(Please enjoy this updated version of my weekly commentary published February 28th, 2022 from the POWR Growth newsletter).

First, let’s review the past week:

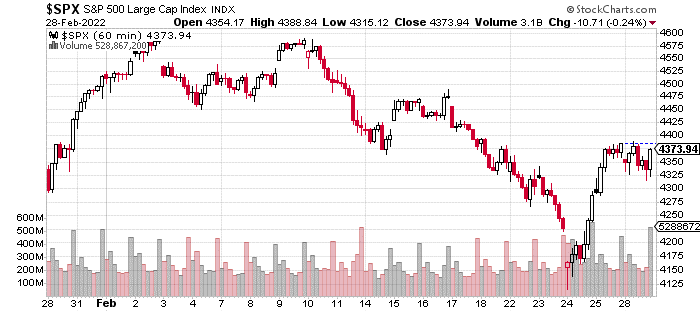

Over the last 2 weeks, the S&P 500 is down by a little less than 1%. However, there has been considerable volatility as we were nearly 7% lower as of last Thursday’s open, and now we are more than 5% above those levels.

In my POWR Stocks Under 10 commentary, I dug a little deeper. Here’s an excerpt:

The reversals for the Nasdaq and Russell 2000 were even more impressive [than the S&P 500]. The Nasdaq closed 3.3% higher after being down as much as 3.5%, a nearly 7% intraday move. The Russell 2000 had a nearly 6% move on an intraday basis from its low to high print.

These are incredible moves – sometimes, we can go for a month without that much volatility.

One key takeaway is that we got our retest of the January lows in all of the major averages. And so far, this retest was successful as evidenced by buyers stepping in aggressively to defend these lows.

Does this mean that the worst is over?

Possibly. As we’ve noted before, the bull market’s underpinnings remain firm especially as earnings continue to trend in the right direction. Inflation and higher rates are a headwind but not significant enough to throw the economy off track.

And, stocks have discounted some significant slowing and a more hawkish path. Further, the recent market dislocation has resulted in many attractive opportunities.

In terms of the near-term picture, I think we have to be open to the possibility that Thursday’s open marked the low given the violent reversal and broad-based strength.

But, I’ve also learned that these corrections don’t usually end in a neat and tidy manner. What I’m more confident about is that choppy conditions will continue to prevail given the market’s various uncertainties and various bullish and bearish headwinds.

Implications for Our Portfolio

Overall, I’m pretty pleased with the portfolio’s performance during this correction.

As I’ve noted in previous commentaries, we’ve been overloaded in cyclicals for much of the past few months and are now moving to a more balanced approach between growth and cyclicals.

Further, I’m particularly bullish on the travel trend as I am seeing case counts rapidly drop, mandates relaxed, and very bullish commentary about the travel boom in Q2 and Q3.

So, this is something I have a high degree of confidence in. I’m less confident about whether growth will accelerate or decelerate or how the Russia-Ukraine situation will play out.

Therefore, our portfolio will continue to shift in this direction.

Market Outlook

Not much has changed in terms of the bigger picture – this remains a choppy market with potent bearish and bullish headwinds.

Certainly, the market’s successful retest and bullish price action off the 4,200 level is a positive. In fact, in a more normal environment, I think it would be sufficient enough to feel confident that a tradeable low is in.

However, I do think it’s better to err on the prudent side given all of the variables that are in play.

So many things about the stock market, politics, foreign policy, and global events have been unprecedented over the last couple of years. In many cases, it’s led to massive policy responses, and we are likely going to see the ripple effects last for generations.

In terms of the stock market, we reached massive heights of bullish hysteria by the end of 2020 that didn’t seem possible at the lows in the spring of 2020. For many growth stocks, their entire rallies from the March 2020 lows have been wiped out.

We could go on for pages giving examples of all the unpredictable events of the last couple of years, but the point is that right now… it’s a good idea to cultivate an open mind and think in terms of probabilities.

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +48.22% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has declined -9.47%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |