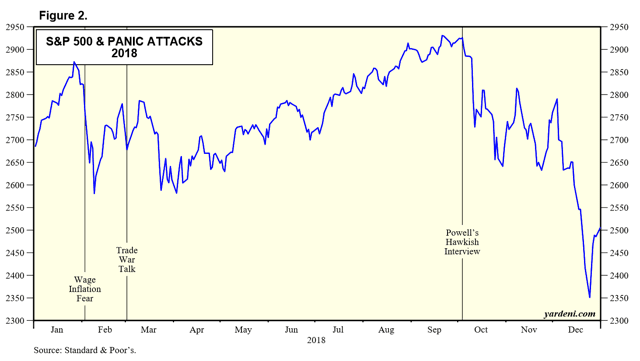

The stock market, whether you’re tracking the S&P 500, Nasdaq or Dow Jones Industrial Average, often panics over “important news.” Since 2009, we’ve seen no less than 65 “panic attacks” including several that caused two corrections last year.

(Source: Yardeni Research)

And that wasn’t even the “scariest” year for the market since 2009.

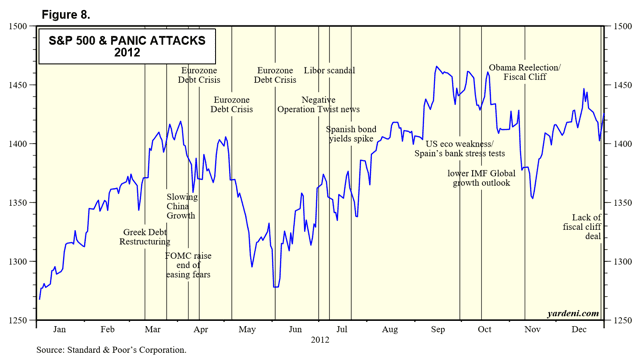

(Source: Yardeni Research)

In 2012 we saw European debt fears, worries over slowing China growth, Fed rate uncertainty and gridlock in Congress all creating a “Wall of worry” for stocks to climb.

Well, this week will bring a flood of important news, which means investors need to be prepared for potentially nasty short-term volatility. Here are the three most important things to watch for, so you can be prepared to protect your portfolio from potentially costly panic-induced mistakes.

Fed Rate Decisions/Guidance on Wed October 30th

Tuesday and Wednesday the Fed’s Open Market Committee or FOMC will meet and decide what to do with short-term interest rates. At 2:30 PM EST Jerome Powell will hold a press conference and outline the Fed’s latest guidance about what’s likely happening with short-term rates in the coming months.

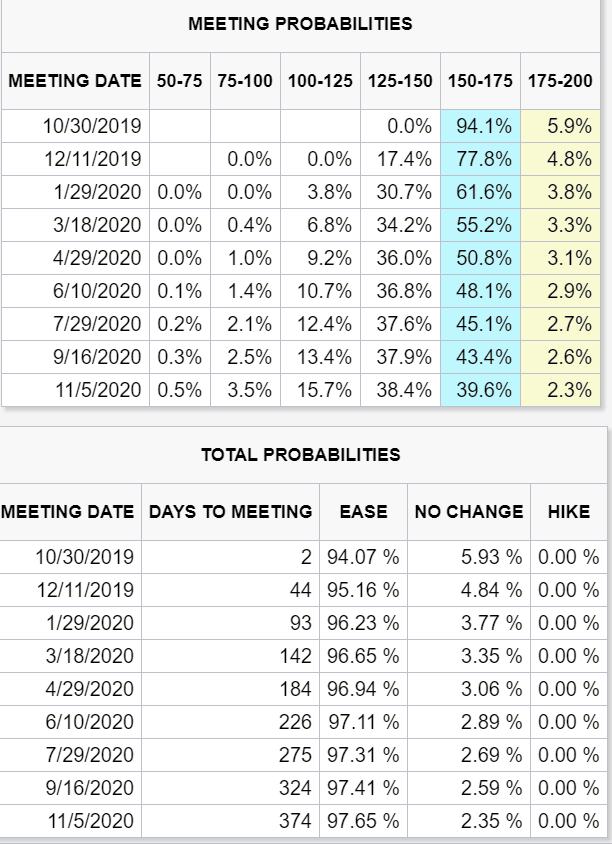

(Source: CME Group)

Currently, the bond market is pricing in a 94% probability of an October Cut, with about a 60% probability that we get at least one more cut through next year. Each cut, according to Moody’s, boosts US GDP growth by 0.1% to 0.15% annually, within 12 months of occurring.

Here’s what Bloomberg economists Yelena Shulyatyeva and Carl Riccadonna think is most likely to happen Wednesday.

The Federal Reserve will not take any chances this week by defying market expectations for additional accommodation — we expect the central bank to deliver a third consecutive rate cut at the FOMC meeting. Had policy makers held strong reservations against the anticipated move, Fed Chair Jerome Powell and Vice Chair Richard Clarida would have pushed back against it in remarks prior to the blackout period; they chose not to.”

I agree that the Fed is likely to make the prudent and reasonable choice given the most recent economic data and provide one final insurance cut. That would fit with the three rate cut “mid-cycle” correction that the Fed took in 1995 and 1998, in the face of increased economic uncertainty to head off a correction (it was successful both times).

The last Dot plot shows that 50% of the FOMC voting members are in favor of one more cut, but after that we’re likely to get a pause. The press conference on Wednesday is likely to move the market depending on whether or not Powell places his emphasis on ongoing risk factors to the economy (dovish) or takes a more hawkish stance that leaves the market fearing the Fed is behind the curve in terms of offsetting our trade uncertainty induced growth slowdown.

What he’s likely to say is very likely to be something along the lines of “the economy is OK for now and the Fed is ready to cut as data indicates is appropriate”. However, how the market chooses to interpret that basic message, which hasn’t changed in months, is the wildcard.

Economic News That Will Likely Point to Slower But Still Positive Growth

In recent weeks economic data has come in weaker than expected, causing the overall consensus for Q3 and Q4 economic growth to be reduced.

Wednesday we get the first estimate of Q3 growth, with MarketWatch reporting the median consensus at 1.5%. That’s down sharply from Q1’s 3.1% and Q2’s 2.0% readings.

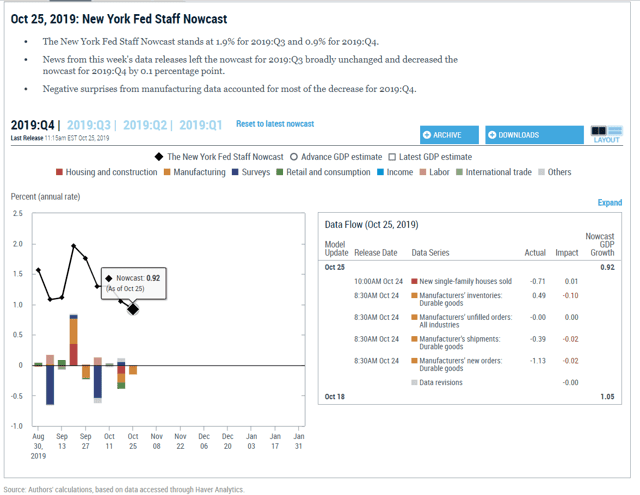

(Source: New York Federal Reserve)

The New York Fed is now estimating that US economic growth in Q4 might be down to 0.9%, a level not seen since the oil crash of mid-2015 to Q1 2016, which also saw 0.9% average US growth. In 2016 we had 1.6% annual economic growth, the worst single year since 2009.

That much slower growth, when combined with 1.8% core inflation, is likely why the Fed will cut one more time, and then pause to see what further data shows.

Friday’s jobs report is expected to show 70,000 net jobs created in October, far below the 107,000 average needed to keep unemployment stable. However, according to JPMorgan, the GM strike likely reduced October’s jobs report by 75,000, and those jobs are likely to bounce back in November.

In other words, 70,000 jobs created in November is actually 145,000 and above September’s 136,000. As long as we get close to that median consensus estimate the US jobs market remains in fine shape.

The bond market, via the yield curve, is estimating just a 30% probability of a recession beginning within a year, which is actually supported by the aggregate economic data.

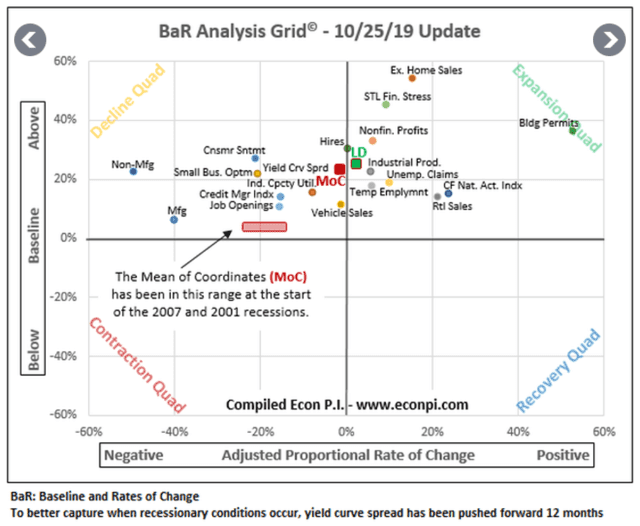

(Source: David Rice)

The average of 19 leading economic indicators is down to about 23% above historical baseline, and still contracting modestly on a month to month basis.

However, the reason the Fed might be right to pause soon is that the eight most sensitive indicators (which tell us where the average of all indicators is likely to go next unless something changes) is slightly higher and expanding on a month to month basis.

In other words, while growth has slowed significantly due to trade uncertainty, we might be stabilizing at levels that indicate little risk of a recession in the near-term.

(Source: David Rice)

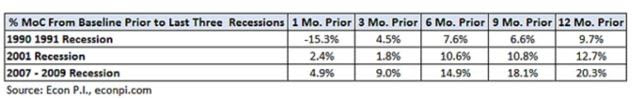

That’s based on the last three recessions, which saw the average of all indicators well above current levels 12+ months out from when the contraction began.

Mr. Rice, who invented and runs the BaR grid (the single best source of aggregate economic data in my opinion) says that 20% and 15% above baseline are the key tipping points to watch.

20% above baseline is when negative business and consumer sentiment is likely to start feeding on itself and the average of all indicators is likely to keep falling. 15% is when recession becomes the most likely outcome, but would likely still be about six to 12 months away.

The Fed’s three rate cuts are designed to keep us from the 20% tipping point. But that’s just the macroeconomic picture. We can’t forget that earnings season is when companies report fundamentals and thus are prone to wild swings in price.

Earnings From 30% of S&P 500 Companies

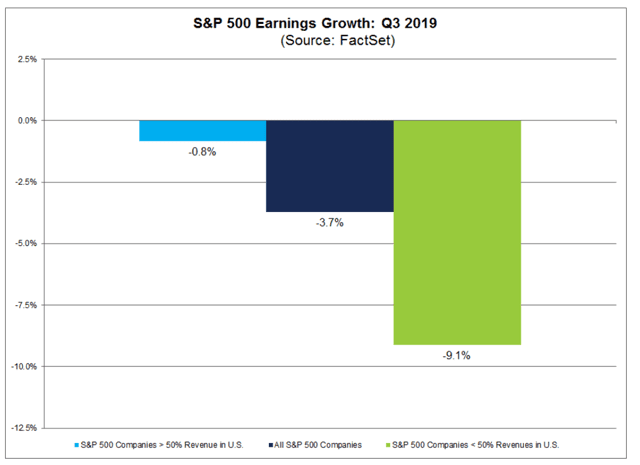

This week 156 S&P 500 companies are announcing earnings and it’s not likely to be pretty for multi-nationals.

The most trade-sensitive companies, technology, energy, and basic materials, are expected to report a 9% decrease in YOY EPS. We’ve already seen some major announcements from Caterpillar (CAT), which revised down 2019 EPS guidance by 12%. Thanks to management slashing production and controlling costs, CAT actually went up the day it missed earnings and slashed guidance, and the stock has continued to rally.

3M (MMM) cut guidance by 5% and saw its share price fall 6% that day. The stock has also bounced back strongly since then, showing that you can’t always predict how the market will react to “bad” news that’s often priced into low valuations.

(Source: FactSet Research)

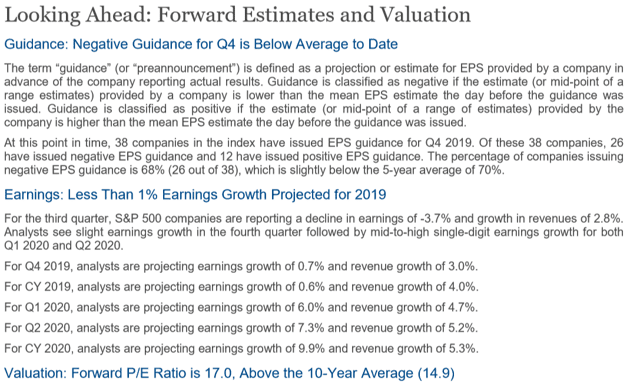

In the aggregate analysts expect a 3.7% YOY EPS decline from the S&P 500 and just 0.6% growth in 2019. That’s compared to nearly 10% growth at the start of the year, which doesn’t bode well for 2020’s EPS growth outlook which similarly has been falling steadily in recent weeks.

Without a trade deal (phase three that ends all tariffs) we’re not likely to see anywhere close to the kind of growth baked into the next year. The S&P 500’s 17.0 forward PE is rising as the market hits new record highs. As I write this the S&P 500 is at 3,040, a forward PE of 17.5, based on the $174 forward EPS consensus per IBES by Refinitiv.

The 25-year average forward PE on the S&P 500 is 16.2 and serves as a good proxy for the broader market’s fair value. That means the broader market is about 8% historically overvalued.

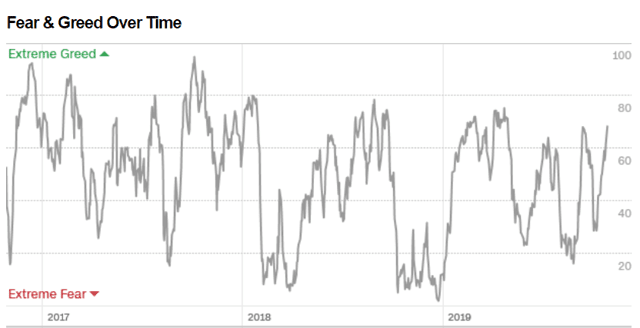

(Source: CNN)

Factor in that short-term broader market technical indicators are now showing investor sentiment approaching extremely greedy levels and I must caution investors who use index funds that discretion is the better part of valor.

If you are overweight stocks (via an S&P 500 index fund) then periods like we’re seeing today, when stocks are historically overvalued despite deteriorating fundamentals, may be a good time to rebalance.

You don’t necessarily have to sell, and indeed buy & hold is the default strategy almost all investors should use. But if the volatility of 2018 and 2019 have caused you to lose sleep at night then it likely means your asset allocation (mix of stocks/bonds/cash) is out of whack relative to your risk profile.

The proper asset allocation, as well as portfolio construction, is how you manage risks during periods of increased economic uncertainty as we face now.

Bottom Line: Important News Can Move Stocks A Lot, But Proper Risk Management Is How You Sleep Well at Night And Avoid Costly Mistakes

When so much news breaks, it’s easy to get confused and not know what to do with your portfolio. That’s especially true when the market freaks out over the Fed’s latest guidance or stocks you own miss guidance and crashes 5% to 20% in a single day.

99% of the time the right move is to do nothing with your portfolio, other than potentially snap up shares of quality companies if Wall Street overreacts to “weak” earnings.

This week earnings from 30% of S&P 500 companies, the Fed’s rate cut decision and guidance, and the GDP/jobs report might send stocks soaring, or crashing, or potentially both in the same week.

Never forget that the key to long-term success is to ignore the noise and not fall victim to the fallacy that you have to “do something” with your portfolio.

Risk management, not market timing, is how you protect yourself from things going wrong, with your companies, or the economy in general. The good news is that the probability of a near-term recession is down from 48% to 30% in recent weeks, and so there is little reason to fear a bear market is imminent.

We’re sure to get historically normal volatility, but as long as you focus on what matters, and remember to use sound investing principles you have little to fear from this week’s flood of important data.

SPY shares were trading at $303.89 per share on Tuesday afternoon, up $0.59 (+0.19%). Year-to-date, SPY has gained 23.29%, versus a 23.29% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |