For good or ill, the stock market is obsessed with the Fed and what it does with short-term interest rates.

(Sources: Jim Bianco, Daily Shot, Jeff Miller)

Over the past 10 months whenever the Fed has been exceptionally dovish the S&P 500, Dow Jones Industrial Average and Nasdaq have been on fire over the following week. When the Fed has been too hawkish, stocks have seen brutal short-term declines.

This week the Fed is meeting on Tuesday and Wednesday, with the next rate decision, dot plot and press conference coming out Wednesday just before the market closes. Here’s what investors can expect from the Fed, how the market (and Trump) might react, and the smart way to manage your portfolio no matter what happens this week.

What The Market (And President Trump) Want The Fed To Do

The stock market, in general, LOVES rate cuts. That’s because, the lower long-term rates go, all else being equal, the more valuable a company’s future cash flow becomes, thus justifying higher multiples and increased share prices.

The Fed Fund Rate has little to do with long-term rates, BUT it does tend to stimulate economic growth by 0.1% to 0.15% per year, 12-months post-cut, according to Moody’s. With recession risk so high, the market wants to see a super dovish fed, which you can see in the current bond futures probabilities.

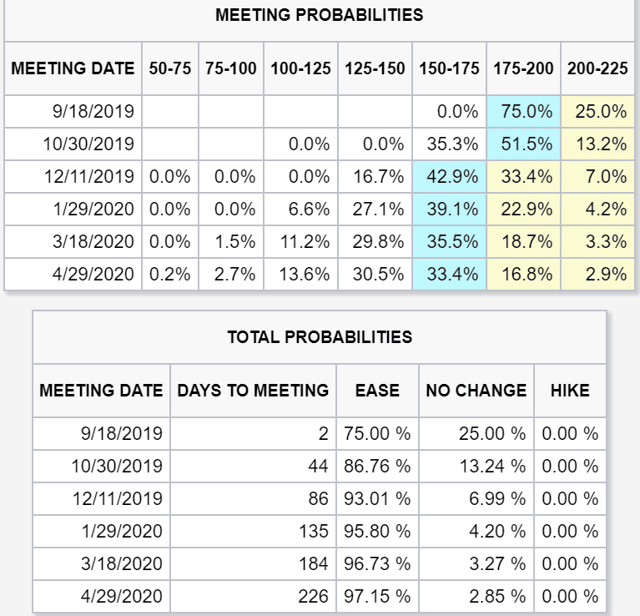

Fed Reserve Rate Bond Futures

(Source: CME Group)

Bond futures are now pricing in a 90% probability of at least one more cut this year, 83% probability of two and nearly 60% probability of three.

Our President is an even more ardent supporter of low-interest rates. That’s because Trump, who seems to equate record-high stock prices with a stronger economy and better re-election chances in 2020, has been attacking the Fed at an unprecedented rate via twitter, pressuring for lower rates and stronger monetary economic stimulus.

He’s not just tweeted that Fed Chair Jerome Powell (who he appointed), is an “enemy” of America, but also urged the “boneheads” at the FOMC to cut rates by “100 basis points rather quickly.”

That was before his most recent twitter salvos demanding “The Federal Reserve should get our interest rates down to ZERO, or less.” Yes, our President doesn’t just want rates at zero, he wants negative rates (like in Europe where the ECB rate is -0.5% and Switzerland’s is -0.8%) but also bond-buying (QE) for good measure.

Fed bond-buying would, theoretically, weaken the dollar and make the trade war easier to win, at least in Trump’s mind. But that’s just what the stock market and President want/expect from the Fed. Here’s what the Federal Open Market Committee is likely to actually do, both this week and in the future.

What The Fed Is Likely to Do

The bond market is correct to assume the Fed will cut 25 bp on Wednesday. The trouble is with the expectation of a third or even a fourth rate cut this year. At the June meeting two FOMC members (there are 10 that vote on rate cuts) voted to hold rates steady, two voted for a 50 bp cut, and the rest for the 25 bp cut that ultimately won the day.

Powell upset the market (and enraged Trump) when he told reporters at the June press conference that this was merely a “mid-cycle correction”, meaning an insurance cut, rather than the start of a long-term easing cycle.

That’s actually the right call by Powell and the Fed.

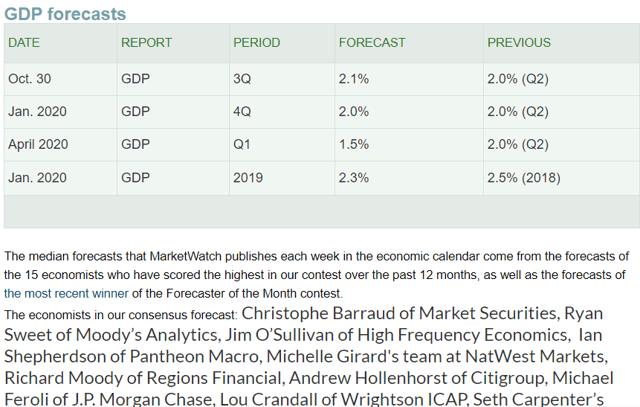

(Source: MarketWatch)

According to the 15 most accurate economic growth forecaster tracked by Market Watch, the US economy is set to grow about 2.3% in 2019 and possibly 1.5% in 2020 (based on initial Q1 2020 median consensus).

Looking at the overall economic data, I consider those reasonable growth estimates.

Here are the 19 most important leading economic indicators, tracked each week by David Rice, both in terms of how high they are above their historical baseline, and how fast they are growing/contracting on a month to month basis.

(Source: David Rice)

Right now the average of all the indicators (the mean of coordinates) is about 25% above baseline, and contracting at a modest 4% month to month. The eight most sensitive leading indicators (the green LD dot) is slightly higher above baseline but contracting slightly faster (about 5% month over month).

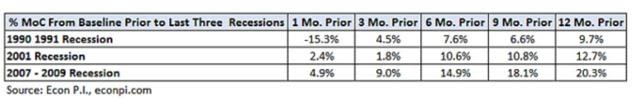

What does that mean? Looking at how high the MoC (average of all indicators) was above historical baseline ahead of the last three recessions, Mr. Rice has said any reading above 20% indicates very little risk of a recession in the coming year.

I personally use the MoC’s distance about baseline to determine what percentage of monthly savings to invest in stocks vs bonds, and what percentage of defensive vs cyclical companies to buy.

Right now, at 25% above baseline, I’m investing 60% of savings into stocks, targeting a 50/50 mix of defensive/cyclical companies.

But the point is that the Fed has a two-fold congressional mandate, full employment (unemployment 3.7% in August) and stable prices (core inflation 1.6% below the Fed’s long-term 2.0% target). Making the stock market giddy or getting Trump re-elected has nothing to do with the Fed’s job.

I’m actually pleased with what various Fed speakers have said in recent weeks, arguing that the economy is strong enough to not require emergency cuts, and thus the FOMC should watch the data as it comes in and make reasonable and prudent moves based on its mandate. Fed speakers have been adamant that they won’t be pressured by the bond market, stock market or our Twitter-happy President (now averaging 12 tweets per day according to Bloomberg).

What about the idea of negative interest rates? Those are likely to backfire, both politically and economically.

According to Richard Fisher, former president of the Dallas Fed,

“Negative interest rates have failed in Europe and Japan…They are anathema for savers and our community and regional banks that bank the average American.”

Since the ECB set its interest rate at -0.1% in 2014, Deutsche Bank’s share price has fallen 75%, because the bank has struggled with profitability that has crimped its ability to lend.

Japan has spent decades trying to money print (via bond and even stock buying) its way to prosperity, with little to show for it.

DiMartino Booth, CEO and chief strategist for Quill Intelligence explains why negative rates are something to be avoided at all costs.

Negative interest rates are about as un-American as you can possibly be…We are a nation that, for better or worse, needs credit creation to grease the wheels of the economy. Without that, growth would truly come to a standstill.”

In Europe and Japan, the theory was that if central banks started charging banks to hold their reserves (negative rates) then banks would be forced to lend more, thus boosting growth.

The trouble is that higher capital requirement for banks post Financial Crisis have forced banks to hold more reserves at their respective central banks. In addition, very slow growth, the very reason for negative rates in the first place, means that businesses and consumers have little desire to borrow, even at record low (or even negative) interest rates. Negative rate debt (like for Danish mortgages) still have to be paid each month.

What’s more, in many negative rate country’s, such as Nordic ones where banks charge negative interest on savings, consumers have responded by saving MORE not less. Older populations, nearing retirement, have smartly ignored the central bank signal to “spend like their’s no tomorrow” because, in fact, retirements can last for 20 to 40 years.

US banks have been able to adapt to falling long-term interest rates (flattening yield curves) with cost-cutting, new fees, and epic amounts of buybacks (up to 10% to 12% share repurchases per year). Should the Fed set the FFR at negative rates? Then US banking profits might start falling (on an absolute basis) resulting in less loan growth, not more, purely because there will be fewer profits to lend.

That’s even ignoring the dangerous moral hazard that is implied by the Fed motivating banks to lend at any cost, to anyone with a pulse. Let’s not forget that it was dangerous subprime mortgage loans, including those to people with no job, income or assets, that triggered the Financial Crisis in the first place.

How Smart Investors React to Fed Decisions

Here’s what’s likely to happen on Wednesday

- the FOMC is likely to cut rates 25 bp

- the Dot Plot is likely to show a consensus for one more rate cut MAYBE though the next Fed minutes (out next month) are likely to show a lack of consensus on this

- The press conference will likely have Jerome Powell tell reporters some version of “the economic fundamentals continue to point to modest long-term growth” but the fed is “watching risks of protracted trade war increasing recession risk”.

What does that mean for stocks?

- the market, eager for a dot plot showing at least one or two more rate cuts coming this year (and one or two next year) will likely be disappointed and sell off mildly

- President Trump, ever more eager for lower rates to boost stocks, help his 2020 campaign and make the trade war easier to fight, will likely be enraged

- Wednesday or Thursday Trump is liable to launch a new tweetstorm, an angry fusillade against the Fed and possibly threaten to escalate the trade war further

This could mean that stocks, recently coming within 0.6% of fresh all-time highs, might pullback Wednesday, Thursday and possibly Friday.

So that means you should sell everything right now right? Wrong! Don’t forget that stocks have rallied for three weeks, on trade deal optimism and falling recession risk (36% 12-month risk per bond market on Friday, down from 48% two weeks ago).

What the market does over a few days or weeks is literally a crapshoot, and anyone trying to dive in and out of the market is speculating, not investing.

The fundamental value of any company is based on long-term earnings, cash flow and any dividends it pays. While stocks can sometimes swing 10+% in a single day, that doesn’t mean a company’s fundamental worth has actually changed that much.

As Joshua Brown, aka “The Reformed Broker” said during 2016’s correction “volatility isn’t risk, it’s the source of future returns.”

I run not just my own retirement portfolio (and advise my father on his), but also four model portfolios for the Dividend Kings. Short-term news, such as Trump tweets, Fed rate cuts, or this weekend’s Saudi Arabian oil strikes, have zero bearings on our core strategy which is:

- buy above-average quality dividend stocks

- with average to above-average long-term expected growth rates

- at below-average valuations

- then let quality management teams work hard to exponentially grow our income and wealth over time

SPY shares were trading at $300.08 per share on Monday afternoon, down $1.01 (-0.34%). Year-to-date, SPY has gained 21.19%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |