Thanks to the 24-hour news cycle and social media (Trump averages 12 tweets per day according to Bloomberg) we’re being constantly inundated with “important” news that is mostly meaningless.

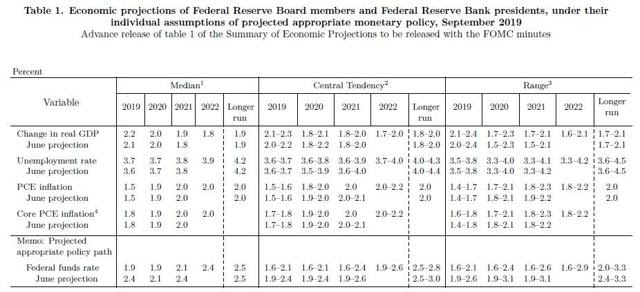

While the S&P 500, the Dow Jones Industrial Average, or tech-heavy Nasdaq, sometimes swing as much as 5% intra-day due to headlines, driven by 90% of trading being controlled by computerized trading, the market itself hasn’t done much over the past year.

(Source: Ycharts)

That’s not surprising given that corporate earnings and cash flow per share have basically risen about 1.5% over the past 12 months. That’s pretty much how much the market is up.

However, this week there is an economic report that is indeed critical to watch because it could serve as the “canary in the coal mine” regarding whether or not the economy, corporate profits, and the stock market goes higher over the next year, or spends another year trade wildly but going nowhere fast.

Why The September Jobs Report Is Truly Important News…

In August just 130,000 net jobs were created according to the Bureau of Labor Statistics. It’s important to remember the margin of error is plus or minus 140,000 and large revisions are common from month to month.

August is also a time when many people are on vacation and so don’t send in their surveys. September generally sees a nice upward revision to the first estimate.

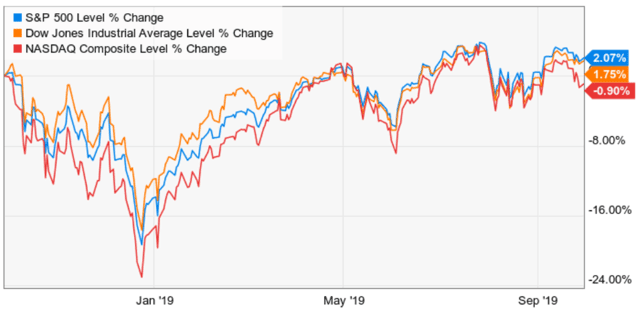

The jobs report is rich in data, not just about the headline job creation number and revisions, but what industries are creating or shedding jobs.

(Source: Marketwatch)

August’s first estimate showed retail and manufacturing, courtesy of the trade war, rather weak, with the slack being picked up by services. 25,000 temporary government jobs for the 2020 census boosted the 130,000 estimates and so the adjusted August figure was actually a tepid 105,000.

The median consensus among economists for September’s report is for 145,000 but the more important number to watch is 100,000. That’s approximately how many jobs it takes each month to keep up with population growth. Anything above 100K will tighten the labor market, reduce unemployment over time and most importantly, cause wage growth to keep rising.

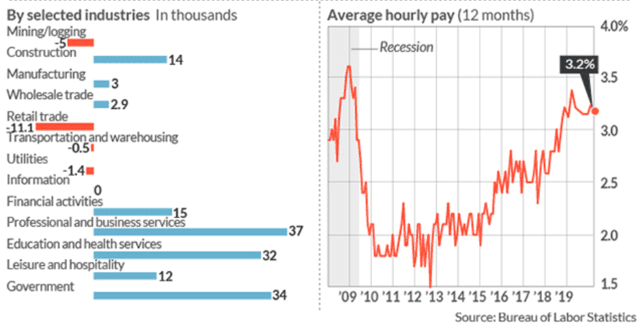

The official wage growth in August was +3.2% YOY but 3.4% for non-supervisors (80% of workers). With core inflation running at 1.6% that means some of the best inflation-adjusted or “real wage growth” in a decade.

(Source: Atlanta Federal Reserve)

In reality, on average over 10,000 baby boomers retire every day (between now and 2034). Since people tend to make their peak earnings at the end of their careers, rolling 3-month median wage growth (50% of workers make more and 50% make less) is the more accurate wage growth tracking statistic.

The Atlanta Fed maintains a median wage growth tracker and indicates that wage growth for most workers is growing at 3.7%. That’s near its early 2019 peak of 3.9% which is near the 2007 highs of 4% (4.4% was the peak before the Great Recession). Given enough time and a tight enough labor market, median wage growth might even head back to its previous 5% levels in the late 1990s.

The reason that wage growth is what I consider to be the single most economic metric to watch is threefold

- strong wage growth makes consumers confident and gives them more money to spend

- 70% of US economic growth is driven by consumer spending (it’s largely what’s prevented a manufacturing recession from becoming a broader economic recession so far)

- higher wage growth and stronger consumer spending creates an incentive and need for companies to invest in productivity-boosting capex (productivity growth + labor force growth is ultimately what drives economic growth)

Another side benefit of rising wages is social stability. Weak labor growth courtesy of terrified workers afraid to ask for higher wages after the Financial Crisis is what caused many people to feel “left out” of the 10-year economic expansion.

Rising income inequality helped to fuel the rise of demagogues on both the right and left, which ultimately brought us President Trump, without which there would be no trade war and the highest recession risk in a decade (not to mention a lot more market volatility).

If we avoid recession in 2020 (61% probability of that according to the bond market) then we could face a far better 2020s in terms of steadier earnings growth, rising stock prices and a lot less political drama (though some will always be with us).

But there is another reason the jobs report is important because this is what the Fed watches closes to determine interest rate policy.

…And Could Determine What Our Interest Rate Obsessed Market Does Over the Next Year

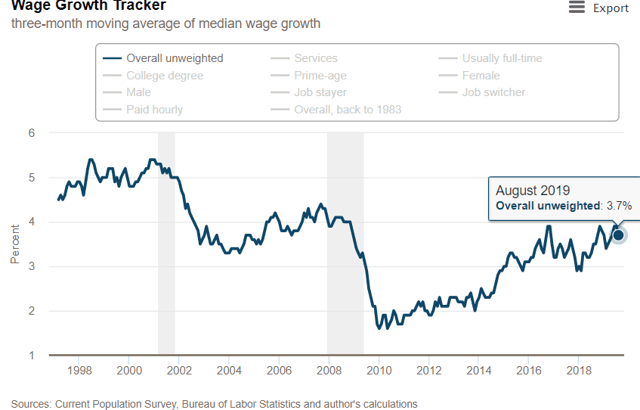

This is the Fed’s latest economic forecast table, showing expected long-term economic growth of 1.7% to 2.1% and a median consensus of 2% growth next year.

Whether or not we get a reasonably strong job report this week will help to determine whether or not the Fed’s growth estimates for this year and next are reasonable or possibly overly optimistic.

That, in turn, will determine whether or not we get more rate cuts, which Wall Street is obsessed with (irrationally so but it still moves the market in the short-term).

The Fed’s latest dot plot shows the plurality of Fed members think no more rate cuts are needed this year, no changes are expected in 2020 and then in 2021, the Fed expects one rate hike and another in 2022.

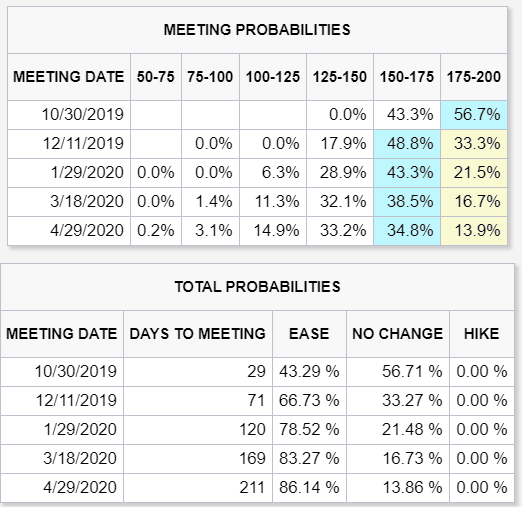

(Source: CME Group)

The bond market (and stock market) currently estimate, via bond futures, a 67% probability of another rate cut this year and about a 50% probability of at least two cuts by April 2020.

The stock market expecting two more rate cuts than the Fed is likely to actually deliver could have important implications for hot momentum stocks right now, such as Nike, which trades at a 36 PE, levels that have always been consistent with corrections or outright bear markets for that stock.

For example, in 1999 Nike was flying high and trading at a 35 PE fueled by hopes that strong digital sales growth (42% YOY in Q2 2019) could drive 20+% long-term earnings growth. The stock then fell 50% within five months from those bubble-like levels (Nike’s historical average PE is 22).

In contrast, undervalued stocks, particularly economically sensitive ones like Caterpillar that are trading at steep discounts to fair value right now, could do very well if economic fundamentals remain stronger than expected and could cause this high-yield dividend aristocrat to soar in the coming year.

Bottom Line: The Jobs Report Is The Most Important News This Week BUT Don’t Overreact to It Either

The strongest job market in 20 years has been the lynchpin for why the US is still growing about 2% despite the worsening trade war. Confidence in being able to keep or find a good job is why consumers are spending freely and why small business confidence remains near record highs.

The jobs report is a lagging indicator, with wide error bars of plus or minus 140,000, so big revisions can come in any given month.

The number to watch isn’t necessarily the median consensus (145,000 this month) but 100,000. That’s the amount of net new jobs that must be created each month to account for population growth and thus keep the labor market tightening.

As long as we’re averaging over 100,000 net new jobs per month, wage growth, which is near 10-year highs, should slowly but steadily rise over time. With inflation running under 2%, 3.4% to 4% wage growth in 2020 and 2021 is the key to determining whether or not the US economy avoids recession in the coming years and thus keeps the longest bull market alive.

Mind you, the reason I’m writing this isn’t to advocate you try to trade around the jobs report since even Wall Street’s best and brightest (or at least best paid) can’t do so consistently or profitably.

Rather it’s to let you know what are the most important numbers to watch and to be prepared for a surprise in the report in either direction, to possibly create attractive long-term buying opportunities for your portfolio.

(Source: AZ quotes)

SPY shares were trading at $293.75 per share on Tuesday afternoon, down $3.02 (-1.02%). Year-to-date, SPY has gained 19.18%, versus a 19.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |