There are numerous ways investors can lose their hard-earned money in the stock market.

- performance chasing

- buying yield traps whose dividends are unsustainable and likely to be cut, possibly several times

- grossly overpaying for quality companies to the extent that even if they grow as expected you might see negative returns for years or even decades

- ignoring deteriorating fundamentals (thesis breaks about 20% of the time even if you perform proper due diligence)

But of all the potential mistakes that stand in the way of achieving your financial goals, one, in particular, is most likely to cost you a fortune in 2020.

Why Market Timing Is the Single Biggest Mistake Investors Make

Dalbar is an analyst firm that has been doing annual Quantitative Analysis of Investor Behavior studies since 1994:

Analysis of investor fund flows compared to market performance further supports the argument that investors are unsuccessful at timing the market. Market upswings rarely coincide with mutual fund inflows while market downturns do not coincide with mutual fund outflows.” -Dalbar Investor Study (emphasis added)

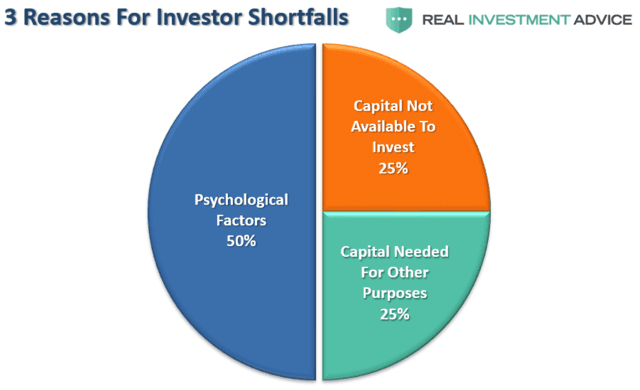

Market timing is hands down the biggest mistake investors make and accounts for about 50% of underperformance over time.

(Source: Dalbar, Lance Roberts)

Poor risk management accounts for another 25%, with improper asset allocation causing many to have to sell even top-quality stocks during corrections and bear markets because they failed to understand their risk profile correctly. Owning a sufficient amount of bonds or cash equivalents (like treasury bills) is how you avoid unexpected expenses turning you into a forced seller at the worst possible time.

What kind of underperformance am I talking about?

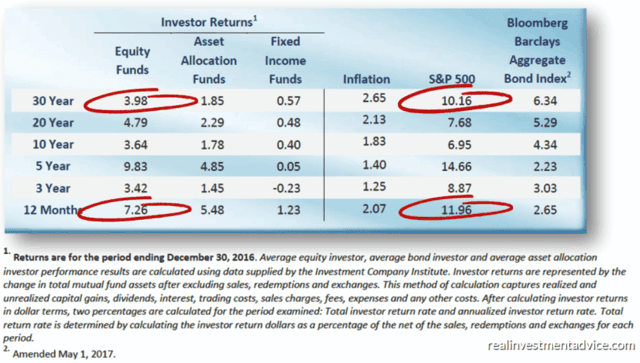

JPMorgan Asset Management is the 4th largest asset manager in the world and has found that over the past 20 years the typical investor, mostly due to market timing, underperformed every asset class and even inflation.

-0.3% CAGR inflation-adjusted returns vs 3.4% CAGR inflation-adjusted returns in stocks has been the price that millions have paid for thinking they could outsmart the army of quants driving short-term institutional money flows.

But wait it gets worse. No matter what time horizon you look at, and whether its stocks or bonds, investors are generally terrible at market timing and as a result have experienced horrendous returns over time.

(Source: Dalbar)

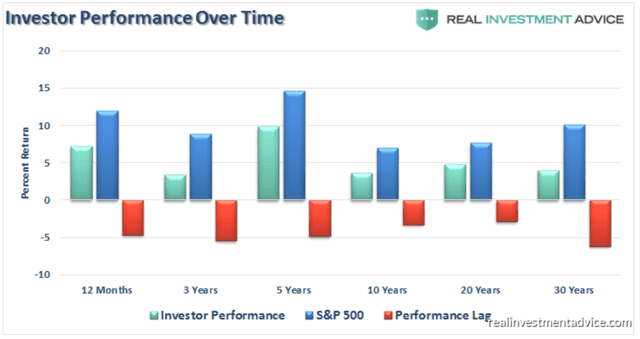

How badly has market timing mangled investor dreams?

- buy and holding a 60/40 stock/bond portfolio over the last 30 years = 6.0% CAGR inflation-adjusted return = 475% inflation-adjusted total return

- market timing a 60/40 target portfolio resulted in -2.65% CAGR inflation-adjusted returns…over 30 years

Keep in mind that over the last 30 years

- stocks went up 18 fold

- bonds went up 6.3 fold in the strongest and longest bond market in US history

- market timing 60/40 investors lost 55% of their wealth…over an entire investing lifetime

Is it any surprise that so many people doing so terribly for so long is why millions view the stock market as a “dangerous” and “rigged” casino?

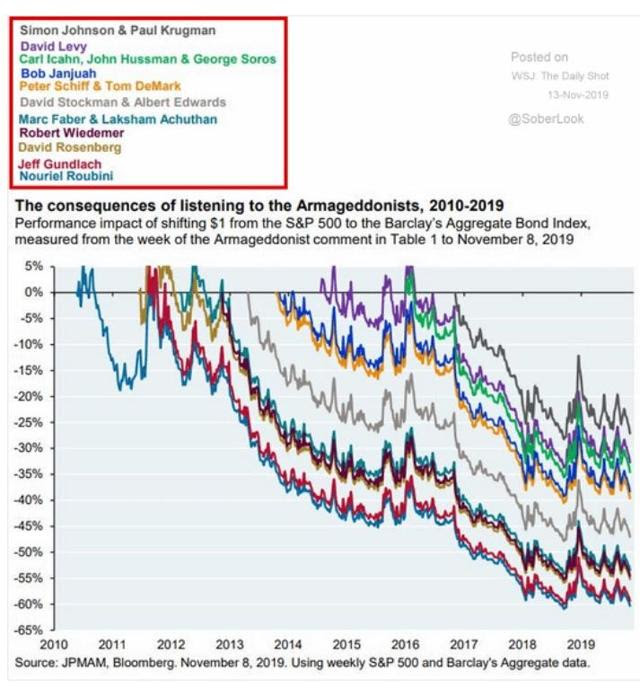

Here’s how much money you would have lost over the past decade had you simply sold stocks and bought bonds as a hedge every time a famous doomsday prophet told the media a major market collapse was coming.

Rather than make 500% total returns as the S&P 500 has done, you could have lost as much as 60%. THAT is the greatest example of how horrible market timing can destroy your wealth, and it didn’t even require you to bet actively bet against the market (such as by shorting stocks).

But guess what? The market isn’t a rigged casino, but rather a long-term weighing machine that always correctly values a company over 10+ year periods.

(Source: imgflip)

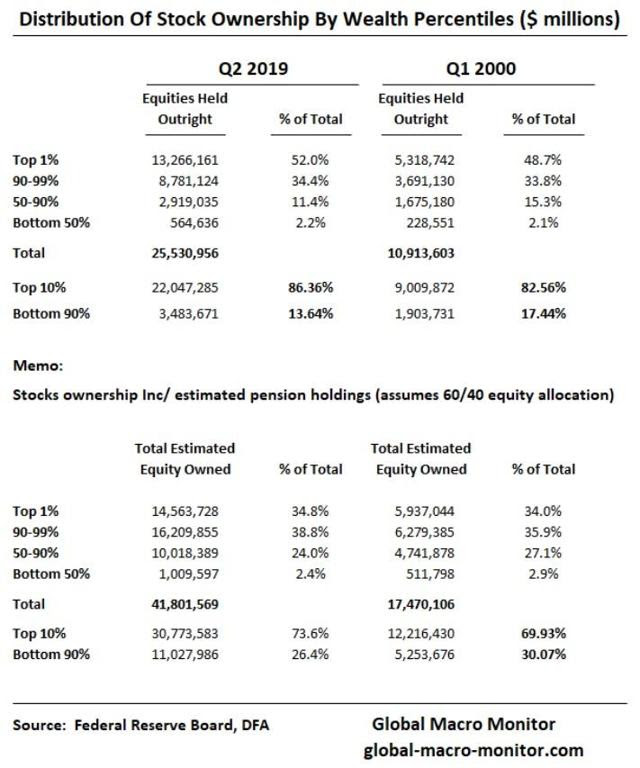

The top 10% of households by wealth own 86% of stocks, which is the reason we have historically high wealth inequality.

That’s not to say that the rich don’t market time at all, but they tend to market timeless. That’s because the rich hold onto stocks as income-producing assets, rather than view them as speculative means of achieving short-term profits.

The good news is that there are two very simple ways to avoid market timing in 2020, especially during the likely pullback/correction we’re likely to see next year.

How to Protect Your Nest Egg From the Ravages of Market Timing

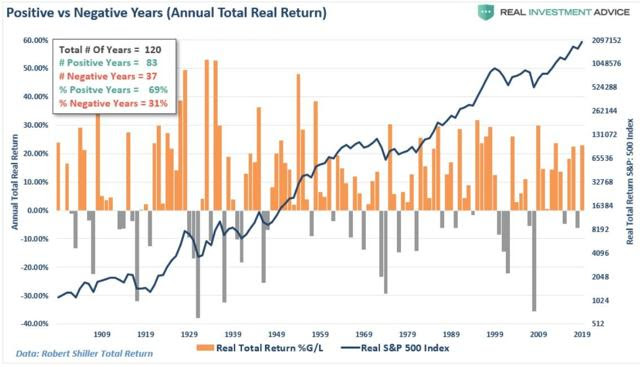

First, it helps to arm yourself with the facts. Stocks have gone up 69% of years since 1871, 75% of years since 1926 and 82% of the years since 1982.

In other words, if you just buy stocks and then ignore them, you’re almost certain to make money over time.

(Source: imgflip)

Next, you need to understand that volatility isn’t something to be feared, but the cost of owning the best performing asset class in history. In fact, corrections and pullbacks are healthy, natural and beneficial, because they help minimize how frequently major bear markets occur.

(Source: imgflip)

Here’s what I mean:

(Source: Guggenheim Partners, Ned Davis Research)

Since 1945 (and 2009) we’ve averaged a 5+% decline from record highs every six months.

5% to 9.9% pullbacks last an average of one month, see stocks fall 7% during that time, and then take one month to recover to new highs.

Corrections average once every 2.5 years, meaning that there is a 40% probability that stocks will fall 10% to 19.9% in any given year. High valuations today are why Vanguard estimates 2020 correction risk is 50%, rather than 40%. Measured from market top to market top, corrections last an average of eight months.

Bear markets average once every decade but usually occur during recessions, which we are at little risk of in the medium-term (25% 13-month recession risk per bond market and Cleveland Fed).

Severe bear markets like the tech crash or Great Recession, average once every 25 years and require some powerful negative catalyst to trigger them, such as a financial collapse or the highest valuations in history.

Right now the S&P 500’s forward PE based on IBES/Refinitive’s 2020 consensus EPS is 18.3, 13% above the 25-year average of 16.2. In 2000 the tech bubble saw the forward PE at 27.2, or 68% historically overvalued.

Is the market currently overheated? You bet. Are we at high risk of a major market meltdown like so many perma bears predict? No.

A properly constructed and risk-managed portfolio is capable of withstanding virtually anything the market or economy can throw at it. Even if we do get a correction in 2020 as Chris Harvey, Wells Fargo Chief Equity Strategist, recently wrote in a note

The last time sentiment felt this positive (4Q17, on the heels of tax reform) stocks initially rallied in 1Q18 before running head-first into a 10% correction… A 10% stock market correction in 1H20 is possible; we can envision one in late March/early April when the Fed’s balance sheet possibly stops growing…If we do see a healthy equity sell-off in 1H20, we would buy weakness, all else equal.” – Wells Fargo (emphasis added)

You don’t have to hope for luck with your investments. As long as you remember the Dividend Kings’ motto of “quality first, valuation second, and prudent risk management always” you can make your own luck, in 2020 and far beyond.

(Source: AZ quotes)

SPY shares were trading at $326.84 per share on Friday morning, up $0.19 (+0.06%). Year-to-date, SPY has gained 1.55%, versus a 1.55% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |