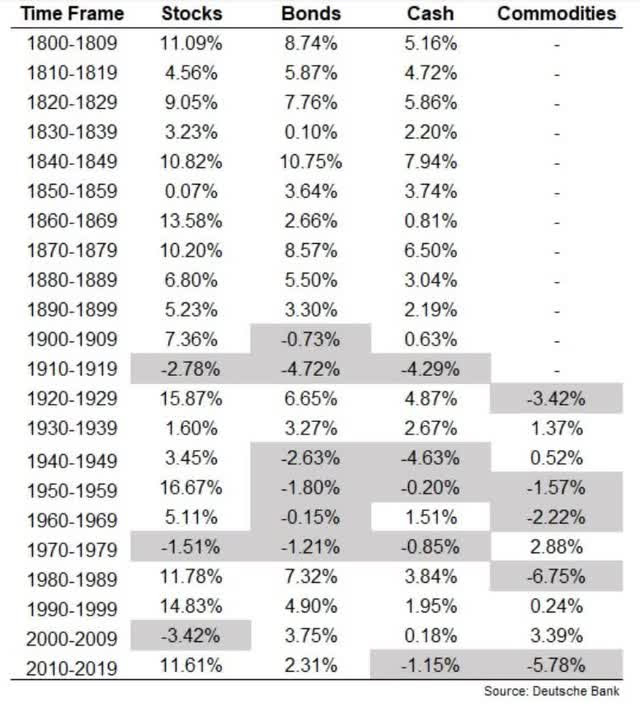

Inflation is something that older investors fear a great deal, and it’s not hard to see why.

(Source: Ben Carlson)

Adjusting for inflation, the 1970’s where inflation peaked at 15%, stocks delivered negative returns in the stagflationary 1970s, and bonds were also negative.

In other words, a classic stock/bond/cash portfolio would have lost value, creating one of the three lost decades for stocks since 1800.

Today I wanted to highlight both the good and bad news about inflation that all investors need to know.

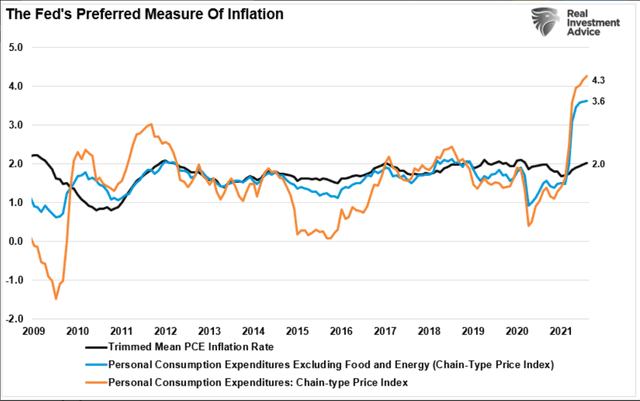

Bad News: Higher Inflation Could Get Worse For A Few More Months

Core inflation, as measured by the PCE index, what the Fed uses to make monetary policy, has jumped to the highest level in 30 years and nearly double the Fed’s 2% long-term target.

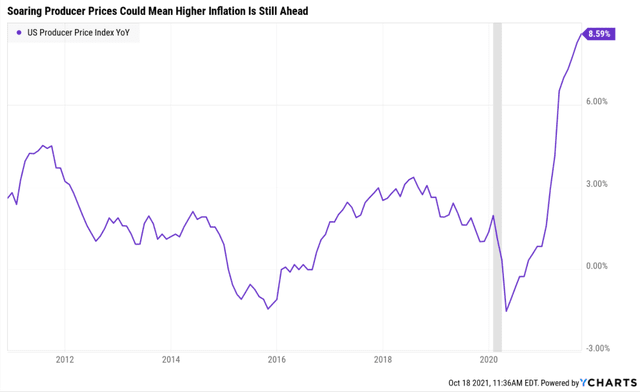

Producer prices tend to lead consumer prices by 3 to 6 months, and producer prices are still rising.

Thanks to supply chain disruptions that Walmart says could last into 2023, producer prices might take several more months to peak.

This means that core inflation could keep rising through the end of 2021 or even into 2022.

Good News: Supply Chain Disruptions Won’t Last Forever

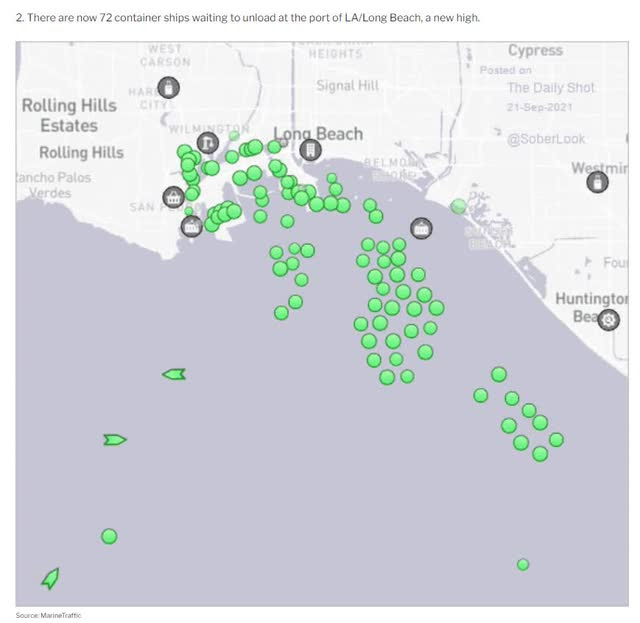

The supply chain disruptions that have plagued the world this year and last, are still being driven by the pandemic.

China’s zero-tolerance policy on COVID caused it to lock down several cities in recent months, including one of the biggest ports on earth.

This resulted in a record 72 container ships having to wait to unload at the Ports of LA and Long Beach, where 1/3 of America’s imports enter the country.

China now appears to have Delta under control but an energy crisis caused by insufficient coal and natural gas has forced it to ration power with many factories being forced to work on reduced hours.

This energy crisis could persist through February, which is traditionally the coldest month in the Northern Hemisphere.

Europe is also experiencing an energy crisis, also due to insufficient natural gas and coal. In fact, gas prices have spiked by as much as 1000% in Europe and in the UK a shortage of 100,000 tanker truck drivers has resulted in gas lines and panic buying of fuel.

One final bit of concern is that the unions at the Port of LA and Long Beach have contracts expiring in mid-2022. If they choose to strike then the global supply chain mess might take even longer to sort out.

But rest assured that these supply shocks are indeed temporary, it’s just a question of how long they will last.

Bad News: Higher Inflation Could Persist Through For Years

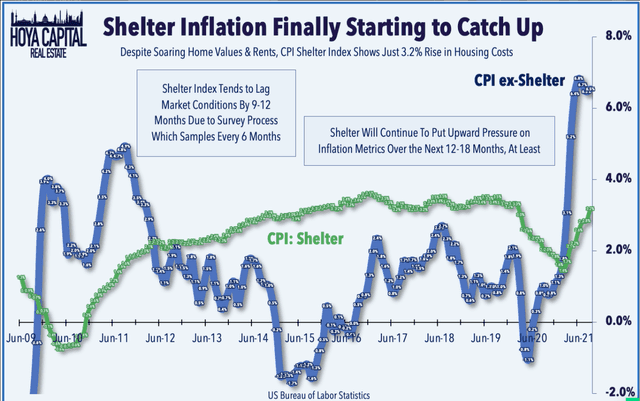

1/3 of the US CPI index is housing and rent.

According to a study from the Dallas Fed, home and rental prices tend to lead CPI by 16 months.

As home prices rise, landlords raise rents with a several-month lag. In other words, there is an indirect connection between housing prices and inflation.

So far in 2021 home prices are up a record 20%. And Goldman Sachs has a troubling note for those worried about the cost of housing.

“Prices for US homes will climb another 16% through 2022, Goldman economists led by Jan Hatzius said in a Monday note. The forecast gives prospective buyers little to cheer as the new year looms. Prices have already surged 20% through the past year, as a dire home shortage has given way to frenzied bidding wars. Builders have moderately accelerated construction of new houses, but they’re far from hitting the pace needed to match demand.” – Business Insider

The shortage of US homes could be as large as 6.8 million, which means that it could take well over 10 years for home builders to finally catch up supply with the insatiable demand of Millenials and Gen Z.

According to Morgan Stanley, those two generations total of 150 million Americans, 2X the population of baby boomers. As those 150 million people start families, Morgan is forecasting an epic 20-year bull market in housing prices.

Prices won’t be rising at double-digits but they are likely to keep rising for the foreseeable future.

If Goldman is correct, then in 2022 the rental impact from 2021’s 20% home price increases would start to show up in CPI.

And in 2023 the 16% increase in home prices could increase rental rates by 4.5% much higher than 2021’s 2.4% increase so far.

This means that rental costs alone could cause 1.5% inflation next year, not counting anything else. For context, the average inflation in the 2010s was 1.6%.

Good News: There Are Several Deflationary Megatrends That Should Prevent Runaway Inflation

There are several secular trends that should help prevent a return to 15% inflation as we saw in 1980.

For one thing, there is the demographics of 10,000 daily baby boomers retiring per day.

For another, high levels of debt tend to slow growth, and thus result in falling interest rates, the trend we’ve seen for 5,000 years.

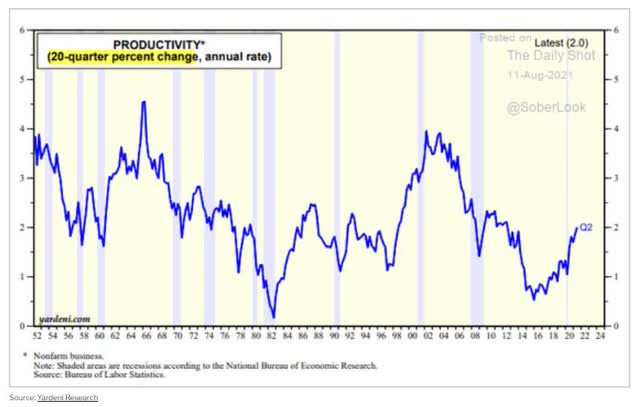

There’s also technology, such as 5G and later 6G which the Fins are already working on. Automation powered by advanced artificial intelligence could send US productivity rising from 2% today, to 3% or even 4% according to Ed Yardeni.

A return to 4% productivity growth could allow wages to grow at 6% annually while driving only 2% inflation. It would also, according to JPMorgan potentially drive 4.2% GDP growth for several years, twice the rate we saw in 2010s.

In part two of this series we’ll examine why permanently higher inflation might be coming, and how you can protect your portfolio if that results in a lost decade for stocks.

SPY shares were trading at $452.16 per share on Wednesday morning, up $1.52 (+0.34%). Year-to-date, SPY has gained 22.12%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |