(Please enjoy this updated version of my weekly commentary from the POWR Value newsletter).

Stocks have been hot since going on an +18% run from the June lows. That’s really hot. Like standing on the sun hot.

So it is easy to look at this weeks sell off as nothing more than healthy profit taking as we go into a well deserved consolidation period.

This especially makes sense as you appreciate that Monday the S&P 500 (SPY - Get Rating) finally found resistance at the 200 day moving average (was 4,326, now a notch lower at 4,321).

This action led to a consolidation period and trading range as the next logical phase for this market. Yes, to digest recent gains. But also to await the next catalyst to determine if the market is truly in a long term bullish mood or if we sink back into bear market conditions.

As you will see from the title of my recent article it tips my hand as to what I see coming next. So be sure to read it now if you have not already as it covers a lot of important ground: 5 Reasons to Still Be Bearish.

One of the main themes in that article is that with inflation this high, and the Fed so hell-bent on raising rates, that its hard not to appreciate the damage that will be unleashed on the economy.

This is probably why the majority of participants in a recent Goldman Sachs survey of investment professionals saw a recession unfolding in the first half of 2023.

The release of the Fed Minutes on Wednesday further put an exclamation on the above as stocks did sell off sharply followed by much more pain on Friday.

Basically the Fed plans to keep raising rates until inflation eases substantially. And with inflation this high…it means a lot more rate hikes to follow.

This should be a shock to no one as they spent the better part of the last month on the speaking circuit telling anyone who would listen that they will continue to raise rates AGGRESSIVELY.

That is not a bullish idea. In fact, by its very nature it is meant to curb economic activity as a means to tame inflation.

So if not bullish is it bearish?

That is the key question investors are trying to answer. Meaning can the Fed raise rates this aggressively and not create a recession and extension of the bear market?

Possible…but not probable in my book which is why I remain bearish.

Bond investors clearly feel the same way given the inverted yield curve pointing out a recession likely to happen in next 1-2 years. And now we await stock investors seeing this with their own 2 eyes in areas like weakening of labor markets and lower corporate profits.

If and when those clues appear then we will retrace to the previous lows from June…and likely lower.

Let’s talk about the corporate earnings part as we are coming off the weakest earnings season since 2020. That may sound surprising given how much stocks rallied the past several weeks.

The best answer to that is that expectations were so horrifically low that it was easy to jump over the low hurdle.

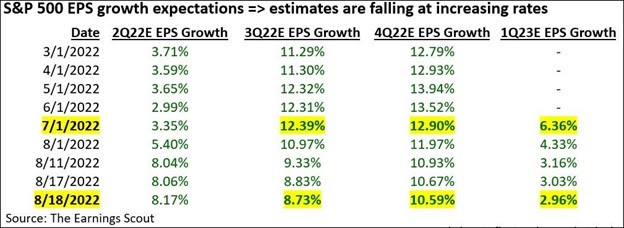

What the image below shows is the erosion in the earnings outlook from when earnings season began on 7/1 til now. You will see that growth expectations have tapered for the next 3 quarters.

Most telling is how Q1-23 is teetering closer to no growth which coincides with the recession outlook noted above from the Goldman Sachs survey.

Now let me share with you the analysis that came along with this chart from my friend, Nick Raich over at EarningsScout.com. (note his points of emphasis in bold)

* Investors may be becoming too optimistic the Fed will win the battle against inflation without hurting future growth.

* They may also be too hopeful the Fed will start cutting interest rates in 2023.

* Our research indicates the worst of S&P 500 EPS estimate cuts are not over.

* A big reason we believe the worst of the estimate cuts are not over is because overall S&P 500 EPS expectations (i.e. multiple periods of quarterly and annual EPS estimates) are only falling at a rate of -2.26%.

* To put that in perspective, overall S&P 500 EPS expectations were falling at a rate of -25% in March 2020 and at rates of nearly -50% in 2000 and 2008.

* For this reason, we anticipate EPS estimate cuts greater than -3% to occur in upcoming 3Q 2022 earnings season, which peaks in mid-to-late October.

* Stay underweight stocks.

Nick and I both spent a lot of years together at Zacks Investment Research where we appreciated the connection between earnings trends and stock prices. So it is very hard for us to see the current estimate drops and not be cautious about our stock market (SPY - Get Rating) outlook.

Worse still is that more estimate declines are likely to come as the Fed puts the brakes on the economy with higher rates. And that is why its hard to agree to the growing bullish sentiment at this time.

For now, I see a consolidation period with trading range being formed. The highs were just found at the 200 day moving average (now at 4,321). And the low side is likely framed by the 100 day moving average (4,096).

All moves inside this range are meaningless noise. That includes the Friday sell off. Investors are awaiting clear and obvious indicators of whether we are truly ready to breakout into a new bull market. Or whether the bear market is still in charge with a likely return to June lows if not lower to follow.

My bet is on the bearish argument to emerge victorious. Yet prepared to objectively review the information as it rolls in and become bullish if need be.

Portfolio Update

Many new people are joining POWR Value this week. And thus no doubt you likely find the above commentary confusing given that we have a portfolio filled with many stocks. So let me spell it out like this…

Think of most every mutual fund or ETF you have ever purchased. All of them have written objectives, which is essentially a mission statement they live by.

In the fund world it would be something like “This fund focuses on small cap growth stocks to achieve long term share price appreciation.”

And rain or shine that fund will stick to the objective no matter if investors are rotating away from small caps. No matter if it is the worst bear market in the history of mankind.

I believe that newsletters should basically work the same way. And in the case of POWR Value I seek to find the very best value stocks regardless of market conditions.

The one difference from the fund example, is that I allow the portfolio to not always be 100% invested. In fact, right now we are only 43.5% invested…but that will go back up to 50.5% when I add the next pick on Monday morning.

The point is that this heavier allocation to cash is a nod to market conditions which I believe to still be quite bearish.

For those who want more of an active trading, market timing element to their portfolio, then be sure to check out how I am running my Reitmeister Total Return service.

There the objective includes market timing and ability to go short when necessary. Right now my solution for the emerging consolidation period and trading range is a hedged portfolio balanced with inverse ETFs and a handful of my favorite stock positions.

Actually it is working spectacularly well this past week as the market has come off recent highs.

Gladly the approach for POWR Value has also worked spectacularly well to date just by having a higher % of cash when the going was rough along with the continued outperformance of our picks packed with the advantages found in the POWR Ratings system.

As of the close tonight the S&P 500 has fallen -11.28% on the year while the POWR Value portfolio has gladly turned that frown upside down with a modest gain.

Long story short, there is more than one way to attack today’s market conditions. No doubt I am proud of what we are doing with POWR Value…but if the approach from Reitmeister Total Return has more appeal to you…then please be sure to get access here.

What To Do Next?

Discover my hedged portfolio of exactly 10 positions to help generate gains as the market descends back into a bear market territory.

This is not my first time employing this strategy. In fact, I did the same thing at the onset of the Coronavirus in March 2020 to generate a +5.13% return the same week the market tumbled nearly -15%.

If you are fully convinced this is a bull market…then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next…then do consider getting my “Bear Market Game Plan” that includes specifics on the 10 positions in my hedged portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com

Editor of Reitmeister Total Return & POWR Value

Want More Great Investing Ideas?

SPY shares closed at $422.14 on Friday, down $-5.75 (-1.34%). Year-to-date, SPY has declined -10.46%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |