Every investor wants high returns but with low and limited risk. This especially the attraction of using options. But in times of high volatility and sharp straight line moves such as has occurred over the past week the losses can be sweeping and total.

So, the question is how do you handle big drawdowns? Before getting to some specific behavior it’s good to step back for a longer-term perspective versus short term trading.

The past weeks’ near 15% drop is the largest and fastest correction from all-time highs in the past 70 years. But while the velocity has been notable the actual size of the decline is well within historical norms.

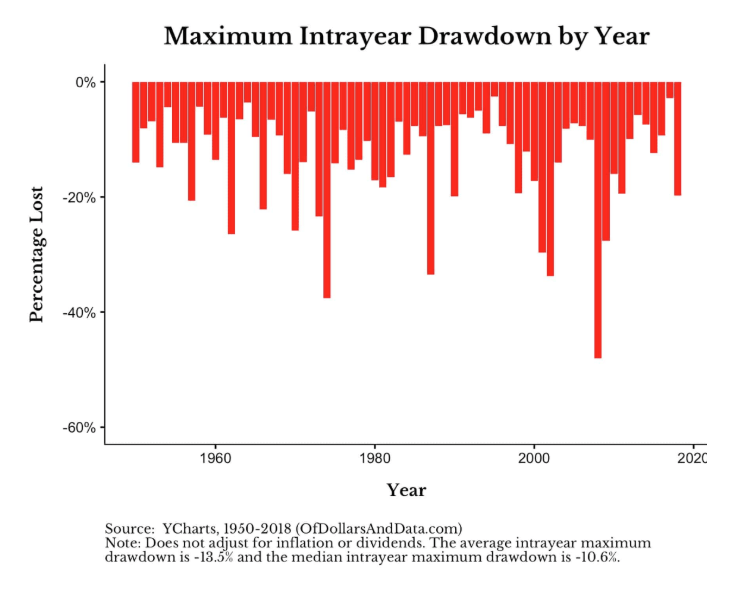

Since 1950, the average maximum intra-year drawdown for the S&P 500 has been 13.5% with a median drawdown of 10.6%. This means that if you had bought the S&P 500 on January 1 of any given year, on average, the market would be down by 13.5% at some point during the year:

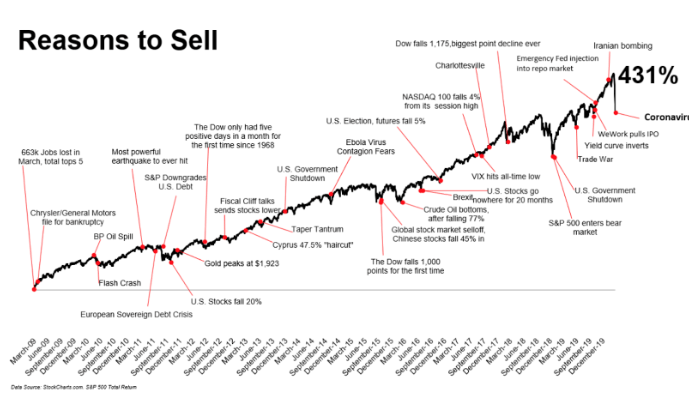

Also, it’s good to note that since the financial crisis in 2008-2009 there have been multiple ‘events’ that would have provided reasons for people to sell. Which of course would have turned the wrong reaction.

So, what can you do to avoid selling at the wrong time and incurring irreparable losses?

First and foremost is applying some form of risk management so you can withstand the investable drawdowns without being forced to liquidate at fire-sale prices. Simply put, the most effective means of building wealth is to simply avoid large losses.

For long-term investors, that means investors not selling after most of the damage has been done. This is the very definition of what capitulation and bottoms are built on.

This also means avoid trying to call a bottom. It’s tempting and can offer bragging rights if you get it right but over the long term, you should employ a rational dollar cost or systematic approach to investing over time or price levels.

This is especially true for more active or shorter-term traders in which they increase their risky behavior at the exact time they should be reigning in their exposure. It’s something poker players or gamblers refer to ‘going on tilt’ in that once losses start to accrue someone tries it win it back with bigger and bigger bets. It’s exciting but it’s also a great way to break.

Lastly, don’t let the natural human emotions of stress spill over into personal life, it will just compound bad and irrational decisions.

SPY shares were trading at $295.01 per share on Friday afternoon, down $2.50 (-0.84%). Year-to-date, SPY has declined -8.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |