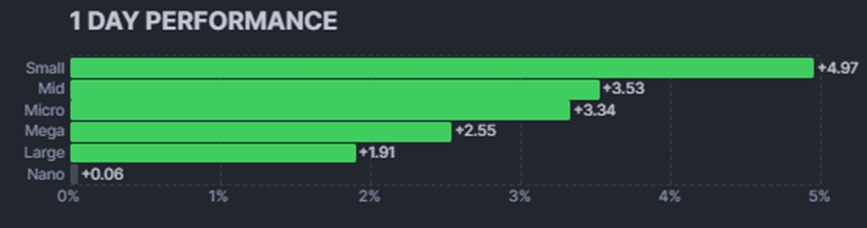

Yet what I think is even more beneficial is the gains in small cap stocks which have woefully underperformed their large cap peers the past 4 years. That did take a very positive turn on Wednesday with the Russell 2000 rising +5.84% on the breakout session (almost 2.5X better than S&P 500).

For as wonderful as all of this is, I think this is the last major bull run before we take an extended break in the new year.

This is not a call for a bear market either. Just a long due, healthy pause after such impressive gains in the first 2 years of this bull market that started October 2022 from a low of 3,491.

This pause should be mostly be for large caps where they are nearing a PE of 23 which is much higher than the long term average of 18. This group could use a little excess taken out. That could come from a reasonable correction. Or simply going sideways for a year with earnings growth helping to get the PE closer to 20.

Gladly there is still value in small and mid caps hovering closer to 16 PE as a group. This is below the long term average and offers tremendous value compared to their large cap peers.

The post election rally offers a preview of this shift to smaller stocks that I think extends well into 2025.

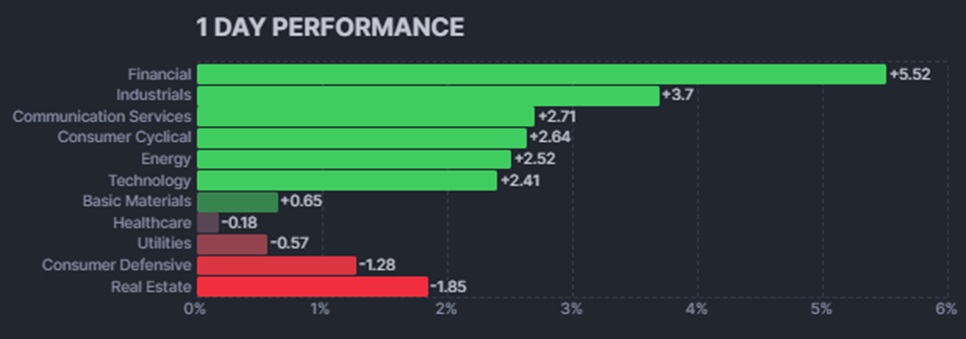

And it highlights industries that likely will outperform going forward:

This all is very much on par with the strategy I have employed in my portfolios the past several months which helps explain why we have outperformed so much of late. And likely to outperform going forward.

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares rose $0.23 (+0.04%) in after-hours trading Thursday. Year-to-date, SPY has gained 26.49%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |