(Please enjoy this updated version of my weekly commentary published February 14th, 2022 from the POWR Growth newsletter).

First, let’s do our review of the past week:

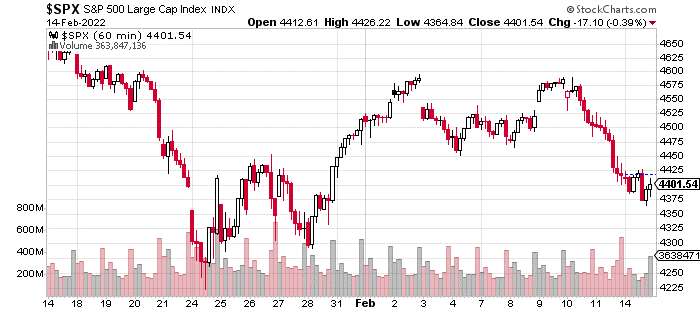

Over the past week, the market is down by a bit less than 2%. It is concerning that we’ve dipped back below the 200 day moving average as the market faces a torrent of bearish headlines like the Ukraine-Russia conflict, soaring energy prices, hot inflation reports, and a hawkish Fed.

But, we do remain above the Jan 24 lows which are a key level to watch.

In total, we have given back about 50% of the rally off this level. Certainly, the odds of a retest of those lows or even lower lows have risen with these developments.

In today’s commentary, we will be going back in the past and looking at 1994, a period in time with a lot of similarities to today but also some differences. 3 previous instances of market weakness, a hawkish Fed, and inflation concerns.

To be clear, no moment in time is identical… as the cliché says – history rhymes but doesn’t repeat. However, this can be a useful and educational exercise that can help us map out various scenarios.

1994

So the next 2 analogues are much more well-known, but this one has the most similarities.

In 1994, we had an economy that was improving, having just emerged out of a recession due to the savings & loan crisis. We had a Democratic, first-term President who was facing a brutal midterm elections. We also had Alan Greenspan, leading the Fed, who hadn’t raised rates for much of the recovery as growth fluctuated between 2% and 4%.

However, in 1994, growth finally started to exceed this level, and Greenspan decided to raise rates. This caught the bond market offguard, and it led to soaring yields for fixed income. This eventually led to weakness in corporate bonds as spreads widened which spilled over into equities.

At its nadir, the S&P 500 was down by a little more than 20%. The stock market topped a couple of weeks before the Fed’s first hike in February. The market bottomed in April after a precipitious decline. And then traded in a range until December before it started climbing once again.

There are a some key differences: Inflation was much more subdued in 1994 as it was only around 3%. However, Greenspan felt that the economy’s strength was going to generate inflation so this was an anticipatory move. Much different than today’s world, where the Fed purposefully let inflation run “hot”.

Another is that yields were much higher with the 10-year at 5.7%. Today, there is much consternation about the 10-year at 2%.

Despite these (and other) differences, I actually do think 1994 is useful in a way. The economy was strong enough to withstand the headwind of raising rates. It did cause a drop and a period of choppy trading, but this eventually led to some of the best stock market returns in history.

Another is that the rate hike cycle was short and steep as inflation started to decline on its accord, terminating the impetus to raise rates and leading to a “goldilocks” period of accelerating growth, falling inflation, and a dovish Fed.

I, think, we could have a similar outcome as the economy normalizes and we finally get the pent-up demand and recovery in services. A drop in demand for goods along with supply chain improvements and transportation bottlenecks improving also add to inflation relief.

In addition to 1994, there are some other interesting moments in market history that offer some useful lessons and guidance for this current period. But, we will tackle those in future commentaries…

Instead, let’s pivot to growth stocks…

A thin silver lining of this past week is that growth stocks held up pretty well given that broader weakness in the markets, strength in short-term rates, and inflation data above expectations. And especially when we have seen this category of stocks absolutely annihilated by those developments for the last few weeks.

By no means is this an all clear signal, but it’s the first in a string of positive developments that is necessary for a trend change.

Of course, this is looking at the group in a macro sense. On an individual stock basis, the most important thing is whether earnings momentum continues. Those will be the stock that go on to make new highs.

Currently, we hold 2 stocks which I would consider classic growth stocks. One is an enterprise software stock for the healthcare market, while the other is a fintech stock.

Unlike many growth stocks experiencing a loss of momentum, these stocks continue to grow at an impressive rate and their growth has nothing to do with the economy or monetary policy.

Given what I see is an improving environment for classic growth or hypergrowth stocks, I plan to increase my exposure during periods of weakness.

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +48.22% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were unchanged in after-hours trading Tuesday. Year-to-date, SPY has declined -6.08%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |