There is a lot of concern right now among investors with the S&P 500 once more near all-time highs despite a lot of trade and economic uncertainty.

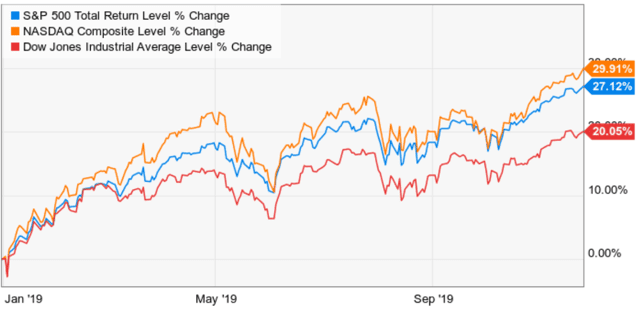

That’s understandable given that the stock market is up almost 30% YTD, despite basically no earnings growth expected this year.

(Source: Ycharts)

The media is full of scary headlines about famous hedge fund managers warning about huge imminent market crashes that make it sound like selling everything now seems like the “safe and sensible” choice.

So here are the actual facts, both about the good and bad news about stocks, with important implications for 2020 and far beyond.

Good News Is That Stocks Are Not as Overvalued as Some Permabears Claim

One of the most popular misconceptions about the longest bull market in US history (now its 11th year) is that it was unjustified and almost all due to the Fed’s $4 trillion in bond buying.

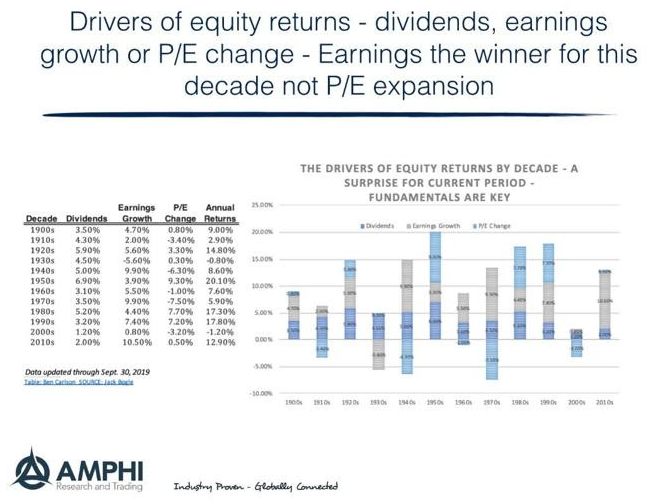

There are three things that make up total returns over time, starting yield, long-term earnings/cash flow growth and changes in multiples.

That’s the Gordon Dividend Growth Model and its been highly effective at predicting long-term (5+ year) total returns since 1956.

While it’s true that some decades have seen multiple expansion drive much of the market’s returns, in the 2010s that hasn’t been the case. In fact, through September 30th, just 0.5% of the S&P 500’s 12.9% CAGR total returns were from rising PE ratios.

The current forward PE on the market is 18.0, which is just 11% above the 25-year average of 16.2. If you adjust for interest rates, by using the 4% average EPS risk-premium since 2000, then the market is currently just 5% above its 17.2 rate-adjusted fair value PE.

But what about buybacks? Surely over $4 trillion in buybacks since 2008 have driven much of that 10.5% CAGR EPS growth? That validates the idea that stocks are currently in a dangerous “everything bubble” right?

Actually, according to Yardeni Research, using Federal Reserve data, 2/3 of all buybacks since 2008 have gone to offsetting stock option dilution. How much did buybacks actually drive EPS growth from 2011 to 2018? 1.3% CAGR, meaning that buybacks accounted for 12% of EPS growth and just 10% of all market returns over the past decade.

That’s not to say that buybacks don’t have their issues, including mostly occurring when earnings and share prices are at peaks and often for companies that are overvalued. But for those worried that the Fed or buybacks or both, have conspired to drive a crazy bubble that makes another “mega-crash” likely?

You have little to worry about because 96% of the market rally since 2009 has been justified by fundamentals. But that doesn’t mean that investors have an all-clear to expect massive gains next year either.

The Bad News: 2020 Earnings Are Likely to Be Far Weaker Than Analysts Currently Expect

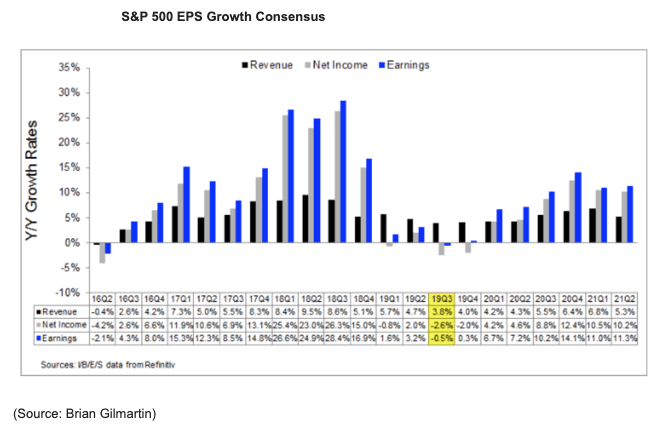

The good news is that in 2020 and 2021 the current consensus among analysts is that EPS growth will reaccelerate off very easy 2019 comps (0% to 0.4% growth).

However, it’s important to remember that earnings forecasts this far out tend to come down about 4% in order to allow 72% of companies to beat expectations by an equal amount. So that means that 10% growth in 2020 and 11% growth in 2021 are accurate right?

In theory yes, however, we can’t forget that global and US growth are still expected to be significantly lower in 2020 due to the lack of a full trade deal.

The full end to the US/China trade conflict requires a three-phase deal and here’s what Reuters’ reports a White House official telling them.

As soon as we finish phase one we’re going to start negotiating phase two…As far as timing around when a phase two deal could be completed, that’s not something I can speculate on.” – White House Official, Reuters’

It now appears as if a phase one deal may not happen until 2020, and a phase two deal will be even harder to come by.

“It’s Trump who wants to sign these deals, not us. We can wait,” one Chinese official told Reuters.

China is in no hurry to cut a deal since their economy is officially still growing about 6%. Are those official growth rates inflated? Almost all economists believe so, but there is little doubt that China’s economy, being less mature and smaller than ours, is growing faster.

President Xi is effectively “president for life” and doesn’t have to contend with elections. And since a Biden spokesman hinted that Biden would end the trade conflict on day one (and pursue a resolution through the WTO) it’s possible that China is content seeking partial tariff rollbacks with a phase one deal.

Then they may be content with no more tariffs going up and just waiting to see how the election plays out.

Moody’s Analytics chief economist, Mark Zandi, says his firm’s political models says that Trump is likely to be re-elected…IF the US economy is growing at about 2% on election day.

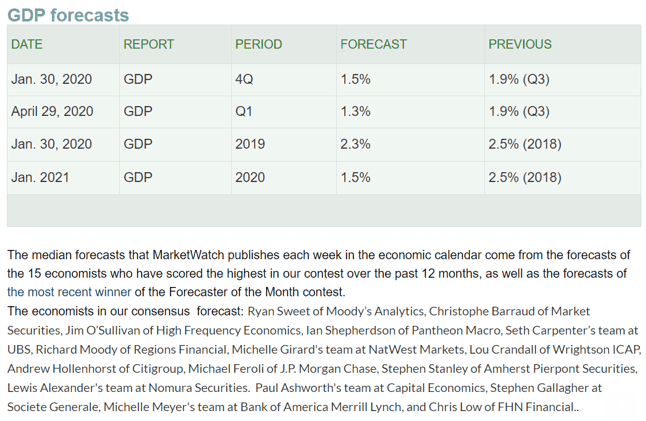

(Source: Market Watch)

Here’s the current blue-chip economist consensus for 2020, from the 15 most accurate economists tracked by Market Watch. Does this imply that President Trump is doomed in 2020? Not at all. These estimates change on a quarterly basis and Goldman Sachs thinks that 2020 growth will be 2.3%.

And the electoral college, which actually decides who wins the White House, gives Trump a 46% probability of re-election based on the 6 swing states that are likley to decide the winner next November.

BUT while most Americans (and our President) might not be aware of these facts, it’s possible that China is betting that slower US growth could hurt Trump’s re-election chances.

Would Beijing be off the hook if Biden were president? Not likely. The US would likely join the EU, Japan, and most other OECD countries in going to the WTO to file claims against China’s flagrant long-term violations of WTO rules, including forced technology transfers and IP violations.

The WTO has often ruled against China, including on the issue of rare earth metal monopolies, that China was forced to accept and back down on. However, the WTO process is a slow one, which can take several years. China would likely prefer that fate to one in which an unpredictable President Trump imposes up to 30% tariffs on all its US imports.

So how fast are earnings likely to grow in 2020 if the economy is growing at just 1.5%? About 6% to 7%, which is in line with overall corporate average since 1950. What might that mean for 2020 stock gains? Barring some impressive and unjustified multiple expansion that could mean that, following a nearly 30% rally in 2019, the S&P 500’s total returns might be flat next year.

So does that mean now is a good time to sell all your stocks and then wait out 2020, which is likely to have historically normal volatility, including two pullbacks of 5% to 9.9%?

Again there is good news on that front.

Good News Is Individual Companies Still Offer Fantastic Bargains

As one of the founders of The Dividend Kings, I maintain our Master List of 289 (and counting) companies. This list tells us the quality and dividend safety of a company, as well as its approximate fair value (based purely on consensus fundamentals in any given year), a good price to buy at, and what kind of realistic total returns it can deliver over the next five years.

That list currently shows

- 132 companies at fair value or better (some at 58% discount to fair value)

- three dividend kings (50+ year dividend growth streaks) at fair value or better

- 17 dividend aristocrats (25+ year dividend growth streaks) at fair value or better

- 13 11/11 quality Super SWANs (collectively they’ve tripled the S&P 500’s returns over the last 25 years) at fair value or better

- 16 safe midstream/MLPs (average yield 7%) at undervalued (average margin of safety 24%) prices

Heck, my retirement portfolio, where I keep 100% of my life savings, just bought three great high-yield stocks in recent weeks. Each of those is a great source of 5.7+% safe and growing yield that’s likely to deliver strong-double digit total returns.

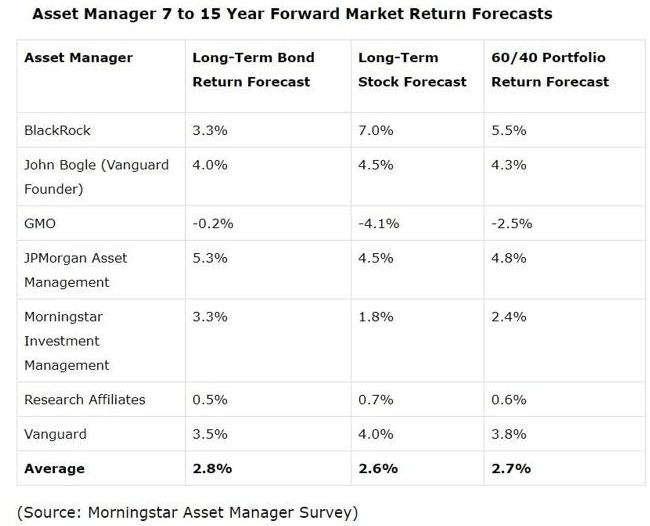

Compare that to the most optimistic long-term market forecast of 7% CAGR for the S&P 500. The Dividend Kings’ own long-term return model estimates 6% to 6.5% CAGR total returns for the broader market over the next five years.

That’s based on the Gordon Dividend Growth model and would still make stocks worth owning. But that’s only for those without the interest/discipline/ability to own individual companies.

It’s by buying above-average quality companies at below-average prices when the market doesn’t appreciate their potential that you can achieve 20-week capital gains like this

Dividend Kings Deep Value Portfolio’s Top 5 Winners

- CVS Health: 38% capital gain

- AbbVie: 32% gain

- Bristol-Myers: 32% gain

- Marathon Petroleum: 31% gain

- Skyworks Solutions: 31% gain

How much is the broader market up during the last five months? 8.3%. Our Deep Value portfolio has a 5.6% yield on cost, and is up almost 10% in the same time period, owning companies with generous, safe yields and 8% to 9% long-term expected dividend growth.

Bottom Line: It’s a Market of Stocks Not a Stock Market

The good news is that doomsday prophecies of imminent market meltdowns are not justified by the actual facts. 96% of the last decade’s rally was driven by fundamentals, not valuation expansion.

Just 12% of S&P 500 EPS growth was driven by buybacks, 66% of which merely offset stock-based compensation. The broader market is between 5% and 11% overvalued, depending on whether you believe that low-interest rates justify a slightly higher market multiple.

That’s the good news. The bad news is that next year corporate earnings, still facing ongoing trade uncertainty which isn’t likely to end next year, could be 6% to 7%, far below the 10% that most analysts currently expect.

The very lack of a recession that investors should root for (and which the bond market says is a 71% likely outcome) also means that rising wage pressure will likely make margin expansion tougher and thus earnings growth is likely to miss the 10% current consensus.

While the broader market may not be very overvalued, it is still overvalued, which means that next year’s earnings growth is likely already baked into current share prices. Thus the fundamentals justify the market trading flat next year, but with normal historical volatility.

However, at any given time plenty of great companies are trading at reasonable to attractive valuations.

Both my retirement portfolio and three Dividend Kings portfolios that I run, never run out of great companies to buy each week. No matter what the S&P 500 does, something great is always on sale.

That includes above-average to wonderful quality dividend stocks offering superior yield, faster long-term growth prospects, and double-digit, market-beating return potentials that can help you achieve your long-term financial goals.

SPY shares were trading at $308.39 per share on Tuesday afternoon, down $3.25 (-1.04%). Year-to-date, SPY has gained 25.12%, versus a 25.12% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |