(Please enjoy this updated version of my weekly commentary published October 18, 2021 from the POWR Growth newsletter).

Market Commentary

First, let’s do our normal recap of the past week:

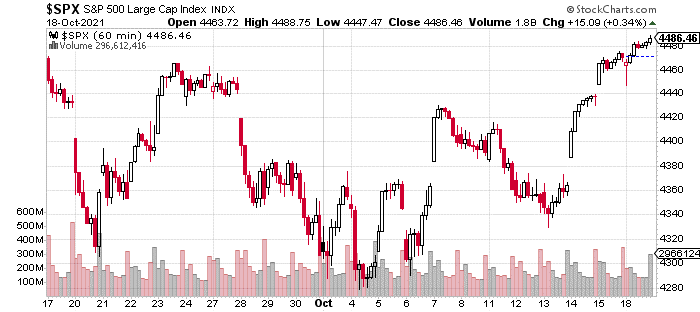

Since last Monday, the market briefly dipped lower before catapulting higher. It was a strong rally across the board with the S&P 500 less than 2% off all-time highs.

As mentioned above, this development fits in with my belief that Q4 will be exceptionally bullish this year. To recap, Q4 is always bullish due to seasonal factors but even more so in years when the S&P 500 is up by more than 15% entering the quarter.

On top of this, this year we have fund managers underperforming the market and underinvested. This combination also favors a year-end move higher as they will be forced to be buyers of stocks in order to make sure they are not underperforming their benchmarks by too much.

The market’s meltup since last Wednesday has to be exceptionally painful on a psychological level as they are likely underinvested due to some belief that the economy is going to stagnate. I see all this pain as being bullish firepower in the weeks to come.

Another favorable development for the bulls is that once again, earnings season seems to be very strong. 8% of companies in the S&P 500 have reported with 80% beating earnings expectations and 82% topping revenue estimates.

Earnings growth for Q3 has been increased to 30% from 27% a couple of weeks ago. It’s also resulted in the forward P/E of the S&P 500 dropping to 20.3 which is only slightly higher than its long-term average of 18.

Market Commentary Summary

The market has spent most of this year in a consolidation-type environment, marked by rolling corrections. Now, we seem to shifting into a much more risk-on, bullish environment that should be positive for our selections.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $450.64 per share on Tuesday afternoon, up $3.45 (+0.77%). Year-to-date, SPY has gained 21.71%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |