The world is moving faster by the day.

Not just technological change…but the speed in which industry peers find ways to beat their competitors. This makes buy and hold investing more difficult than ever as stocks that once looked fundamentally promising can sour quickly and become a drain on your portfolio.

This calls out for each of us to consider the virtues of “Active Investing” which leads you to closely and continuously purge weak stocks at the earliest possible stage to avoid undue harm.

Note that I am drawing a clear distinction between “Active Investing” and “Active Trading”. Meaning this is not a call to becoming a day trader…or slave to the market guzzling Red Bull all day long while watching 8 computer monitors.

Rather it is about proactively making sure that you stay in the healthiest stocks to give yourself the best chance to outperform. That’s because at the end of the day fundamentals are what truly drives stock prices.

Why?

Because we are actually buying an ownership stake in a company (not just random stats or a chart pattern on a screen…but a real living/breathing entity with a clearly definable value).

My goal for this article is two-fold.

First, to convince you that it is in your financial best interest to become a more active investor.

Second, to give you free access to a set of tools that provides a fountain of profitable picks for active investors.

The Importance of Timeliness

Some investors are more focused on preserving capital. While most have their eyes set on outperforming the market.

The only way to accomplish the latter task is to have timely stocks. The ones ready to rise now.

The #1 ingredient of timely stocks is improving fundamentals. That’s because the attractiveness of that healthier growth profiles is what leads investors to bid up shares.

On the surface this sounds like an overwhelming task as there are literally thousands of fundamental factors to consider.

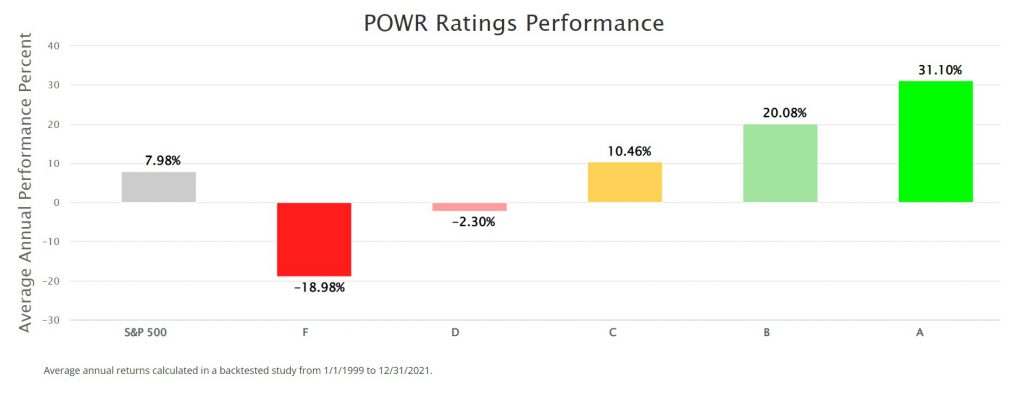

Gladly, members of StockNews already know that the POWR Ratings gives them a leg up in this journey. That’s because this proven stock rating model narrows down to 118 unique factors that have historically pointed to stocks likely to outpace the market.

These impressive gains come from the computers doing the heavy lifting crunching these numbers daily in order to make our lives easier. But there is still 1 more problem to solve…

1,300 Buy Rated Stocks is Too Many

The POWR Ratings does a phenomenal job scanning over 5,300 stocks to narrow down to the top 25% ready to outperform (A & B rated).

However, that is still a whopping 1,300 stocks to consider on any given day.

No matter how much you love picking stocks…reviewing 1,300 is still a daunting and unwelcome task.

It is for this reason that we created several unique portfolio recommendation services to narrow down to the very best stocks.

In fact, right now we only have 41 total active recommendations across our popular portfolio trading services:

- Reitmeister Total Return

- POWR Growth

- POWR Stocks Under $10

- POWR Trends

- POWR Value

- POWR Breakouts

- POWR Options

Even better, 34 of those 41 trades are winners…not easy to do with so much market volatility.

However, it does make clear the benefit of the POWR Ratings system in the hands of veteran investors who manage these newsletter portfolios for the benefit of our customers.

What to Do Next?

Remember what I said about the goal of this article up top:

“…give you free access to a set of tools that provides a fountain of profitable picks for active investors.”

And that is exactly what we will do now.

Look again at the above list of seven market topping newsletter portfolio services. The bundle of all those newsletters is what we call POWR Platinum.

Now you can enjoy a free 7 day test drive of POWR Platinum to see all of these services including the ability to see all 41 of our top trade ideas.

All you have to do is click the link below to get started:

7 Day Free Trial to POWR Platinum to See All 41 Trades >

p.s. Please note that this offer is only available until Sunday November 27th @ midnight.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $402.27 per share on Friday afternoon, down $0.15 (-0.04%). Year-to-date, SPY has declined -14.32%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |