In part one of this series, we learned about the dangers of being absolutely certain about one’s views about the economy or financial markets.

In part two, I’ll show you how to not just survive in an uncertain world, but potentially thrive in it, retire rich, and stay rich in retirement.

How To Get Rich In An Uncertain World

Do you know that even knowing big macro events ahead of time can’t tell you what the stock market will do in the short-term?

Imagine if you had a crystal ball that told you that the worst pandemic in 100 years was coming on January 1st, 2020. Imagine you knew that Q2 GDP would plunge by 32% and over 22 million Americans would lose their jobs in a single month?

Now consider that the stock market had just rallied 31% in 2019, the 2nd best year for stocks in over three decades.

How much would you have guessed the market would have fallen given this perfect storm of high valuations and the sharpest quarterly economic contraction in recorded history? 20%? 30%? 40%?

Actually, stocks went up 18% in 2020 after that 31% rally in 2019.

Now imagine that on January 1st, 2021 you knew that 5% inflation was coming in 2021 and another 4% potentially in 2022? Imagine that you knew with certainty that long-term interest rates would triple from their August 2020 lows?

Now imagine that you knew that the US would come within 3 days of defaulting on its debt and Fitch would lower its outlook for US bonds to AAA negative outlook?

Surely that would cause the market to finally have a very bad year, the first since 2009, right?

We’re at 56 record closes and counting and the market is up 23%.

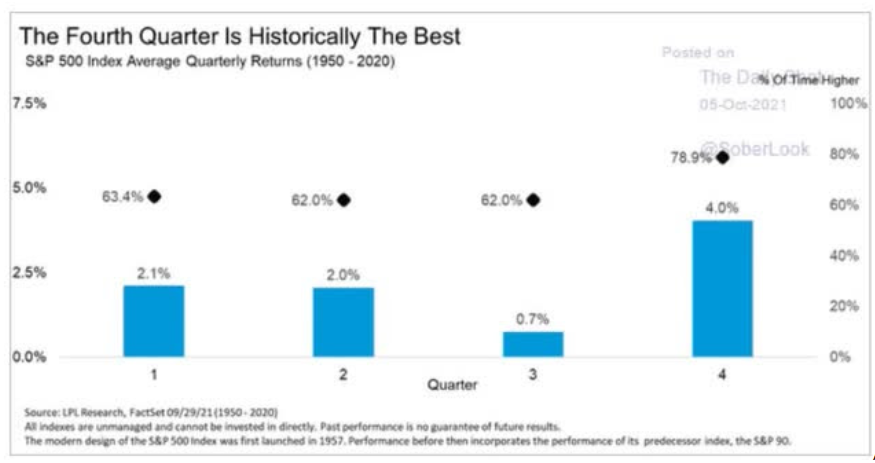

And Q4 is historically the single best quarter for stocks, meaning we might not be done rallying yet.

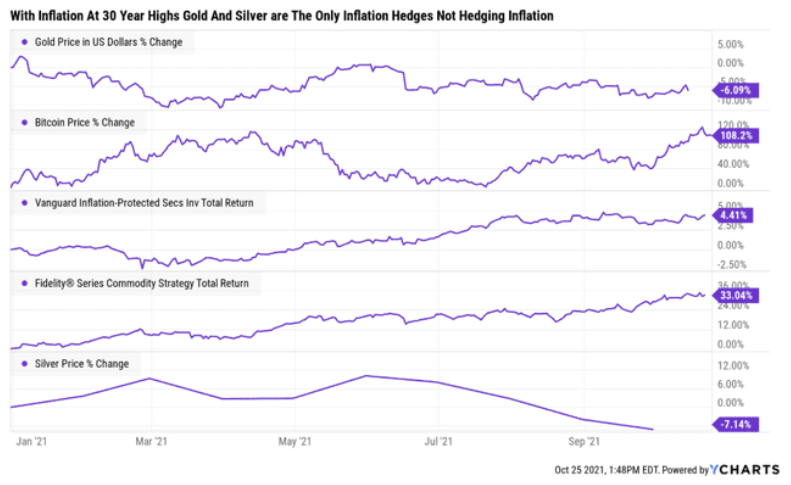

Finally, let’s consider inflation and gold, the ultimate inflation hedge historically speaking.

In the worst inflation in 30 years, you would have probably been 100% certain that Gold and Silver were going to crush almost every other asset this year.

Guess what? Your certainty would have cost you dearly.

Did you stay out of stocks as Robert Kiyosaki said? Did you avoid bonds and go all-in on gold and silver as he pounded the table too? You missed a 23% rally in stocks, and precious metals are the only inflation hedge down this year.

In fact, they are pretty much the only asset class down this year.

Commodities are ripping, as one would expect with high inflation. Inflation-protected securities are up modestly, as one would expect. And Bitcoin, so-called “digital gold” is up 108%.

But gold and silver are down 6% and 7%, respectively, proving that even if you could predict the big macro with perfection, being 100% certain with your portfolio is a dangerous fool’s errand.

How To Stay Rich In An Uncertain World

The key to retiring rich and staying rich in retirement is NEVER to go all-in on even your highest conviction ideas.

There is a 20% chance that even if every single fact points to one guaranteed outcome, you’re missing something or facts will change, and investment returns will turn out differently than you expect.

Consider this.

Jeff Bezos founded Amazon, is its chairman, and owns 10% of its stock. There is no one on earth that knows Amazon better than Bezos, and yet even his fortune is just 90% invested in Amazon.

Bill Miller is one of the greatest value investors in history. He beat the S&P 500 for 16 consecutive years.

Miller now only runs his own money and is a big believer in concentrated high conviction portfolios.

He’s literally the most concentrated investing legend I know of, 86% in Amazon and 13% in Bitcoin.

Yet even this very rich man, who could lose 99% of his fortune and still be a multi-millionaire, doesn’t go all-in on anything, even those high probability/low-risk opportunities are as close to a “sure thing” as exist on Wall Street.

Warren Buffett running Berkshire’s $300 billion portfolios, has an infinite time horizon and theoretically infinite risk tolerance.

Apple is 45% of Berkshire’s portfolio, and Buffett was recently trimming Apple because apparently, he’s uncomfortable with any company, even an 18.6% CAGR grower like Apple, becoming over 50% of BRK’s portfolio.

The point is that sound risk management is key to successful investing and remaining successful over time.

Concentration is how you get rich. Diversification is how you stay rich.” – Ben Carlson, Animal Spirits

The most concentrated rich person I know of is Raul Pal, co-founder of Real Vision.

He describes his portfolio as “recklessly long” crypto, with 98% of his net worth in Bitcoin and Ethereum.

Mind you Mr. Pal was an early investor in both cryptocurrencies and didn’t start out anywhere close to 98%. How rich is Pal? About $90 million rich. If he lost 90% of his fortune, he’d still be able to retire on a nice Caribbean island (he lives on the Cayman Islands in fact).

The point is that the richer you are, the higher your theoretical risk profile is.

Jeff Bezos could lose 99% of his wealth and still be a multi-billionaire, that’s why he doesn’t lose sleep with a 90% allocation to Amazon.

The right asset allocation and risk management strategy based on your personal needs is the best way to achieve a rich retirement and stay rich in retirement.

For example, let’s consider a diversified and prudently risk-managed portfolio built around the classic 60/40 stock/bond retirement portfolio.

| Company | Yield | Growth Consensus | Long-Term Consensus Total Return Potential | Weighting | Weighted Yield | Weighted Growth | Weighted Total Return Potential | Conservative Risk-Adjusted Expected Return |

| AMZN | 0.0% | 29.6% | 29.6% | 10.0% | 0.0% | 3.0% | 3.0% | 20.7% |

| BTI | 8.2% | 4.2% | 12.4% | 10.0% | 0.8% | 0.4% | 1.2% | 8.7% |

| Magellan Midstream | 8.1% | 3.40% | 11.5% | 10.0% | 0.8% | 0.3% | 1.2% | 8.1% |

| FB | 0.0% | 20.00% | 20.0% | 10.0% | 0.0% | 2.0% | 2.0% | 14.0% |

| ENB | 6.2% | 6.60% | 12.8% | 10.0% | 0.6% | 0.7% | 1.3% | 9.0% |

| Bitcoin | 0.0% | 60.0% | 60.0% | 1.0% | 0.0% | 0.6% | 0.6% | 42.0% |

| Ether | 0.0% | 80.0% | 80.0% | 1.0% | 0.0% | 0.8% | 0.8% | 56.0% |

| 60/40 (BAGPX) | 1.7% | 5.1% | 6.8% | 0.0% | 0.0% | 0.0% | 0.0% | 4.8% |

| Total | 29.4% | 330.0% | 359.4% | 52.0% | 2.9% | 7.8% | 10.7% | 7.5% |

A portfolio that’s 50% blue-chips, 48% 60/40, and 2% crypto is expected to deliver 10.7% CAGR long-term returns and yields 2.9%.

That’s compared to 1.7% for a 60/40 portfolio which is expected to deliver 6.8% long-term returns over time.

On a risk-adjusted basis, this portfolio is expected to deliver 7.5% CAGR vs 4.8% for a 60/40.

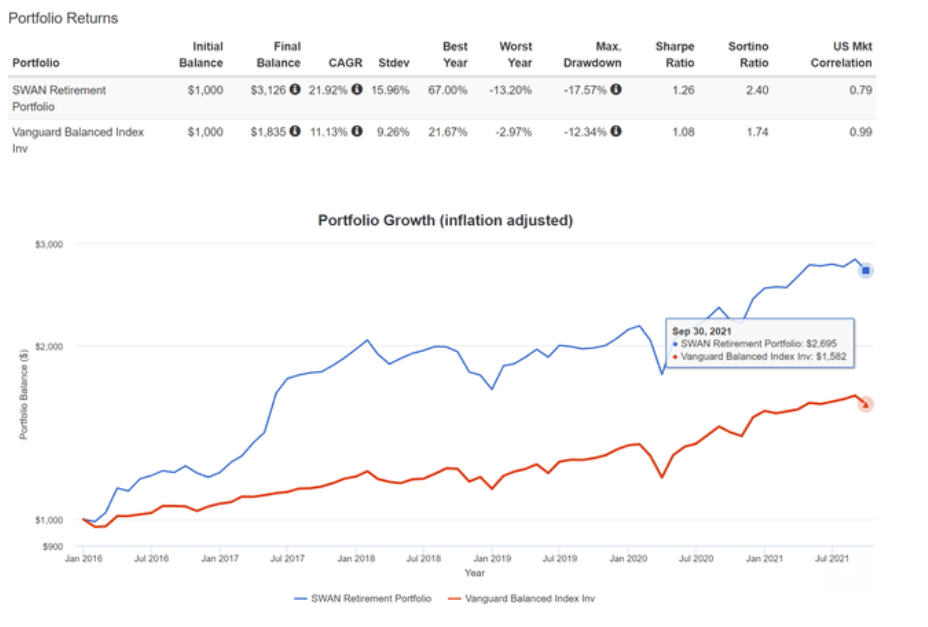

Let’s call this our sleep well at night or SWAN retirement portfolio.

SWAN Retirement Portfolio Returns Since 2016 (Semi-Annual Rebalancing)

(Source: Portfolio Visualizer)

This effective 80/20 portfolio smashed the S&P 500 with nearly identical volatility.

It more than doubled the 60/40’s returns thanks to a tiny 2% allocation to crypto.

If crypto to zero? Who cares, it’s 2%. If it goes to the moon? Then we beat the S&P 500 during a red hot bull market while earning 3% income in a portfolio dominated by blue-chips, bonds, and the S&P 500.

What was the biggest decline for this portfolio? -17.5% in the March 2020 pandemic.

A 60/40 fell just 12.5% but the S&P fell 34%, and remember we’re 80% stocks with this portfolio.

Superior income? Check.

Superior return potential? Check.

Superior historical returns? Absolutely.

Sound allocation and prudent risk management? Amen.

This is how you achieve a rich retirement and stay rich in retirement. Even when you own speculative assets, you don’t take on dangerous risks.

Even when you’re very confident that certain companies, like AMZN, FB, and BTI are poised to soar to the heavens in the medium-term, you don’t go “all-in” and risk everything.

When you focus on safety and quality first, and prudent valuation and sound risk management always, you don’t need certainty, you can thrive in all economic and market conditions.

In fact, the very lack of certainty on Wall Street is what creates the corrections and downturns that let us achieve long-term returns that most people can only dream of.

Want More Great Investing Ideas?

SPY shares were trading at $458.79 per share on Friday afternoon, up $0.47 (+0.10%). Year-to-date, SPY has gained 23.91%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |