(Please enjoy this updated version of my weekly commentary published October 11, 2021 from the POWR Growth newsletter).

Market Commentary

First, let’s review what happened in the past week:

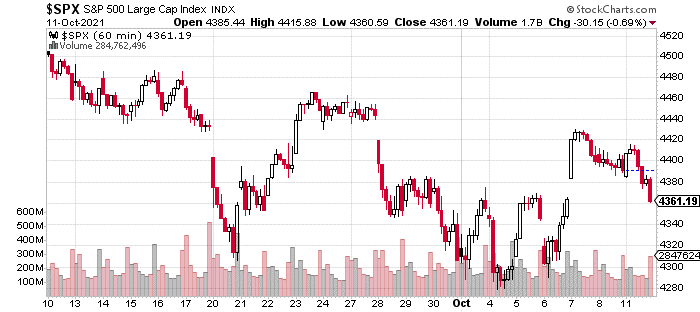

The bounce we speculated about last week did take place as the S&P 500 climbed from 4280 to 4420 before giving back about half of its gains. I think the S&P 500’s inability to hold these gains shows that one more retest of these levels should happen this week.

This would mark the third test of the 4300 level, and I expect it to be successful especially given the improvements in market conditions and economic conditions that I’ve been noting over the past month. The following are some of the strongest pieces of evidence that I can marshal to make this case:

Market Breadth is Improving: More breadth-dependent indices and measures like the NYSE Advance/decline line and the Russell 2000 have been making higher lows over the past month, a strong sign of accumulation.

Earnings Growth is Intact: EPS growth projections for the S&P 500 continue to trend higher and are currently at $215.

Coronavirus Case Counts Continue to Drop: The seven day moving average of new cases is at 85,000 a steep drop from the delta variant-high of 167,000 in early September.

Supply Chain Issues Will Ease: I believe that we have peaked in terms of concerns over the supply chain. Meaning, that problems will continue but the situation will improve. This is one reason that I became less interested in shipping stocks as they have benefitted from the backed up ports.

Q4 is the Most Bullish Time of Year: Over the last decade, Q4 has averaged a 4% gain for the S&P 500 and a 6% gain for energy, materials, and industrials, sectors which we have healthy exposure to.

Economic Data Continues to be Strong: There’s so much noise and volatility given the extremes of the economy over the past 18 months from shutdowns to stimulus payments. But, overall, the economy is doing well especially in terms of major areas like housing, manufacturing, and consumer spending. Yes, the economy is slowing but there’s no risk of a recession.

These are some of the most important reasons to take a bullish stance even if the market can’t seem to find its footing. Another indication of the market’s strength from a bottom-up perspective is the performance of our portfolio.

The combination of this bottom-up strength in concert with the broad market rallying is key to the favorable, trending conditions for growth stocks that we have been talking about for months. It’s seeming closer to a reality these days.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $434.83 per share on Tuesday afternoon, up $0.14 (+0.03%). Year-to-date, SPY has gained 17.44%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |