Given the intensity of the November/December bull run…it only made sense for investors to take a step back to start 2024.

Now just a week later, investors seem ready to buy that modest dip with the all time highs for the S&P 500 (SPY - Get Rating) of 4,796 once again in sight.

Are investors ready to break higher…or will 4,796 prove to be stubborn resistance a good while longer?

That and more will be at the heart of this week’s Reitmeister Total Return commentary.

Market Commentary

To start the year there was a lot of profit taking and price reversals across the investment spectrum.

This was obviously true with the stock market. Especially the big name tech stocks giving up a small chunk of their tremendous gains from 2023.

This can easily be understood as a strategy to delay the tax consequences of those capital gains for another year. But that wasn’t the only group reversing course.

Let’s remember that the main catalyst for the late 2023 stock rally was the tremendous decline in bond rates as the Fed finally looked prepared to lower rates in the new year. This had the 10 year rate tumbling from 5% to under 3.8% in the final couple months.

So, when bond investors took some profits off the table with 10 year rates bouncing back over 4%…that too was yet another reason for the early 2024 stock market declines.

That was then…this is now with stocks bouncing back the last few sessions pushing back towards the all time highs 4,796.

There is little doubt that stocks will break above at some point this year. That’s because the prospect of lower rates starting in 2024 looms large as a catalyst for corporate earnings growth and therefore stock prices.

But WHEN that happens is a bit of a mystery that got more complicated last Friday after the release of the Government Employment Situation report.

Not only did job adds come in higher than expected at 216K jobs added versus 150K expected, but also wage inflation stayed too hot at +4.1% year over year (above consensus). Even worse was the month over month reading at +0.4% which speaks to the pace of increases closer to 5% annualized.

The Fed is not going to like these figures in their fight against high inflation. Not that they would necessarily raise rates again…but perhaps dig in their heels at the current restrictive level longer than investors anticipate.

This came through loud and clear with the changes to odds for when rates will likely be cut as measured by the CME.

The March 20th Fed meeting was the one that investors expected the first rate cuts to flow in. That has been cut from 89% likelihood a week ago to 61% today.

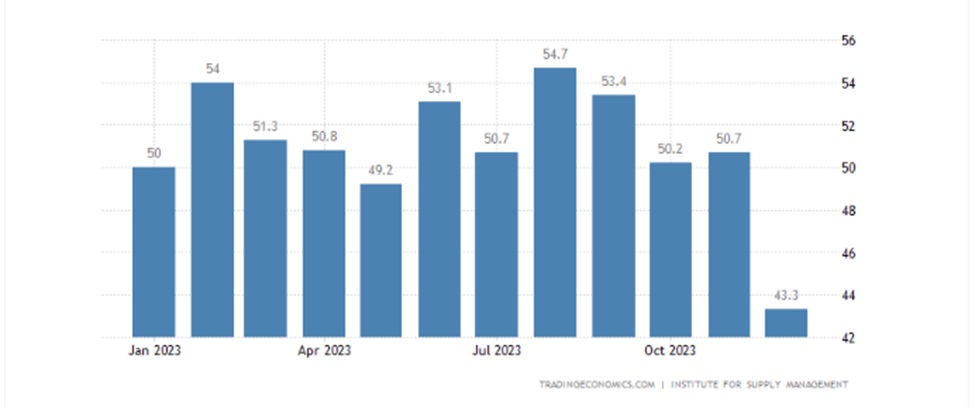

Interestingly, not everything is rainbows and lollipops with the economic data. The manufacturing sector continues in contraction territory as can be seen by the recent 47.4 reading for ISM Manufacturing. In fact, the sector has not grown according to this report since mid 2022.

More interestingly, ISM Services was lighter than expected with the employment reading showing the most pain dropping from 50.7 to 43.3. Remember that below 50 points to contraction. And this is the worst showing for this reading in a long, long time.

With services previously being the healthiest part of the economy, this is very interesting clue that things might be slowing more than expected.

What we don’t want is heading into a recession which is not always so speedily solved by Fed rate cuts. Meaning creating a recession is akin to opening up Pandoras box…very hard to get the monsters to quietly go back in the box.

What we do want is modest signs of a slowing economy to keep reducing inflation back to the 2% target. And that would compel the Fed to cut rates, thus boosting the economy and leading the charge back for earnings growth and stock prices.

Price Action and Trading Plan

My prediction is that stocks will not break above the all time highs at 4,796 in a meaningful way until investors are convinced the Fed is truly going to lower rates. With that unlikely to happen at the January 31st announcement then it has investors putting their sites on the March 20th event.

Again, investors are currently putting the odds of that first cut in March at a little over 60%. But with Fed officials still putting out hawkish rhetoric…and some parts of inflation, like the aforementioned sticky wage inflation issue, then indeed the first rate cut may not be til May or June.

That would cap the upside for the overall market. Which is not so terrible given the above average gains we enjoyed last year.

The good news is that quality stock pickers can always find companies ready to sprint ahead regardless of overall market conditions. And we are already finding that to be the case with the POWR Ratings narrowing in on the top stocks primed to outperform.

To be clear, the Buy & Strong Buy rated stocks in our model, top 25%, still amounts to over 1,300 stocks. Yes, a smaller selection than the over 10,000 US stocks you could invest in. But still too many stocks for the average person to investigate properly to narrow down to the ones that are best for your portfolio.

That is why I have put in the time for my Reitmeister Total Return service to narrow down the field to the 11 best stocks to own now. Plus 2 ETFs that have the right stuff to outperform in the weeks and months ahead.

More about those select picks in the next section…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have selected 2 special ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares fell $0.22 (-0.05%) in after-hours trading Tuesday. Year-to-date, SPY has declined -0.30%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |