(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Stocks plummeted in September and quickly found itself pressed under the 50 day moving average for the first time in several months. However, by the end of September a new rally formed with stocks breaking back above this key technical level. And almost gave the old highs a run for their money.

Gladly we did not take the bait on this rally and stayed true to the view that being aggressively bullish into the election was a mistake. Since then stocks have fallen nearly 5% from the mid-October high and broke back under the 50 day moving average Monday as we come down the home stretch to the 11/3 Presidential Election.

Let’s discuss what is in the recent brew leading to stock weakness and what happens next.

Market Commentary

First need to let you know that Monday November 2nd is the next Reitmeister Total Return Members Only Webinar. What a perfect time to focus on the election that sits right ahead of us. We will talk about all the potential outcomes and what each contingency means for our portfolio. Meaning…

- What if Biden wins?

- What if Trump wins?

- What if the election results are very delayed because of write in ballots?

- And worst of all, what if the election results are contested by one of the candidates leading to a lengthy legal battle.

I will contemplate all those possibilities with specifics on how it changes our trading plan. So this is a webinar you won’t want to miss.

(This webinar is reserved for Reitmeister Total Return members. Learn more how to start a 30 day trial to the service and participate in the upcoming webinar by clicking here.)

Speaking of the election, we got an odd news item right after I sent out last week’s commentary. That is when the FBI announced that Russia continues to meddle in our election and may have gotten American voter info. And on top of that Iran is also actively trying to influence our elections. This was immediately met with weakness in the after hours trading.

However, those losses were quickly erased as the economic news rolled out Thursday that we got the first weekly jobless claims report under 800,000 since March. Even more impressive is that continuing claims once again dropped by more than 1 million from the previous week. That is a feverish pace of people getting back to work that does bode well for the economy, corporate earnings and stock market moving forward.

The positive economic news doesn’t stop there. The PMI Flash report on Friday further confirms the improvements in the economy. Manufacturing was solid at 53.3 which is pretty well even with the previous report. However, it was the services side showing the most gains at 56.0 vs. 54.6 the last time around. Also New Orders was ramped up saying that the recent gains are likely to continue into the future.

The train of good economic news kept chugging along this week including Consumer Confidence on Thursday. If you remember from my commentary last month, it shocked to the upside in September all the way up to 101.3.

This reading shows a much healthier outlook than the competing Consumer Sentiment report that remains under 90. Thus, many thought this report was due for a steep downward correction this time around. Thus, the nearly equivalent 100.9 read today is a statement that indeed the consumer is feeling much better than expected. This also resonates in the Redbook Weekly Retail Sales report today which shoes year over year gains for 6 straight week.

As for manufacturing more of the regional reports are showing healthy signs including Richmond Fed Mfg. this morning rising from 21 to 29. And yesterday the Dallas Fed Mfg report came in at 19.8 versus 13.6 last month. This corresponds with healthy readings from most of the other regional reports which should culminate in another impressive ISM Manufacturing survey on Monday.

Earnings season is another clear feather in the cap showing that the economy is healing faster than expected. My good friend, and ex-Zacks Research colleague, Nick Raich does an excellent job recapping earnings season results on his website www.EarningsScout.com. Here are some recent insights from nick. . Thursday email from Nick Raich…perhaps share more up to date data.

- “83% are beating EPS estimates by one of the widest margins (+19.08% on average) that we have ever measured in over 20+ years of compiling this data.

- 80% have topped sales estimates

- These are sharply better figures than what was reported last quarter, which clearly helps to justify the rally over the past six months. For stocks to rally more, the Street must believe the improvement will persist.”

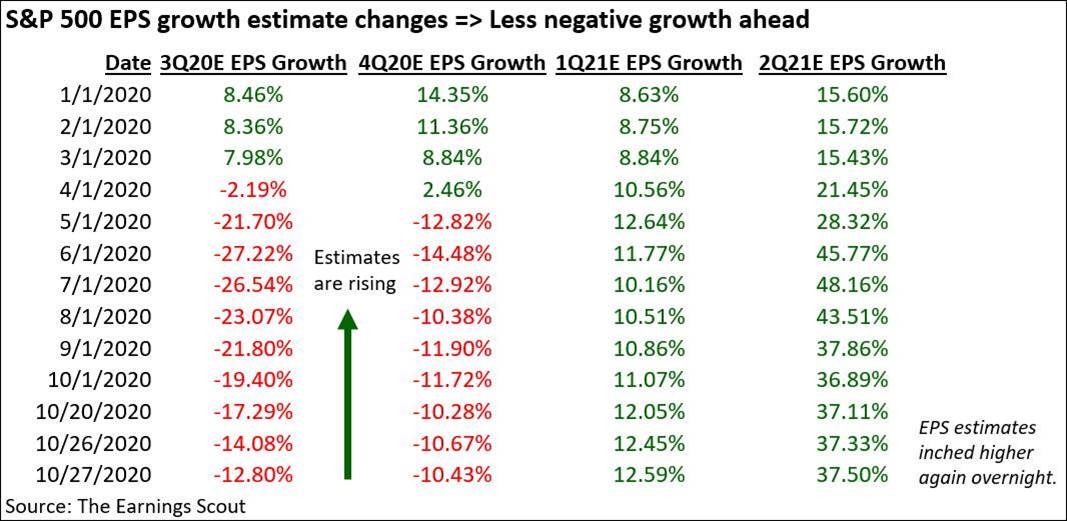

Most importantly is the image below which shows that the expected loss for Q3 has been shaved from -27.22% to -12.80%. Yes, that is still a negative number, but direction of change is more important to Wall Street than the absolute level. Meaning the fact that the loss has been cut in half and future estimates are rolling higher is MUCH more important than the current red arrows for current corporate growth.

Yet, with all this good news in place, the stock market has been quite weak of late falling back below the 50 day moving average at 3,409 on Monday. Fell further on Tuesday. And after hours at this moment the pain train seems to on track for even steeper losses tomorrow.

Why?

The headlines will tell you that it is mostly about Coronavirus cases spiking around the US (and the rest of the globe for that matter). Second, others will point to the stalemate in Washington DC on a stimulus deal.

There is some truth in both. However, I believe that more investors are realizing the election is right around the corner and there is still much uncertainty there.

Remember that the market hates uncertainty leading to a “sell first, ask questions later” mentality. And the fact that polls got it so wrong in 2016 offers little comfort for the seemingly impressive lead that Biden holds at this moment.

On top of that, the poll #s have been narrowing this past week which is pretty typical coming into election day.

And on top of that is the millions of write in ballots that virtually guarantees a delayed election result. Which, yes, it more uncertainty.

And of top of that we all know that the odds of a contested election is much higher than any time in history. If true, it could be weeks or months until we have a finalized election whereby the loser actually concedes to the winner.

Until that happens…I just can’t stomach getting long the market. And I suspect more people are waking up to this fact leading to market downside.

Gladly we never faltered in our view of these events and that is why we are firmly outperforming the market at this moment (more specifics on that in the Portfolio section below).

Portfolio Update

An impressive week of outperformance as our defensive shell scored especially well on Monday as the S&P sank nearly 2%. We actually made a little profit on the day.

Of course the inverse ETFs were all in the plus column. But also GO and HELE gained ground. In fact 10 of 11 positions outperformed the S&P on the day.

But Monday was not the only impressive session. We have actually been in the plus column for 6 straight days. And going back 2 weeks we have gained a modest +0.32% all the while the S&P has skidded -3.45%. That is a nice outperformance given conditions.

(Wednesday afternoon update: The S&P is now down over 6% the past couple week while the Reitmeister Total Return portfolio is essentially break even because of the defensive moves made in the portfolio).

What To Do Next?

Right now my Reitmeister Total Return portfolio has correctly been positioned for stocks to come off the September highs and head lower into the election. This has led to a more conservative portfolio mix that has nicely outperformed the past couple months.

Here is a breakdown of the 11 positions currently in the portfolio:

5 GAARP Stocks (Growth At A Reasonable Price) that are well positioned for the coronavirus economy.

3 Inverse ETFs to mop up gains as the market is heads lower into the election

2 Precious Metals positions because when every world government is throwing money out of a helicopter it creates a bullish environment for gold and other precious metals.

1 Stock Sector ETF of a group likely to outperform. This was added on Wednesday October 21st and already breaking higher.

If you would like to see the current portfolio of 11 stocks and ETFs, and be alerted of when it is time to get 100% bullish once again, then consider clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $329.99 per share on Wednesday afternoon, down $8.23 (-2.43%). Year-to-date, SPY has gained 4.00%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |