The stock market continues to fluctuate wildly, and the VIX, a measure of implied volatility is sticking above the 40% level. That’s down from the recent high of 85% but still well above normal levels, but still ranks in the top 10% of all-time readings.

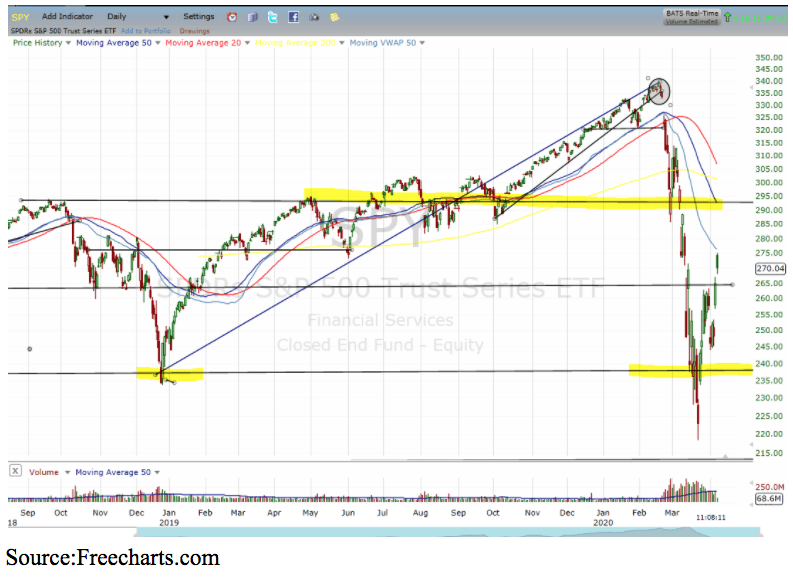

This means options’ premium is all plumped up and ready for feasting upon. Two weeks ago, with daily moves in excess of 6%, trying to predict a bottom, or even how high a bounce might rise, seemed a fool’s task. But, it now looks like the “SPDR 500 (SPY - Get Rating)” has found a range, albeit a large one, between the recent low around $230 and the resistance from the $295 gap down.

The trade I will focus on is in the SPY with expectations that it will remain between $230 and $295 for the next few weeks.

But, before I get to the specific trade, let’s discuss credit spreads and iron condors.

Many traders of iron condors and credit spreads tend to enter their trades every first or second week of the month, or they have established a hard number of days before expiration where they force themselves to enter their positions mechanically.

In my experience, this is not the best way to trade these strategies. This doesn’t mean you cannot be profitable trading that way, merely that I personally think there are better ways.

The problem with iron condors and credit spreads is that you are usually risking a lot to win a little. So, entering a position is not something you should take lightly. It is my personal belief that they should only be traded when odds are clearly in your favor. If the conditions are not given, then staying put is the best decision.

These are the ideal conditions under which I would enter a trade:

For Bear Call Spreads:

- 70% or more of stocks above their 20 Simple Day Moving Average

- Stochastics Oscillator (80, 20, 8, 3) above 80

- McClellan Oscillator above +150

For Bull Put Spreads:

- 30% or less of stocks below their 20 Simple Day Moving Average.

- Stochastics Oscillator (80, 20, 8, 3) below 20.

- McClellan Oscillator below -150.

- The logic behind these entry conditions is that for those elements to be present the market usually has to make a pretty sizable move, and by then chances are increasingly higher that it will need to digest the move, that is trade sideways or pull back.

Let’s say 70% of stocks are above their 20 SMA, and both Stochastics and McClellan are overbought. At that point, the market has probably made at least a 5% run upwards. If at that point you can sell a Call Credit Spread 5% above the current price, then you are challenging the market to make a total run of 10% upwards. All in a period of a month, or a little bit more than a month.

Needless to say, a market-moving 10% in one direction over only a month is a highly unlikely event. It will happen from time to time, but your winners should outnumber your eventual losses if you play them all.

Many traders get killed trying to pick the exact bottom or exact top. That’s impossible. So, my advice is that even though the markets are overbought or oversold by the parameters described above, never sell your credit spreads less than 3% away from the current market price. Try to always sell at strike prices that are at least 4% or more away from current prices. That gives you room for error. You may not guess the exact top or bottom. But, the market still needs to make another big move to cause you a loss.

Going back to the previous example, in the event that the market threatens your Bear Call position, you can adjust it further up. That is, close it (for a temporary loss) and open another Bear Call spread 3 % to 4% even further up, and now you are challenging the market to a total move of 13% – 14% in a month, a very unlikely event.

The Opportunity Factor

If you were to wait for all three conditions to be present, then you would only end up trading 3 or 4 positions in the year. Those would be very good trades and potentially profitable and easy to ride, but very few for many traders. In order to mitigate this effect and give myself some more trading opportunities, I tend to relax the rule in certain periods.

For example, during historically bearish periods, I would only need two of the three rules to be true in order to sell Call credit spreads. But I would expect to see the three conditions fulfilled for selling Put Credit spreads. Likewise, during December and January, I would expect all three conditions to be met in order to sell Calls, but I could relax the rules expecting only two of them to be met in order to sell Puts because it is a naturally bullish season of the year.

Specifically, I’m looking at it in the SPY to sell iron condors using the 220/225 put spread and the 295/300 call spread with the May 15th expiration.

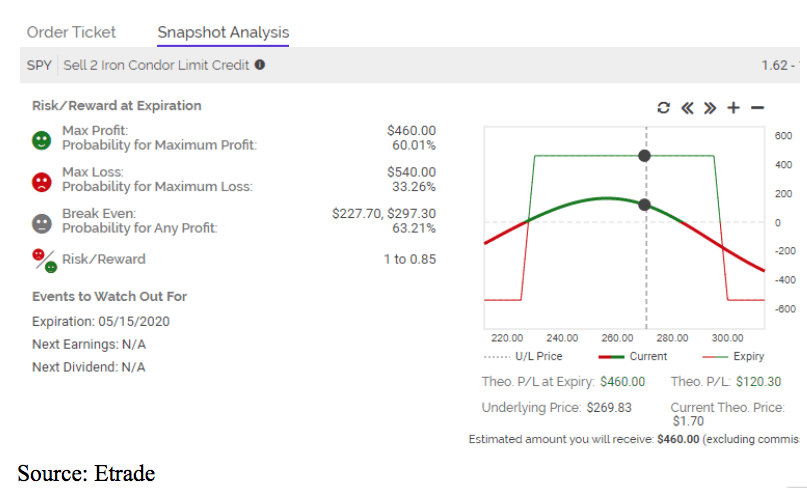

I can collect a total credit of $2.30, meaning my risk is $2.40—that’s the $5 width between strikes minus the $2.30 of premium collected.

Here is what the risk/reward profile of the trade looks like:

The recent quarantining and stay-at-home aside, human beings are social beings in nature, and the herd mentality comes impregnated in our brains at the time we are born. It feels just comfortable to trade in agreement with the crowd. But, that’s the best way to lose this game.

Paraphrasing Warren Buffet, you will enter a bullish trade (Bull Put spread) when everybody is scared, and you will enter a bearish trade (Bear Call Spread) when everyone is greedy.

When establishing credit spreads and iron condors give yourself some room for error, selling at least 4% away from the current price and that room is there to give you the confidence boost that you need in order to bet against the crowd.

Want more great investing ideas?

The Fake Rally is Over! – Why the bear is still in charge. Along with the right investment strategy to generate profits while stock prices head lower.

How to Make Money in a Bear Market – Learn more about this vital webinar with famed investor Marc Chaikin.

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

SPY shares were trading at $272.97 per share on Tuesday afternoon, up $8.11 (+3.06%). Year-to-date, SPY has declined -14.69%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |