Wednesday was an exciting day as the headlines proclaimed that the S&P 500 (SPY - Get Rating) made new all time highs at 5,796. This was nice to see after the weak start to the month.

Sadly, this is a hollow victory. That’s because investors are once again running to the usual suspects like the Magnificent 7 while the broader market is in negative territory on the month.

This is a sign of risk aversion, which is pretty typical behavior a month before a highly contested Presidential election. Unfortunately, I think the rest of October will be quite the same.

So what is the investment plan from here?

The answer will be at the heart of today’s commentary.

Market Outlook

We covered a lot of this ground in my commentary from last week: Will the Stock Market Winning Streak End in October?

The short answer is yes…I suspect stocks will end October modestly in the red. Then everyone should get ready to ride the bull again once the election results are in hand. Tack on the seasonal benefit of the Santa Claus rally and 6,000 could very well be in hand before we close the books on 2024.

Just 2 things are needed to keep this bull market on track:

- No recession in sight

- Fed keeps the rate cuts coming

Nobody is talking about a recession at this time. Or at least no rational person.

Q3 GDP is on track for an above trend +3.2% reading according to the GDP Now model from the Atlanta Fed. Even a downward surprise of only +2% would still be considered good news on the economic front.

On top of that you have Goldman Sachs recently lowering their odds of recession to only 15%. To be clear, the base case for economists and market strategists is to assume that even in the best of times there is a 10% chance of recession coming out of the woodworks. This is barely above that level especially because the Fed is on the economies side with lower rates on the way.

The rate cut party started in mid September with expectations for another 1.5% to be shaved off the Fed funds rate by the end of 2025. However, what is not so clear is the pace of those rate cuts.

CME’s FedWatch measures the probability of rate cuts for upcoming meetings. Right now they show a 82% chance of 25 basis point cut and 18% of nothing happening. Yes, that slow and steady pace of continual 25 basis point cuts at each meeting is quite possible.

However, I think that people are underestimating the odds of there being no cut in November. As in the Fed could go with bigger 50 point cuts…then pause for 1 to 2 meetings, then cut another 50 and so on. Over time it’s the same pace of total cuts…just a different path to get there.

So, it will be interesting to see what happens at the next meeting on November 7th as we likely get more insights on which of these paths is the more likely. No doubt the rate cut decision will have a lot to do with fresh data on inflation.

Fed officials can not be happy with the stickiness of wage inflation shown last week in the Government Employment Situation report. The tick up to 4.0% year over year inflation when drifting down to 3.7% was not good news.

Further, the CPI report on Wednesday brought some unwelcome facts. Yes, overall inflation ebbed lower from 2.5% to 2.4% but that includes the benefit of temporarily low gas prices that are already on the rise in early October.

Looking at the Core Inflation reading rising to +3.3% was an unwelcome outcome. The main problems there are shelter (aka housing) and transportation remaining stubbornly high.

These fresh facts have me more like 50/50 odds of no rate hike taking place on November 7th as Fed officials patiently await more data before making their next cut.

Regardless of the above, the primary trend is bullish. And a bull market can run higher at any time for any reason. So don’t get too cute trying to time the market. Just better to be fully invested for whenever the next run higher begins.

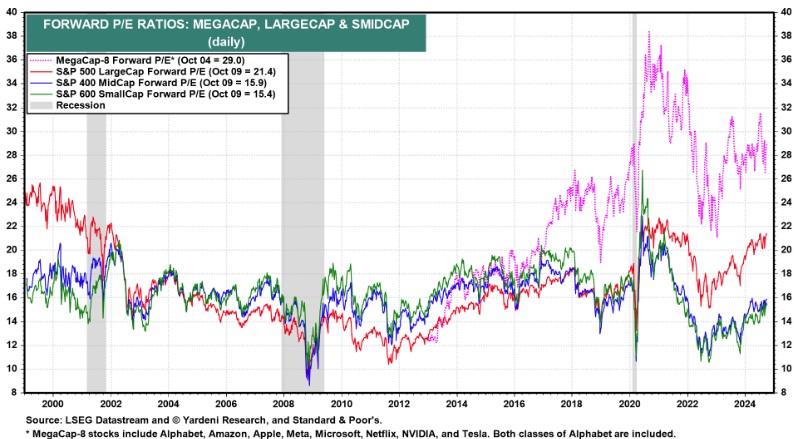

My money continues to ride on small and mid caps leading the parade from here. To me no chart says that more clearly than this one showing the PE of stocks by market cap:

Megacaps (pink) are at nose bleed levels that cannot be sustained over the long term.

Large caps (red) are hovering around a PE of 22. That is clearly above the long term average and suggests they are full valued to slightly overvalued.

Then we have small (green) and mid caps (blue) actually below the long term average at around 15 PE. This is clearly where the value is in the market.

Sooner or later the money should flow there. I believe that party starts now with 2025 being a year of tremendous outperformance for small and mid cap stocks.

But not just any small stock will do. They still need healthy growing earnings. That is the “shiny object” that grabs the most investor attention and the value aspect is just a bonus.

Gladly our POWR Ratings do a stellar job of finding healthy growing companies with a focus on 13 factors of Growth and 31 factors of operational strength captured in the Quality score. Add to that 31 more measures focused on Value and you are talking about buying the best growth stocks at attractive prices.

As always, my current favorite of these POWR Ratings stocks is shared below…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $579.03 per share on Friday morning, up $2.90 (+0.50%). Year-to-date, SPY has gained 22.97%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |