(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

Last week, I wrote:

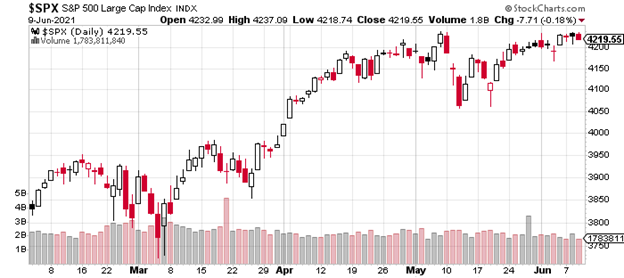

“The S&P 500 has essentially been locked in a range between 4,200 and 4,050 since early April.

In mid-May, we tested the lower end of the range and have steadily moved higher and are now consolidating under all-time highs set in early May around 4,230.

See the 4-month chart of the S&P 500 below:”

Everything from last week remains valid.

However, the chart is updated. And, it shows the price action over the last week. Attempts to break higher have failed, but there’s been little to none downside pressure either. Any weakness has been instantly bought.

The defining feature of this market has been the lack of volatility, and it seems to be compressing even more given the small ranges and moves this week.

In last week’s commentary, I noted that from a bottom-up perspective, I wasn’t impressed by the market’s leadership. There have certainly been improvements this week in terms of an expansion in the number of stocks making new highs and a broadening in terms of sector participation.

Another important factor is that volumes are dropping along with volatility. And there is always that adage – never short a boring market.

Additionally, the underlying fundamentals – low rates and earnings growth – remain supportive of higher prices. Recent jobs data was ideal for stocks. Strong enough to ensure continued earnings growth but not strong enough to accelerate the Fed’s timeline for tightening monetary policy.

Given these positive, underlying fundamentals, inflection points in the market will tend to resolve higher.

Bearish Notes

Despite these positive developments, I still remain in the patient camp as there are some reasons to believe that a bigger dip is necessary before stocks can stage a sustaining and trending move higher.

Here are my concerns.

Meme Stocks

The last rally in meme stocks topped in late January. This marked a choppy period for the S&P 500 and ultimately, it topped two weeks later in mid-February.

AMC seems to already have topped and will eventually plummet. Some of that selling in those names could spill-over into the broader market even if just temporarily.

However, the meme stock drop in late-January did mark an inflection point lower in growth stocks that was much more significant than the broader market’s short and sharp pullback. Between mid-February and early-March, many growth stocks pulled back more than 10%, while speculative ones dropped even more.

Bullish Sentiment

The meme stock frenzy is certainly an orgy of greed that should concern all rational-minded people. It’s also consistent with other readings of high bullish sentiment that tend to lead to limited gains on the upside or can unleash cascading moves lower if negative catalysts emerge.

Some indications of bullish sentiment are 78% of global fund managers in a Bank of America survey saying that they expect higher profits over the next 12 months which is a record high. The number of bearish respondents to an AAII survey showed a six-month low. Put/call readings are at a six-month low.

This type of complacency and over-positioning on the bullish side could be one reason that many companies with strong earnings reports and upgraded guidance sold off.

We are Due

This is more of an intangible reason, but we really haven’t had a serious selling episode since the March 2020 low that really tests people’s resolve in the bull market.

After the March 2009 low, we had two serious sell-offs in 2010 and 2011. I think there are some similarities in terms of the economy remaining in growth mode but the rate of growth decelerating. Those years also featured inflation scares which in hindsight turned out to be transitory.

Inflation Update

The market’s major focus is on inflation. It’s been at multiyear highs.

It’s possible that the trigger for a breakout or a more decisive rejection of the S&P 500 at these levels could be determined by tomorrow’s inflation data.

As I’ve stated before, I am not concerned about inflation at this point. Inflation could have a negative impact on stock prices in certain situations when it leads to eroding corporate profits or tighter monetary policy.

Market Commentary Summary

Given this confluence of bullish and bearish forces, I believe our current positioning remains appropriate.

We are outperforming the market on up days, while retaining the ability to take advantage of any market dislocation.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $423.33 per share on Thursday afternoon, up $1.68 (+0.40%). Year-to-date, SPY has gained 13.60%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |