A market that refuses to go down…will inevitably go up

And that simple logic is precisely what we see happening at this stage. Even as the start date for Fed rate cuts gets kicked further down the road, investors just don’t want to lose their grip on the stock market.

This helps explain why the S&P 500 (SPY - Get Rating) pushed to new highs once again on Thursday even as Fed officials are singing in unison about the dangers of cutting rates too soon. One has to assume this positive price trend will stay in place until there is a dramatically negative catalyst.

So that leads to the question…what could derail this bull market?

That will be at the center of today’s discussion.

Market Commentary

One of my favorite investment sayings is:

“It’s a bull market til proven otherwise”

Meaning that the natural gravity of the stock market is to move higher. That helps explain why the average bull market lasts 63 months while the average bear market only 13 months. That is a 5 to 1 advantage in favor of being in a bull market.

Or to put it another way…it is harder to create a bear market than most people realize. So, you really need some extraordinary events to shake stocks off their bullish axis.

When you boil it down there are really just 2 ingredients that create a bear market. Let’s explore both below.

First, and most obviously, is the idea of a recession forming. This lowers the earnings outlook plus reduces risk taking leading to lower PE for each stock. This combination culminates in an average bear market drop of 34% for the S&P 500.

The second reason stems from an equity price bubble that bursts (often with a recession to follow from all that loss of household net worth). The two obvious examples are 1929 and the tech bubble of 2000.

Yes, some might point to the Great Recession of 2008. But that was from an equity bubble in real estate that led to banking failures. That is an interesting situation for sure…but different than stocks being overpriced leading to their eventual fall.

On the recession front the economy continues to clip along at a healthy pace with the GDP Now estimate for Q1 ticking up to +2.5% growth. That is very close to the long term average of +2.7% and certainly does not hint at a recession forming.

Granted, there is always the concern that the Fed overstays their welcome with high rates that begets a future recession. This fear comes from 12 of the last 15 rate hiking cycles ending in recession. However, it does seem like Powell and company are good students of history and are on their way to managing a soft landing that allows them to cut rates before a recession unfolds.

I recently saw that the current PE of the market (20.7) is in the top 5% of all time. That does make one stop in their tracks and consider if we are overvalued.

The counter argument to that is that investors now better understand the risk and reward of the stock market versus bonds and cash. This has led to higher PE’s for stocks over the last 20-30 years making the long term historical standards a bit outdated.

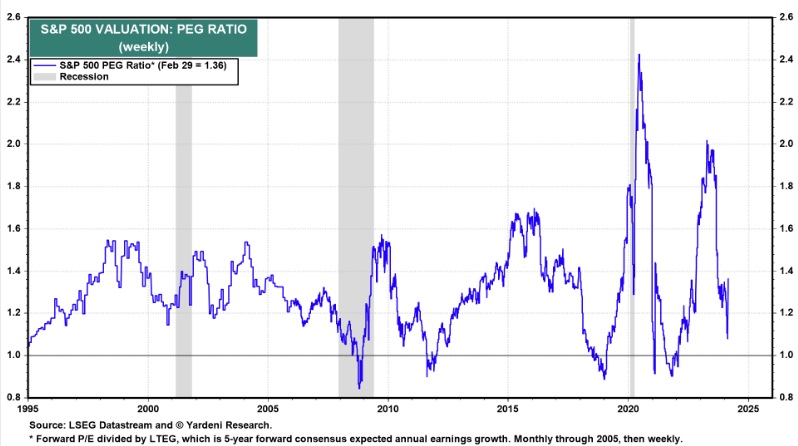

As a counter argument I want to share this PEG Ratio chart going back 30 years:

The PEG ratio is my favorite valuation metric as it says what you are willing to pay for each unit of earnings growth. Meaning that a tech stock growing earnings 20% a year SHOULD have a higher PE than a sleepy utility company with meager 3% earnings growth.

As you can see that the current PEG level for the market is kind of middle of the pack for the past three decades and not a cause for alarm on the valuation front.

Yet there most certainly are groups that are being a bit too richly valued like the Magnificent 7 stocks and some of the “in fashion” AI companies. Interestingly Tesla has already finally fallen from their too lofty heights with shares 40% off their highs. I would like to see some of that profit taking roll to these other names with that money flowing to other worthy companies with more appealing valuations.

Taking it back to the top, it’s a bull market til proven otherwise. And since we just reviewed what could possibly derail the market (recession and valuation) we are on pretty safe footing on that front as well.

Thus, continue to be fully invested in stocks. Just have a greater eye towards value at this time given that there are indeed some overripe stocks due for a fall.

Are you interested in my favorite stocks at this time?

Read on below to discover them now…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $514.66 per share on Friday morning, down $0.15 (-0.03%). Year-to-date, SPY has gained 8.28%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |