(Please enjoy this updated version of my weekly commentary originally published May 25th in the POWR Stocks Under $10 newsletter).

Stocks have pulled back a bit and volatility has gone up as we approach the debt ceiling. This is no surprise (both the behavior of the market and the fact that the ceiling has yet to be resolved).

That being said, I still think there’s a less than a 1% chance we actually default on debt. One way or another, something will get worked out.

In the meantime, life goes on. Tech stocks jumped 2.5% on Thursday after great earnings from NVIDIA (NVDA).

Speaking of NVDA, as overvalued as it may be (trading at 218x earnings), the company has posted some very positive news.

The stock is now valued at almost a trillion dollars and it’s the 5th largest component of the S&P 500 (SPY).

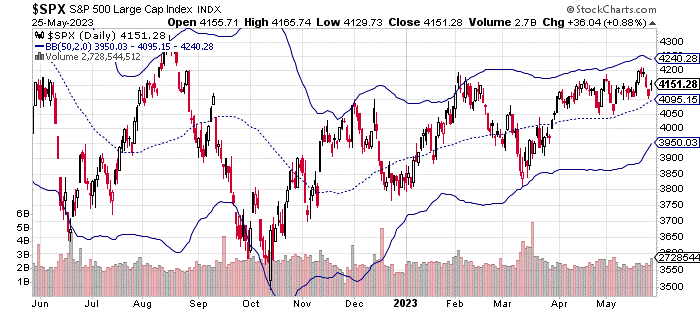

The S&P 500 pulled back to its 50-day moving average before the NVDA news sent it back higher. It remains within the 2 standard deviation range that you can see on the chart above. Positive news on a debt ceiling deal could send the index much higher in a hurry.

Of course, as we get closer to the actual debt limit, volatility will go up and stocks will go down. Most people don’t believe an actual default will happen, but the financial markets have no choice but to react as we come down to the wire.

There isn’t a whole lot of meaningful economics news this week, although PCE comes out after this issue is released. The metric (which is an alternative to CPI in terms of looking at inflation) could potentially move the market if the results are a big surprise.

The markets are now at about a 50/50 chance on a rate increase at the next Fed meeting in June.

We have a few more weeks until then, so things can obviously change. PCE results may go some way towards convincing the markets one way or the other what the Fed is going to decide.

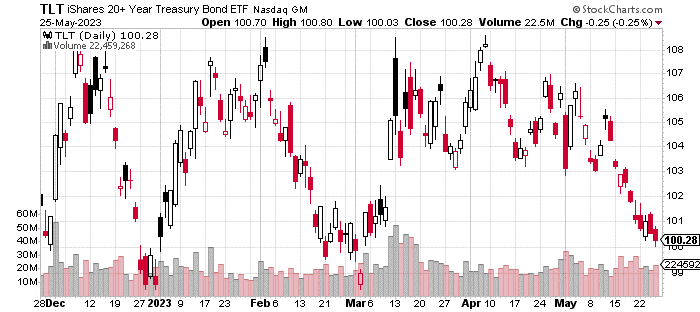

Looking at the chart of iShares 20+ Year Treasury Bond ETF (TLT), bond prices have come back down recently.

Keep in mind, bond prices move inverse to bond yields, so this move is likely due to the greater expectations of a rate hike than what we saw a few weeks ago. If there is a rate hike, I strongly suspect it will be the last one of the year.

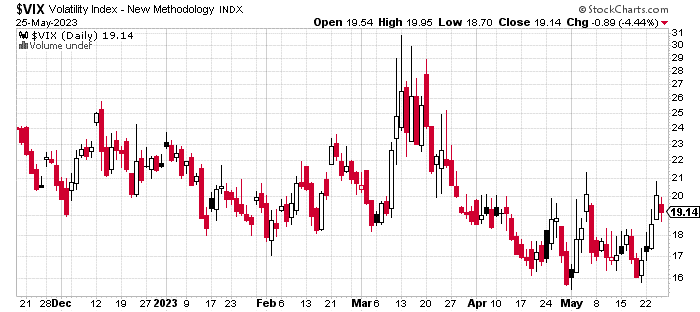

The VIX (the market volatility index) has climbed a fair amount over the last week as a response to the approaching debt ceiling. Again, this isn’t really a surprise under the circumstances. The index is still under 20, which is about the long-term median level. .

The 18-20 level in the VIX doesn’t tend to be a place the index sits at for very long (as you can see in the chart above). It’s kind of a transition level historically.

Whether market volatility goes higher or lower depends almost entirely on what happens with the debt negotiations. We’ll know a lot more next week.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this challeging stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Jay Soloff

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares were unchanged in after-hours trading Friday. Year-to-date, SPY has gained 10.25%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jay Soloff

Jay is a former professional market maker who cut his teeth trading on the floor of the CBOE. With more than 20 years of experience trading and investing, his focus is on making professional strategies accessible to everyone, which is exactly what does in his highly profitable POWR Income and POWR Stocks Under $10 investment advisory services. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |